Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2024-05-31

Home Mortgage

published

What are the Mortgage Pre-Approval Requirements?

-

-

What are Mortgage Pre-Approvals?

A pre-approval involves contacting a mortgage lender before making an offer on a home. During this process, you complete a mortgage loan application that includes details about your finances. Then, a loan underwriter reviews your financial documents and commits to providing a loan up to a certain amount.

Why Should I Get Pre-Approved for a Mortgage?

Getting a pre-approval offers several key benefits. First, it speeds up the homebuying process. Instead of the typical 30-day closing period, you might be able to close in just two weeks, allowing you to act quickly when you're ready to make an offer. This speed gives you a competitive edge, especially in a seller's market. Sellers and realtors prefer working with pre-approved buyers because it simplifies the process and reduces the risk of delays from financial issues. A pre-approval shows sellers that you are serious and prepared because it gives them confidence that this deal will close smoothly. Additionally, real estate agents can work more efficiently with pre-approved clients, helping you find homes within your budget.

Pre-approval also gives you a clear understanding of your financing before you start house hunting. You will know exactly how much you can afford and the terms of your loan, so you won't waste time looking at homes outside your budget.

What do Lenders Review for Pre-Approvals?

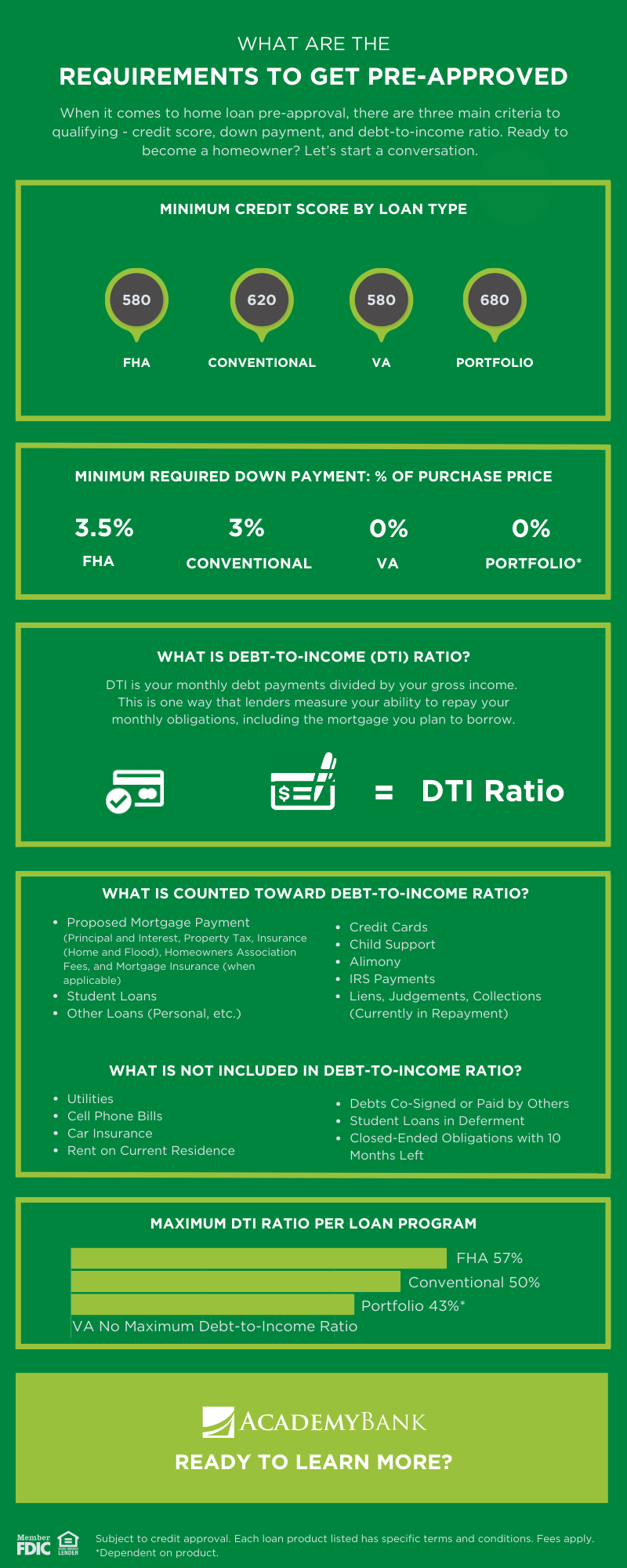

During the pre-approval process, the lender considers your income, credit score, debts, and employment history. Specifically, they review your last two pay stubs, last two bank statements, last two years of W-2s and tax returns, and creditworthiness.

The credit check involves more than simply reviewing the borrower’s three-digit credit score (or FICO score). Lenders dig deeper into factors such as credit history, amounts owned, credit utilization ratio, credit history, credit mix, and new credit.

In the end, the better your creditworthiness, the better your rates and terms on a home loan.

What are Minimum Required Down Payments?

During the pre-approval process, the percentage of your minimum required down payment is determined. This number varies for each person and depends on your specific circumstances, rather than adhering to a standard guideline. However, understanding the standard guidelines can still provide valuable insights.

As mentioned in the infographic above, the minimum required down payment percentage for a FHA loan is typically 3.5%, a figure determined by the Federal Housing Administration (FHA). This standard makes FHA loans a popular choice among first-time homebuyers due to their lower down payment requirements and more flexible credit qualifications.

VA home loans stand out for not requiring a minimum down payment, thanks to their backing by the Department of Veterans Affairs. This support makes homeownership more accessible for military service members and their spouses. By waiving the down payment requirement, VA loans break down financial barriers so veterans and their families can achieve their dreams of homeownership.

Meanwhile, for conventional loans, the minimum required down payment is solely based on the lender's requirements and the specific terms of the loan (typically hovering around 5%). However, there are exceptions. For example, loan applicants who are first-time homebuyers (OR have not owned a home in the past three years) who earn less than or equal to 80% of county area medium income may qualify for a reduced minimum down payment of 3%.

A portfolio loan may not need a down payment, which is why the minimum percentage goes as low as 0% in the infographic. Portfolio loans are mainly chosen by investors or borrowers if they have unique needs not met by other loans. Unlike conventional home loans sold to investors, portfolio loans are kept by the lender. This lets them be more flexible, meaning they can finance more of the purchase.

Can I get a Mortgage Pre-Approval at Academy Bank?

At Academy Bank, we provide a wide range of resources to assist you throughout your home buying process. Whether you are a first-time buyer, starting the pre-approval process, or simply exploring mortgage options, our team is here to assist you every step of the way.

Be sure to take advantage of our online mortgage calculators—including the mortgage qualifier calculator, mortgage loan calculator, and mortgage comparison calculator—to better understand your financial options.

Ready to get started? Let our experienced mortgage experts and loan advisors guide you toward reaching your goal of homeownership!

Member FDIC

Subject to credit approval. Qualification guidelines and restrictions apply with each loan product. Fees apply.