Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-05-16

Digital Banking

published

4-minute

Why Budgeting Apps Are Gaining Popularity in Personal Finance

-

-

Academy Bank recently surveyed over 300 people to better understand how they manage their money—from daily habits to preferred tools. In our previous article, we examined common budgeting strategies and found that people who follow a budget tend to have more confidence in money management.

Now, we shift focus to one budgeting method gaining traction: budgeting apps. While not the most widely used strategy in our survey, budgeting apps are steadily gaining popularity as more people turn to technology for financial support. Let’s take a closer look at how people are using budgeting apps, which features matter most to users, and why these digital tools are becoming a go-to resource for financial planning.

Adoption of Budgeting Tools

After identifying the survey respondents who follow some type of budget (whether strict or flexible), we asked about their budgeting strategies. The most common methods were tracking expenses manually (53.8%) and setting financial goals (45%). About 20.9% reported using budgeting apps.

In a separate question, we asked participants if they use any digital tools to manage their finances. A total of 45.3% said they do. Since only 20.9% mentioned using a budgeting app specifically, we can conclude that the remaining 24.4% are using other types of digital tools, like budgeting spreadsheets, online calculators, or digital banking platforms.

What is a Budgeting App?

A budgeting app is a digital tool that helps people take control of their finances. By connecting your financial data from various accounts—like checking, savings, credit cards, and investments—a budgeting app gives you a clear picture of where your money is coming from and where it’s going.

At its core, a budgeting app makes managing your money simpler and more transparent. It transforms complex financial information into easy-to-understand insights, helping you make smarter decisions, stay within your budget, and work towards your financial goals with confidence.

How Often Do People Use Budgeting Apps? And Do They Work?

Budgeting apps have become a regular part of financial management for many users. Nearly 80% of respondents who use these apps engage with them at least weekly: 50% use them weekly, and 29.9% use them daily. Another 13.6% use them monthly, while only 6.5% open them less than once a month. These numbers show that budgeting apps aren’t just backup tools—they are part of a consistent financial routine.

