Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

Blog

Featured Post

What can we help you find?

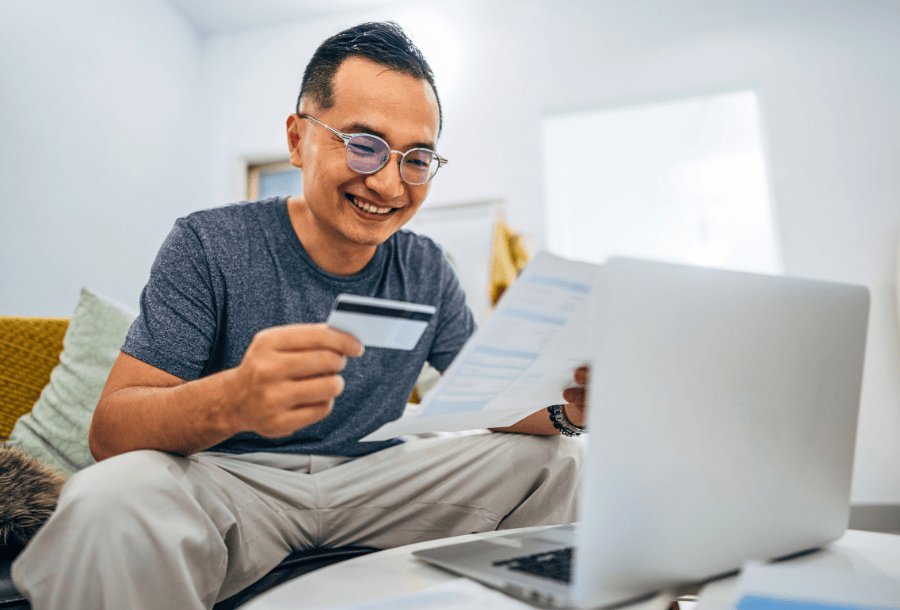

Financial Health

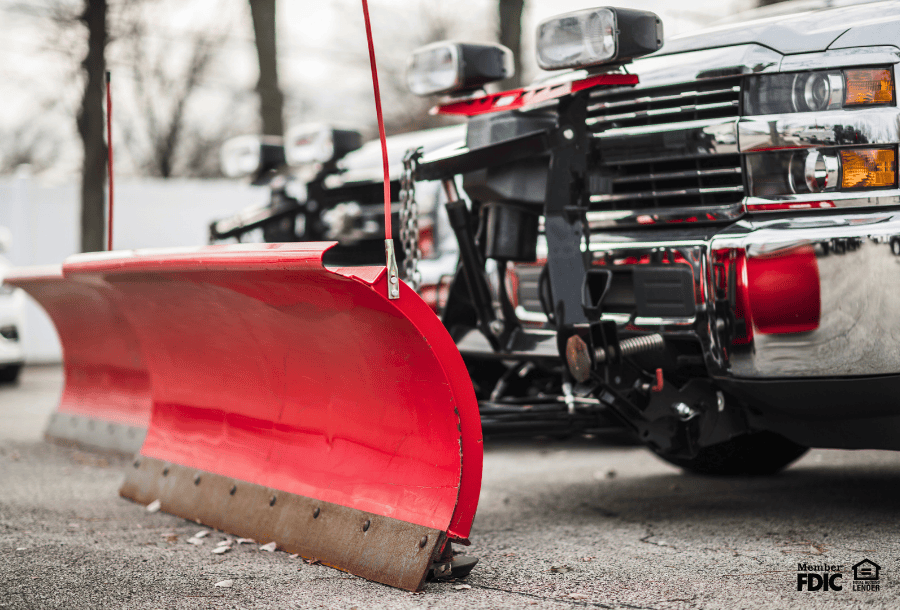

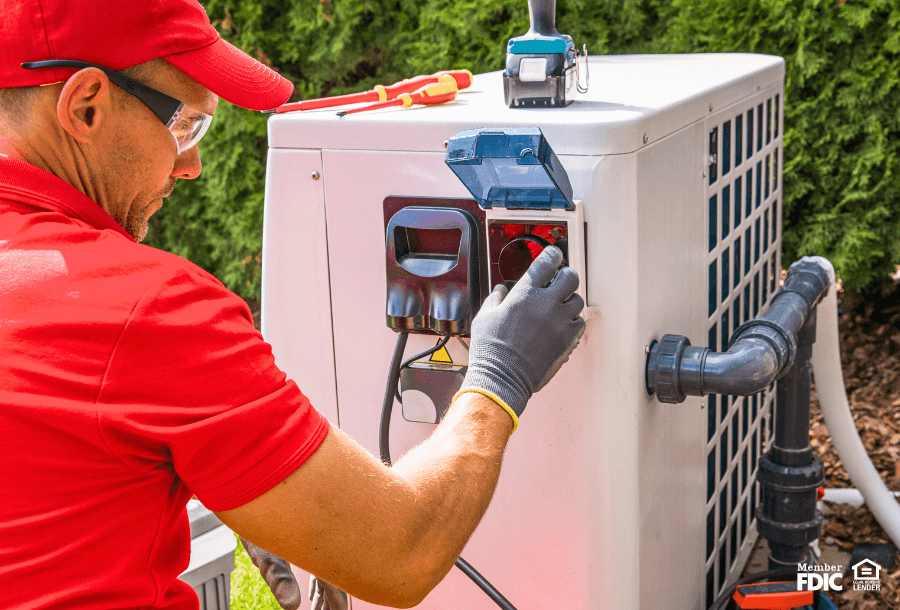

Commercial Banking

Business Banking

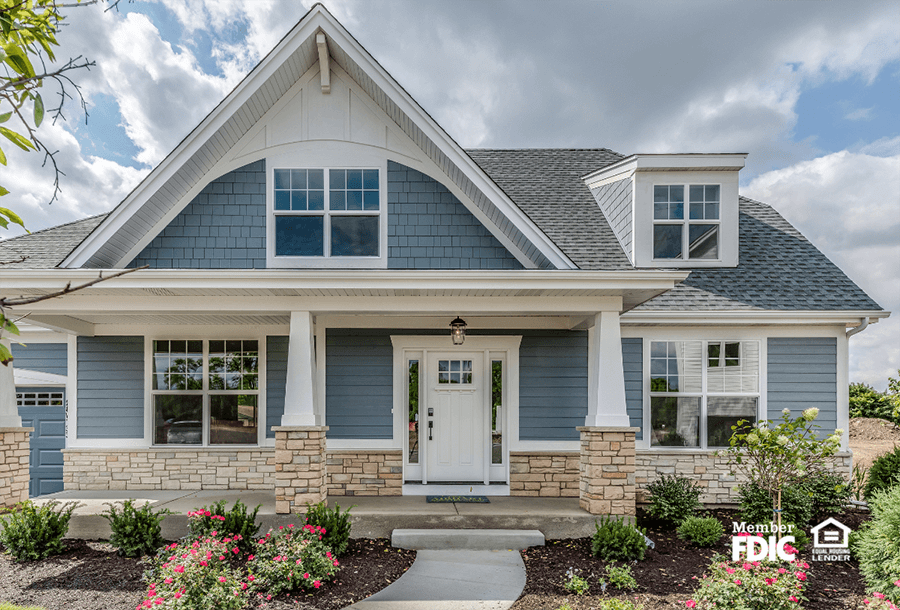

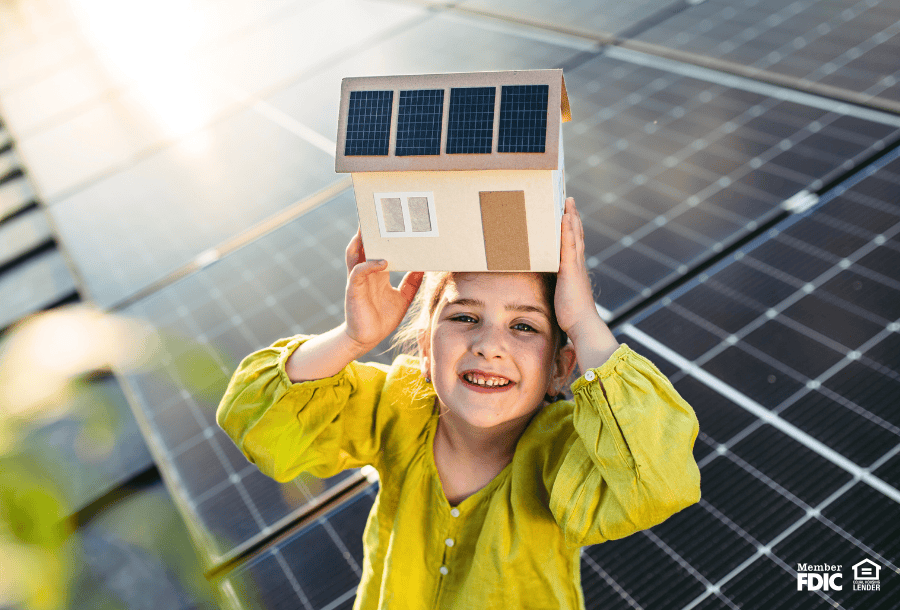

Home Mortgage

Home Mortgage

.png)

People & Culture

Commercial Banking

Business Banking

Commercial Banking

Business Banking

Business Banking

Business Banking

Home Mortgage

People & Culture

.jpg)

Commercial Banking

Business Banking

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

.png)

%20a%20900x610%20compressed%20(1).png)

.png)

.png)

.png)