Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2023-11-30

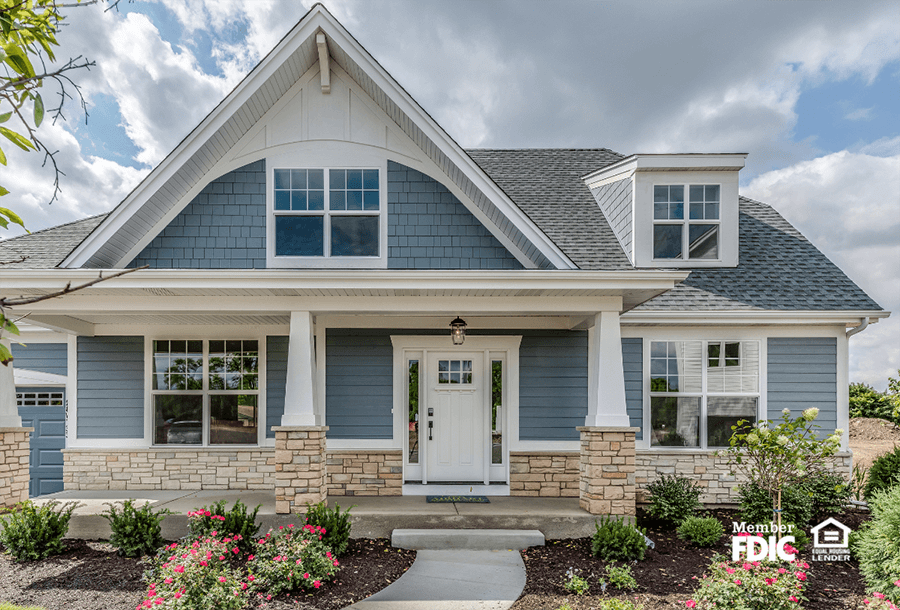

Home Mortgage

published

Riding the Wave of Mortgage Magic in 2024: Increased Conforming Loan Limits

-

-

We've got some awesome news to spice up your property game – the 2024 conforming loan limits are getting a turbo boost!

How to understand conforming loan limits:

So, imagine the baseline conforming loan limit as the VIP pass Fannie Mae and Freddie Mac hand out for your mortgage adventures. In 2024, that pass got an upgrade to $766,550, up by a cool 5.5% from the previous $726,200.

How are conforming loan limits set?

Now, for areas where home values are living their best life at 115% above the local median, the Housing and Economic Recovery Act (HERA) says, "Hey, let's set the roof at 150% of the baseline limit." What's that mean for you? Well, for one-unit properties, it's a whopping $1,149,825.

What's in it for Homebuyers?

1. House Hunting Extravaganza:

With the new baseline limit flexing at $766,550, you've got the golden ticket to a wider range of homes. No need to stress about jumbo loans – you're in the conforming club with more options to explore.

2. Big Loans, Small Rates:

Calling all refinancers and big dreamers! The sweet part about these higher limits is that you can snag larger loans while still enjoying those competitive conforming loan interest rates. It's like getting the deluxe package without the deluxe price tag.

3. Local Flavor Recognition:

Shoutout to HERA for being the cool aunt who gets it – different places, different vibes. The 150% ceiling respects the uniqueness of local housing scenes, ensuring everyone gets a fair shot at the mortgage party.

Tips to Rock Your Mortgage Journey:

1. Know Your Money Dance:

With the upgraded loan limits, do a little financial jig to see if you're eligible for the bigger, bolder loans. Check your income, credit score, and dance moves (just kidding about the last one).

2. Chat with our Mortgage Specialists:

Our mortgage experts are like your backstage pass to the homeownership concert. Hit them up, talk options, and let them guide you through the mortgage playlist.

3. Lock in Your Rate Groove:

Quick heads up – with the buzz around these new limits, consider locking in your interest rates sooner rather than later. It's like snagging tickets to the hottest show in town before everyone else catches on.

In a nutshell, the 2024 conforming loan limit boost is your golden ticket to homeownership bliss. At Academy Bank, we're not just about mortgages; we're about turning your homeownership dreams into reality. Read more about the home loans we offer and let's make your home sweet home dreams come true!

Subject to credit approval. Each loan product listed has specific terms and conditions. Fees apply.

Member FDIC