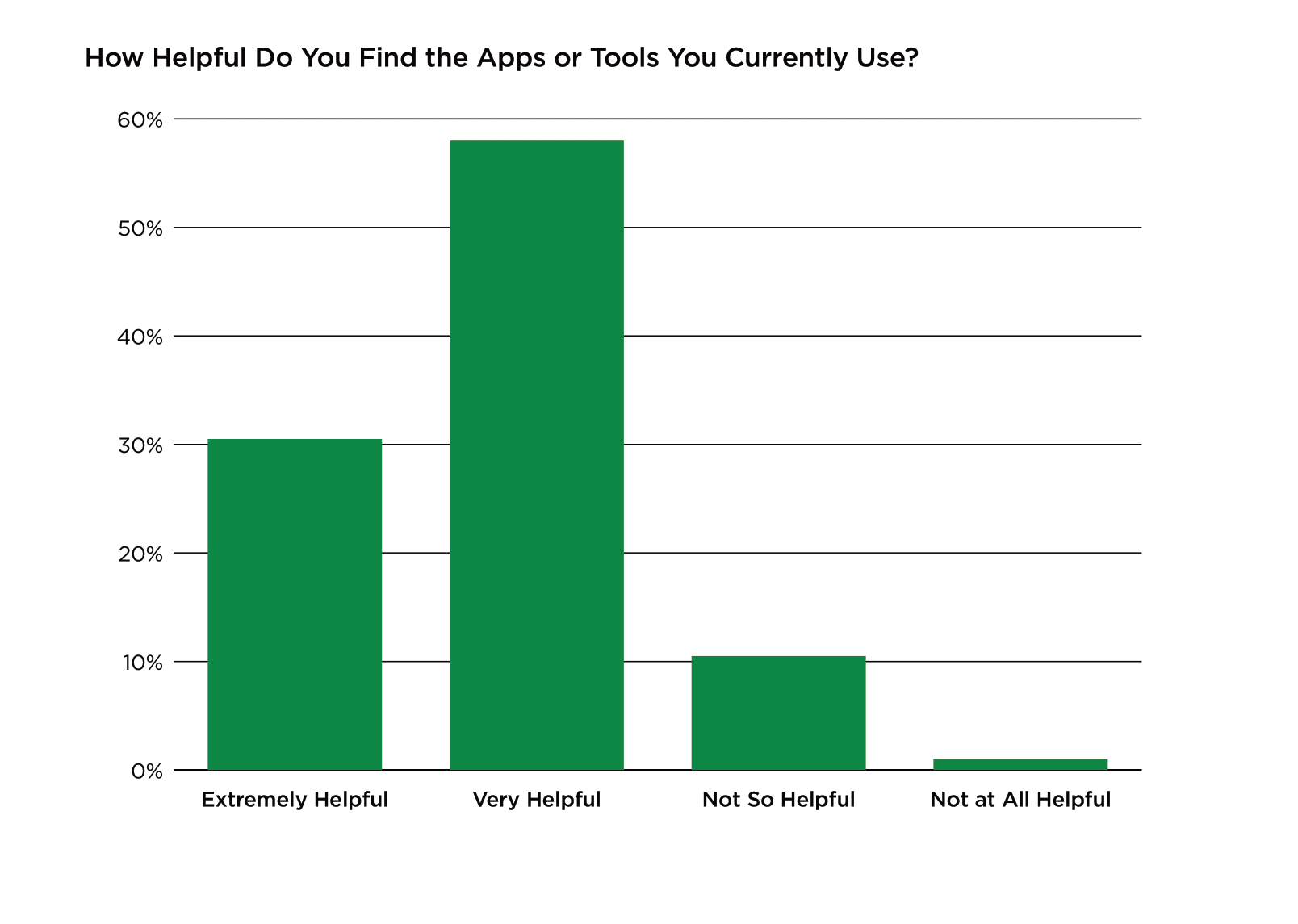

When it comes to utility, budgeting apps and tools earn high praise. More than 88% of users said they find these resources either very helpful or extremely helpful. This suggests that once people adopt budgeting technology, they start to see real value in it.

Among those who use budgeting apps:

- 47.7% rely on apps provided by their bank

- 29.4% prefer third-party apps like YouNeedABudget or RocketMoney

- 22.9% use a mix of both

Together, these results show that once users commit to a budgeting app—regardless of the provider—they tend to use it often and find it highly effective. It highlights the role that digital tools play in building consistent, confident money habits.

What Features Do the Best Budgeting Apps Have?

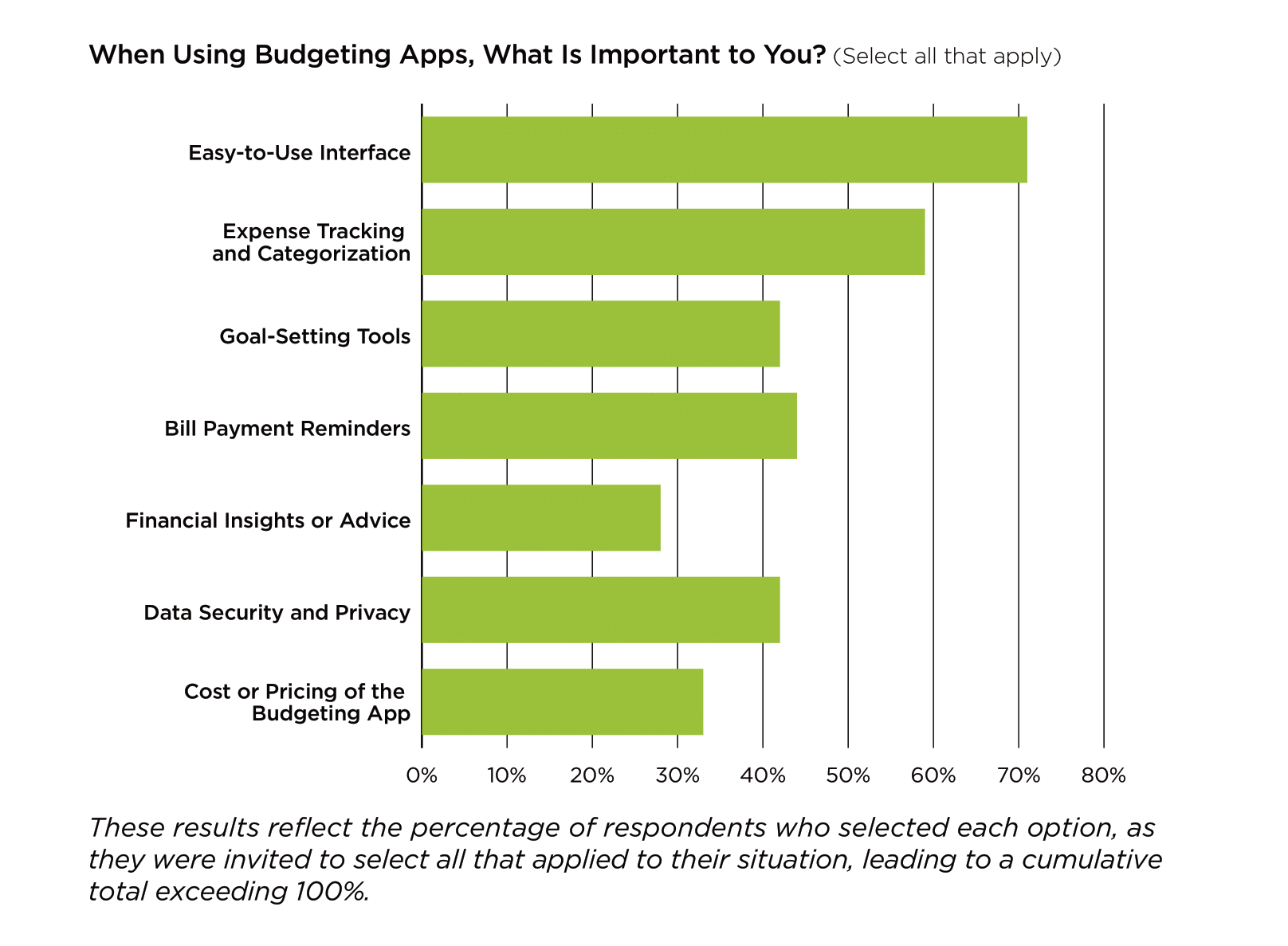

As more people turn to budgeting apps to manage their money, certain features are emerging as clear favorites. According to our survey respondents, the best budgeting apps incorporate the following attributes:

