Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2024-05-28

Personal Loan

published

Consider a Personal Loan for Home Improvement Projects

-

-

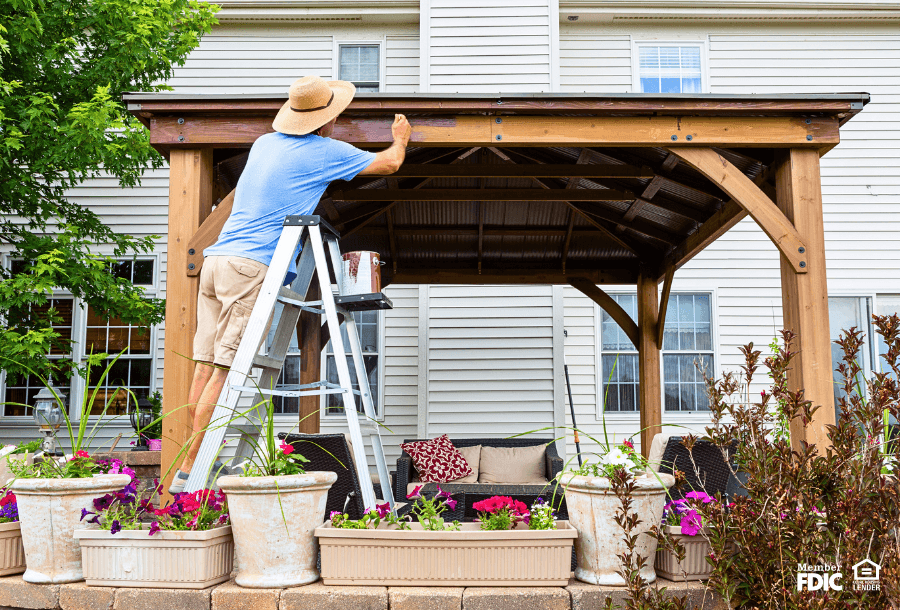

Are you dreaming of renovating your kitchen, adding a cozy nook to your living room, or finally fixing that leaky roof? Home improvement projects can transform your living space and enhance your quality of life. But of course, there’s always the nagging question: What’s the best way to pay for these projects? It turns out that personal loans for home improvement projects could be your best bet.

While there are many avenues to consider as far as financing options, personal loans offer a flexible and accessible solution for homeowners looking to upgrade their homes. Keep reading to learn more about personal loans and how they work, as well as the benefits of using personal loans to finance your home improvement projects.

What Is a Personal Loan?

A personal loan is money that individuals can borrow from a bank, credit union, or online lender to cover personal expenses.

Unlike loans for specific purposes like buying a car or a house, personal loans can be used for many different things such as paying off debt, making home improvements, funding a move, covering medical bills, purchasing birthday or holiday gifts, or funding special events like weddings or vacations.

How Do Personal Loans Work?

Personal loans, unlike some other types of loans, are usually unsecured. That’s why you may also hear them referred to as “unsecured personal loans.”

An unsecured loan means that borrowers don't have to offer any valuable assets like a house or car as collateral. Instead, lenders decide whether to approve a personal loan based on factors like the borrower's credit score and credit history, income, and ability to pay back the loan. They use this information to determine the interest rate and the amount of money the borrower can get.

Personal loans often have fixed interest rates, meaning the interest stays the same for the entire loan term. The loan term, in other words, is the length of time over which you’ll be paying back the loan. Loan terms are typically between one and five years, or even longer – it just depends on the lender and what you agree on. The borrower repays the loan by making monthly payments over the loan term.

What Are the Benefits of Personal Loans for Home Improvement?

While there are many different types of loans out there – and some are specifically designed for home improvement – personal loans have a few unique benefits.

First, personal loans provide flexibility in terms of loan amount and repayment terms. Whether you're planning a minor renovation or a major overhaul, you can tailor the loan amount to suit your specific needs. Additionally, you have the freedom to choose a repayment period that aligns with your budget and financial goals.

Opting for a personal loan also allows you to preserve your home equity for other purposes, such as emergencies or future investments. Unlike home equity loans or home equity lines of credit (HELOCs), which use your home as collateral, personal loans enable you to access funds without tapping into the equity in your home, providing greater financial flexibility.

You also get quicker access to funds than you might with other loan types which may require extensive documentation and appraisal processes. Personal loans, on the other hand, offer quick access to funds. In many cases, you can complete your personal loan application online and receive approval within a matter of days. This in turn allows you to kick-start your home improvement project.

Consider an Academy Bank Express Personal Loan for Your Home Improvement Project

Current customers can access funds in minutes with the Academy Bank Express Loan, providing quick access to the cash you need without resorting to high-interest payday lenders. With loan amounts ranging from $250 to $15,000, you’re in control of your funds.

Even those with low credit scores can be considered with a satisfactory account relationship. This loan is a great alternative to high-interest, short-term lenders like payday lenders, with fixed terms and monthly payments to simplify your budget.

Plus, automated payments ensure you'll never miss one – all you have to do is set it and forget it!

Applying online allows for quick approval status and access to funds, but keep in mind that direct deposit is required and there's an origination fee of 10% of the loan amount or $100, whichever is less.

Ready to get the funding you need for your home improvement project?

Existing customers can apply for our Express Loan in just minutes. We invite new customers to visit your nearest Academy Bank branch location.

Member FDIC

Subject to credit approval. Restrictions Apply. Direct deposit relationship required. Origination fee, 10% or $100 whichever is less. Annual Percentage Rate (APR) is based on credit score. Only one personal loan allowed to any borrower at any time. Loan terms are based on the loan amount.