Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2024-05-07

Home Mortgage

published

Mortgage Pre-Approvals: What You Need to Know

-

-

For many people, the dream of owning a home is a significant milestone in their lives. But the journey to homeownership can be tricky, filled with complex processes and terminology. Luckily, there are several steps that prospective homeowners can take to help make the process go more smoothly: for example, obtaining a mortgage pre-approval.

Keep reading to learn more about mortgage pre-approvals – from what it means, its benefits, how to get one, and more.

What does a mortgage pre-approval mean?

A mortgage pre-approval is a preliminary assessment from a lender that indicates how much money you may be eligible to borrow for a home purchase. It's not a guarantee of a home loan, but rather a conditional commitment based on certain financial information provided by the borrower.

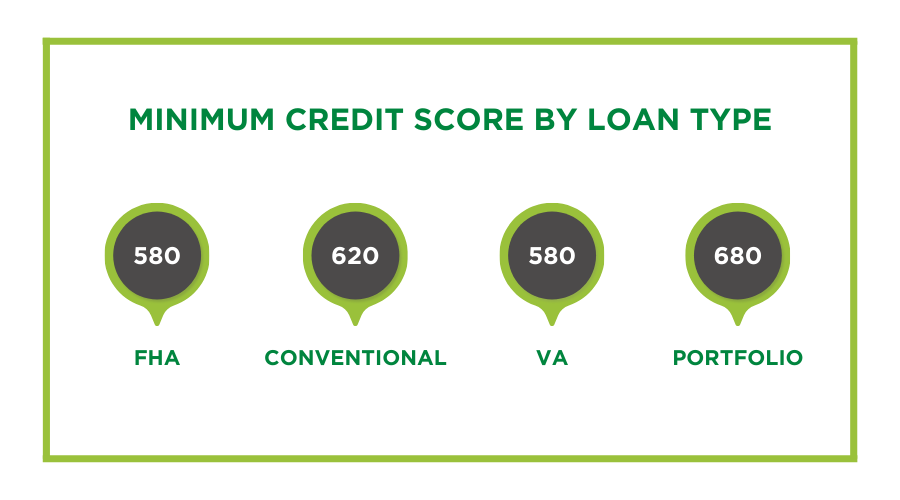

During the pre-approval process, mortgage lenders evaluate factors such as your income, credit score, employment history, and debt-to-income ratio to determine your borrowing capacity.

How does a mortgage pre-approval work?

To get the ball rolling on the mortgage pre-approval process, the prospective homebuyer – you – would fill out an application for a lender, detailing your financial situation. You’ll need to provide information about your income, assets, debts, and work history. The lender then carefully examines this application, verifying the information provided with documents, such as pay stubs, tax returns, and bank statements. This thorough review gives the lender a solid understanding of your financial health.

A crucial part of this process is the credit check, where the lender looks into your credit report and score. This assessment is vital in deciding your creditworthiness and the terms of the pre-approval. Additionally, the lender will likely consider other financial factors like debt-to-income ratio and job stability to gauge your ability to handle a mortgage.

Once all these aspects are weighed, the lender makes a call on the pre-approval. This would provide you with a clear idea of how much you can borrow on your path to homeownership.

What are the benefits of a mortgage pre-approval?

Obtaining a mortgage pre-approval can be a good idea because it offers several advantages for prospective homebuyers. Here are just a few of them.

1. Know your budget

With a pre-approval, you'll have a clear understanding of your purchasing power, helping you narrow down your home search to properties within your price range.

2. Gain negotiating power

Sellers often view pre-approved buyers as serious and financially capable, which can give you an edge in negotiations and may lead to more favorable terms.

3. Streamline the buying process

Once you find the right home, having a pre-approval in hand can expedite the mortgage application process, potentially shortening the time to closing.

4. Identify potential issues

If there are any red flags in your financial profile, a pre-approval can alert you to areas that may need improvement before proceeding with the home purchase.

How can you get pre-approved for a mortgage?

To obtain a mortgage pre-approval, follow these steps:

- Gather necessary documents: Be prepared to provide documentation such as pay stubs, W-2 forms, tax returns, bank statements, and proof of assets.

- Research lenders: Shop around and compare pre-approval offers from multiple lenders to find the best terms and rates.

- Submit an application: Complete a mortgage pre-approval application with your chosen lender, providing accurate and up-to-date information about your financial situation.

- Undergo a credit check: Lenders will review your credit history and score as part of the pre-approval process to assess your creditworthiness.

- Wait for the decision: Once you've submitted your application and documents, the lender will review your information and determine whether to pre-approve you for a mortgage.

How long does mortgage pre-approval take?

The timeline for mortgage pre-approval can vary depending on factors such as the lender's workload, the complexity of your financial situation, and how quickly you provide required documentation. In general, the process typically takes a few days to a week to complete.

How long is a mortgage pre-approval good for?

Mortgage pre-approvals have a shelf life, typically ranging from 60 to 90 days. After this period, the pre-approval expires, and you may need to reapply if you haven't found a home or locked in a mortgage rate. It's essential to keep this timeframe in mind when shopping for homes to ensure your pre-approval remains valid throughout the homebuying process.

Academy Bank Is Your Mortgage Partner

Academy Bank has all the tools you need for your home buying journey. Whether you’re considering buying a home for the first time or just exploring your mortgage options, Academy Bank is by your side. Our experienced mortgage experts and loan advisors are ready to help you work toward your goal of homeownership.

Member FDIC

Subject to credit approval.