Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2024-06-03

Business Banking

published

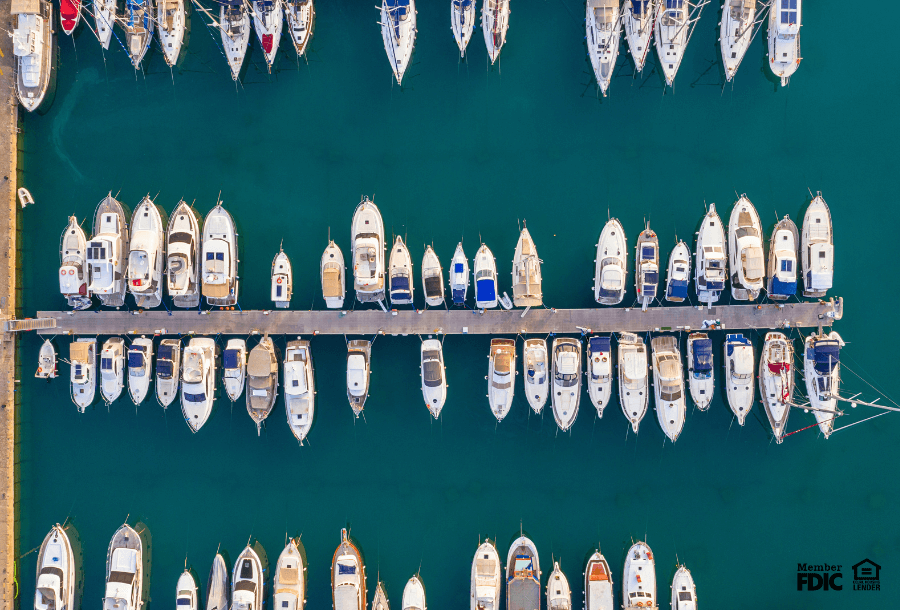

Best Loans for Boating and Marine Businesses: Term Loans

-

-

Warm days ahead! And for businesses in the boating and marine sector, the peak season means more than just adventure—it's a time for smart planning and financial readiness. As the industry gears up for its busiest time of the year, being prepared to meet the demands of eager boaters is essential. One key resource to rely on? Business term loans—a lifeline for stability and flexibility during the industry's ups and downs

Join us as we explore how boating and marine companies can leverage business term loans to navigate challenges and seize the opportunities throughout the year.

Business Term Loan Definition

A business term loan is a type of financing where a lender provides a lump sum of money to a company. The business then pays back this money over time, along with interest. Term loans for business offer fixed repayment schedules, meaning companies can easily plan their finances and handle debts.

These loans can be used for different professional needs, and they are especially helpful for companies dealing with revenue fluctuations throughout the year, including the boating and marine industry. Ultimately, term loans help businesses during slow times and prepare for busy ones.

Read more about business term loans and how they work in our previous article.

How Can Boating and Marine Businesses Use Term Loans?

When taking advantage of financial opportunities, businesses in the boating and marine industry can use term loans as a solution. Term loans help these companies manage the increased demand for boat rentals and marine services during peak seasons in several ways, including:

1. Inventory Management and Stocking Up

The peak season requires a large inventory of boats, marine equipment, and accessories. Whether you are a retailer, a rental service, or a marina, having sufficient stock to meet the increased demand is essential. Business term loans provide the necessary capital to purchase inventory in bulk, often at discounted rates, ensuring that your business is well-prepared to cater to your customers without facing shortages.

2. Facility Upgrades and Maintenance

Marine facilities, including docks, marinas, and boatyards, require regular maintenance and occasional upgrades to remain safe and inviting to customers. A business term loan can fund these necessary improvements, keeping your facilities in prime condition to handle the influx of customers during the busy season. This includes everything from repairing docks to upgrading navigation and safety systems.

3. Marketing and Promotional Campaigns

Effective marketing is crucial for attracting customers during the peak season. Investing in targeted campaigns like online ads, social media promotions, and local events can significantly boost visibility and engagement. Some recent trends in the boating industry underscore the need to diversify marketing techniques:

- Targeting a Wider Audience: While the average age of boating clients hovers around 50-58 years old, recent shifts in boating demographics show that younger individuals between the ages of 20 and 30 are becoming increasingly interested in boat rental and sharing. Therefore, tailoring marketing efforts to appeal to this demographic can tap into new revenue streams.

- Video Marketing: Video marketing continues to grow in popularity, with 69% of people preferring to watch short videos. Therefore, leveraging this medium allows businesses to engage potential customers better than they would with traditional methods. From showcasing scenic boat trips to demonstrating safety features, video marketing can drive customer interest and ultimately lead to increased sales and revenue.

A business term loan can fuel these updated marketing initiatives, ensuring your business stands out in a competitive market.

4. Hire and Train Seasonal Staff

The boating season often calls for hiring additional staff to handle the increased workload. Having a well-trained team—including sales personnel, boat handlers, and customer service representatives—is vital for providing excellent service. Term loans can cover the costs associated with recruiting, hiring, and training new employees, allowing your business to scale operations smoothly as demand peaks.

5. Investment in Boating Technology

Innovations in technology are reshaping the boating industry, offering exciting opportunities to heighten the on-water experience. By tapping into business term loans, marine businesses can invest in these advancements, staying ahead and attracting customers. Some recent technological trends include things like autonomous docking systems, customization options, improved safety features, eco-friendly projects, high speed internet at sea, and more. Investing in these technologies doesn't just make customers happier—it also helps businesses stand out and ensures long-term success.

6. Cash Flow Management

Seasonal businesses often struggle with cash flow. They spend a lot of money getting ready for the busy season, but they might not see profits right away. A business term loan can help during this time because it gives companies the funds to cover things like payroll, bills, and buying supplies until they start making money again. Successful management of cash flow can make a big difference in keeping businesses running smoothly throughout the year, allowing them to seize opportunities and weather any challenges that come their way.

Finding the Best Business Term Loan for the Boating and Marine Industry

As companies in the boating and marine industry gear up for the busy season, it’s important for owners to prepare both strategically and financially. Business term loans are a versatile tool that can help address various needs, from stocking inventory to launching marketing campaigns.

At Academy Bank, we offer businesses financial support, fixed interest rates, and predictable repayment schedules. This financial certainty makes budgeting easier, especially during slower times, ensuring that loan repayments remain manageable for businesses.

When you partner with Academy Bank, you gain access to tailored business banking options designed to meet your specific needs. Our dedicated business bankers will work closely with you to find the right loan solution and unlock opportunities for expansion and growth.

Here are some advantages of Academy Bank’s business term loans:

- Competitive interest rates

- Flexible repayment terms suited to your business cycle

- Opportunity to build and strengthen your business credit profile

A business term loan from Academy Bank can be the financial anchor that your boating or marine business needs!

Ready to set sail? Visit a nearby banking center, call 866-277-4539, or email our Business Bankers at businessbanking@academybank.com.

Member FDIC

All loans and lines of credit are subject to credit approval and require automatic payment deduction from an Academy Bank business checking account. Origination and annual fees may apply. Terms, conditions, and loan product eligibility applies.