1. Easy-to-Use Interface

A clean, intuitive interface can make or break a budgeting app—and according to our survey respondents, it’s the most important feature of all. Users want to log in and immediately understand where to go and what to do—no guesswork, no steep learning curve. Whether it’s viewing account balances or adjusting budget categories, simplicity and straightforward navigation are key attributes. If the app feels complicated, it’s likely to be abandoned quickly.

2. Expense Tracking and Categorization

Earlier in our survey, we found that more than half of budgeters use expense tracking as a core strategy—even outside of apps. Therefore, it’s no surprise this feature ranks highly among budgeting apps.

Budgeting apps that automatically track spending and sort it into categories like groceries, bills, dining out, or gas can help users stay aware of where their money is going. This makes it easier to spot patterns, cut back where needed, and stick to a financial plan.

3. Goal-Setting Tools

These tools help users pinpoint and work toward specific financial objectives, such as saving for a vacation, paying off debt, or building an emergency fund. Special features might include setting savings targets and tracking progress as you go. Goal-setting tools keep users motivated by giving them a clear plan and visual checkpoints. This helps people stay focused on reaching those financial milestones.

4. Bill Payment Reminders

This feature sends automatic notifications to remind users about upcoming bills and payment due dates. It’s a simple way to prevent missing payments, which ultimately helps you avoid late fees and keep a positive credit profile. By automating these alerts, you can stay organized and make sure your bills are paid on time—no more scrambling or forgotten deadlines.

5. Financial Insights or Advice

While some apps offer tailored money saving tips or financial advice to save, our respondents didn’t consider this feature “essential.” Compared to more hands-on tools like tracking and categorizing expenses, advice is considered a “nice-to-have” more than a “must-have.” Users may prefer to make budgeting decisions on their own or seek guidance elsewhere.

6. Data Security or Privacy

Since most budget planners and money apps handle sensitive financial information, it’s no surprise that users care about data security and privacy. Strong security measures may involve things like encryption, secure login methods, and clear privacy policies that protect your data. When you feel confident that your personal information is safe, you are more likely to use a personal budgeting app without concern.

7. Cost or Pricing of the Budgeting App

Believe it or not, people who care about budgeting aren’t too eager to spend money on budgeting tools. Some apps are free, while others come with a price tag—either a one-time fee or a subscription. While the cost can help users determine whether an app is worth it, this feature is not the highest priority for our survey respondents.

Are Budgeting Apps Here to Stay?

Budgeting apps are clearly becoming a regular part of financial management for many individuals. With nearly 80% of users engaging with them weekly and 88% finding them helpful, it’s clear these apps aren’t just a trend—they are delivering real value.

The best budgeting apps include features like simple, user-friendly interfaces, automatic expense tracking, and goal-setting tools. These attributes enable users to stay on top of their finances and make smarter choices. At the end of the day, budgeting tools are helping people build better financial habits and feel more confident about managing their money.

Budgeting Tools and Apps at Academy Bank

Academy Bank doesn’t just prioritize understanding the needs of our community; we take action to meet them. Our research goes beyond insight—it drives us to create practical solutions that truly support your financial goals.

For those searching for budgeting apps that cover all the bases, Academy Bank’s My Finance360 provides a fresh perspective on money management. Here’s why it is a top choice for budgeters:

- Set personalized savings goals and track your progress

- Link all accounts, including external ones, for a comprehensive 360-degree view of your finances

- Monitor income, expenses, and manage debt

- Set and track spending limits

- Enjoy automatic, personalized transaction categorization

- Benefit from an easy-to-use interface

- Trust in bank-level security and encryption to protect your information

- Free for Academy Bank mobile banking and online banking users

With My Finance360, you have everything you need to stay on top of your finances in one place. And to cover the rest, we offer a range of online calculators. Top choices include the Savings Goals Calculator, Monthly Budget Calculator, and Net Worth Calculator.

If you haven’t started budgeting yet, now is a great time to begin! With the right tools and a clear plan, you can build a budget that fits your needs and supports your financial goals.

Be sure to catch our next article, where we tie everything together. We will take a closer look at ongoing budgeting challenges and how they influence financial outcomes. And to explore our complete set of survey insights, read our full report: “The Role of Budgeting Apps in Personal Finance.”

Message and data rates charged by your mobile carrier may apply.