Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-06-02

Digital Banking

published

5-minute

Banking Trends in 2025 & Beyond: Budgeting Apps for Financial Success

-

-

Financial wellness hinges on smart money management. However, many people still struggle with budgeting, expense tracking, and setting financial goals. To fill this space, digital tools like budgeting apps are gaining traction by offering a helpful way for users to monitor their finances.

Academy Bank recently surveyed over 300 participants to better understand how people are managing their money. The survey explores budgeting habits, budgeting app adoption, and ongoing financial challenges. What emerged offers a clear picture of how people approach their finances today—and where things may be heading next.

For more insights and a closer look at the data, see the full report: “The Role of Budgeting Apps in Personal Finance.”

Personal Budgeting in 2025

The survey results reveal that a strong majority of people (88.7%) feel at least some confidence in managing their finances. In addition, 83.1% report following a budget—whether strictly or loosely. This overlap suggests a connection between confidence and budgeting behavior.

Budgeting itself can ease financial stress and provide a clearer plan for reaching your goals. And the more consistently someone follows a budget, the more confident they may feel in their financial decisions. In this way, budgeting and confidence reinforce each other—creating a positive cycle that supports stronger financial habits over time.

When it comes to budgeting strategies, our respondents share the approaches they prefer most:

- Manual Expense Tracking: 53.8%

- Setting Financial Goals: 45.0%

- Using Budgeting Apps: 20.9%

- None of the Above: 14%

These results reflect the percentage of respondents who selected each option, as they were invited to select all that applied to their situation, leading to a cumulative total exceeding 100%.

While only 20.9% of respondents specifically use budgeting apps, our data shows a broader move toward digital tools for managing money. Overall, 45.3% report using some kind of digital solution. By subtracting the 20.9% who use apps, we can infer that 24.4% are using other tools—such as online calculators or budgeting spreadsheets.

This shift matters because it signals that more people are becoming comfortable using technology for personal finance. As this trend grows, there’s a clear opportunity for more innovative and adaptable digital financial solutions.

Detailed analysis of budgeting habits: “Popular Ways to Budget in 2025.”

The Adoption of Budgeting Apps

Our research shows that while budgeting apps aren’t the most common method overall, they are becoming increasingly popular and used more consistently. Nearly 80% of budgeting app users engage with these platforms at least weekly. Plus, many respondents report recognizing the value early on, with a majority describing budgeting apps as “very helpful.”

Key features driving app effectiveness include:

- Easy-to-Use Interfaces: Clear layouts and thoughtful design can make users stay engaged and come back regularly.

- Expense Tracking and Categorization: Automatic sorting helps users understand their spending patterns and make adjustments when needed.

- Goalsetting tools: Clear objectives motivate users to save money and pay off debts.

- Bill Reminders: Notifications to prevent missing deadlines or paying late fees.

These findings indicate that budgeting apps are establishing a notable role in personal finance by enabling users to build consistent and confident money habits.

Detailed analysis on budgeting app adoption: “Why Budgeting Apps Are Gaining Popularity in Personal Finance.”

The Remaining Challenges for Budgeting

Despite the availability of budgeting tools, some people still find managing their finances difficult. When asked about their biggest challenges, more than half (55.9%) of respondents said that overspending is a major concern. This suggests that resisting temptation and spending wisely continues to be an ongoing issue. In addition to overspending, respondents also pointed to irregular income (30%), a lack of financial knowledge (27.6%), difficulty tracking expenses (23.7%), and other issues (5.3%) as common hurdles.

From this, we can draw that while budgeting apps can assist in tracking expenses, they don’t always help users prevent impulse buys, maintain a steady income, or stick to their financial plans.

The Future Role of Budgeting Apps in Reaching Financial Goals

For budgeting apps to be truly effective, they need to go further than basic expense tracking. The best budgeting apps must offer helpful solutions for overcoming money problems and reaching goals.

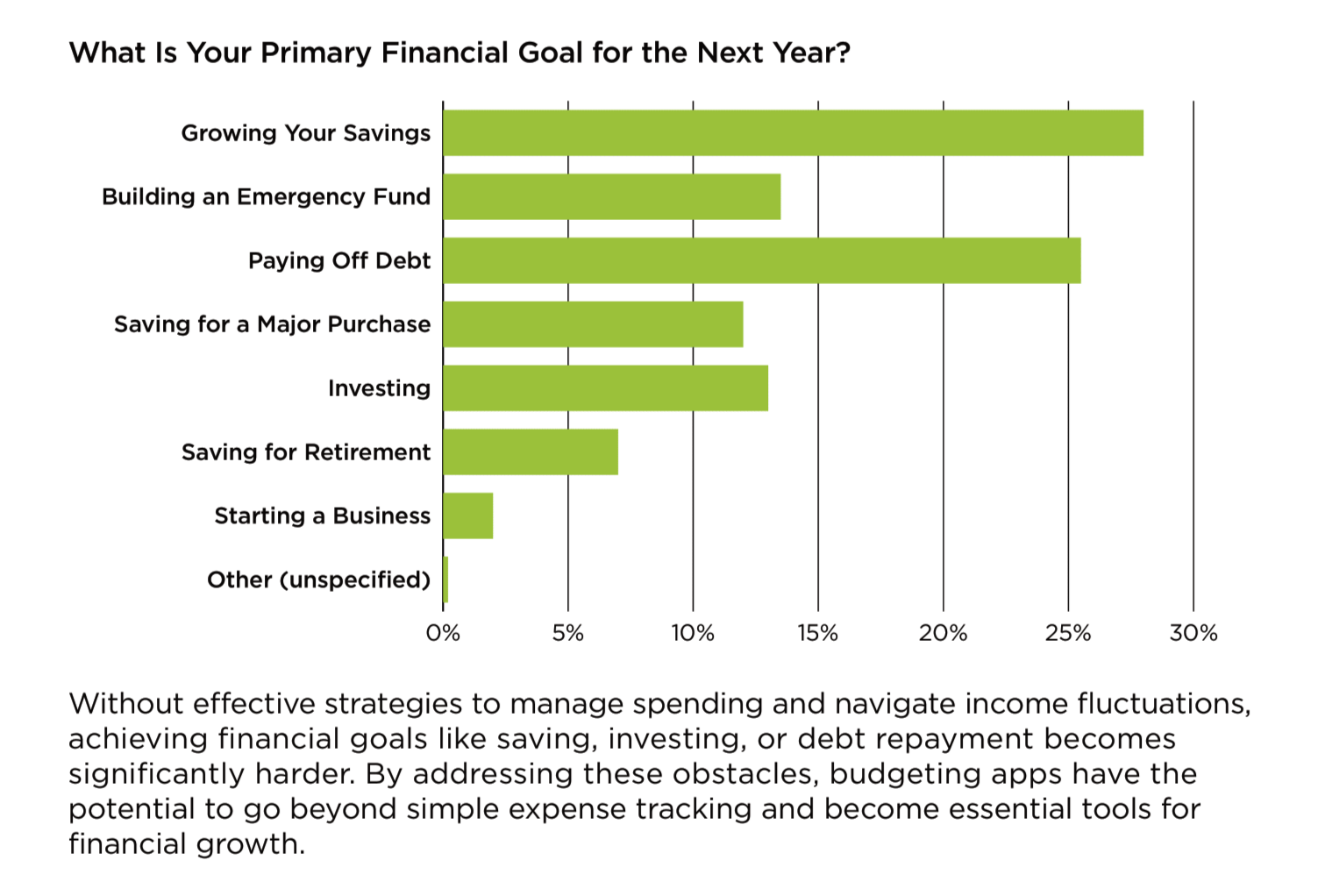

When asked to share their top financial focus for the next year, our survey respondents identified:

To reach their financial goals, individuals require more than a surface-level view of their money. Whether they are growing their savings, tackling debt, or starting to invest, users need tools that keep them prepared and motivated. That specifically is where budgeting apps have the most opportunity in the future.

Main Takeaways: Budgeting and Financial Success

Our findings indicate that, while budgeting apps have become an essential resource for many people, financial management itself remains a complex issue. Most respondents feel confident in their budgeting abilities, but challenges like overspending and fluctuating income still persist.

When budgeting apps are designed with the right features—such as user-friendly interfaces, goals-setting tools, and expense tracking—they can make a meaningful difference. However, for these solutions to be fully transformative, they must address the users’ biggest challenges and support them in building lasting financial habits.

While budgeting apps play a valuable role, they are not the silver bullet for financial success. Instead, they are a powerful resource within a broader strategy. True success requires a combination of the right tools, knowledge, and support. This creates an opportunity for new financial products and platforms. And if embraced, it will shape the future of digital finance.

Budgeting Tools at Academy Bank

At Academy Bank, we don’t just listen to what our community needs—we act on it. Our research drives us to build real solutions that help our clients reach their financial goals.

We recently introduced My Finance360, an innovative platform that provides a fresh perspective on money management. With real-time insights, easy-to-use budgeting tools, and automatic savings, My Finance360 puts you in control of your money, and it’s all built into your everyday online banking experience. Highlights include:

- User-friendly interface

- Automatically categorize your spending

- Set and track savings goals

- Manage your debt and monitor income

- Bank-level security to protect your personal information

- AND SO MUCH MORE!

“Banks and fintech providers that prioritize intuitive, feature-rich budgeting solutions stand to capture a growing market demand, and that is driving our development of this type of digital experience.” – Jodi Vickery, Chief Digital Officer.

Taking things one step further, Academy Bank offers additional tools and resources to support client needs. With online calculators for saving goals, net worth, and monthly budgets, creating a financial game plan is easier than ever. And with expert guidance just one click away, you are never alone in building a stronger financial future (see financial advice and education).

At Academy Bank, we see banking from a different point of view: yours! Let’s personalize your finances together!

Message and data rates charged by your mobile carrier may apply.