Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-04-25

Financial Health

published

2-minute

Popular Ways to Budget in 2025

-

-

Budgeting is the backbone of financial stability. Whether you are saving for a new car, tackling debt, or building up your emergency fund, a good budget is the first step toward reaching your monetary goals. But how do you keep a budget? Academy Bank recently surveyed over 300 people to uncover their everyday budgeting habits and strategies. Keep reading to learn how people are managing their money in 2025 and explore tools to help you stay in control!

Why Budgeting Matters

When you think about budgeting, the word "freedom" might not be the first thing that comes to mind—but it should be. A budget isn’t just about cutting costs; it’s about making your money to work for you. Budgeting helps you cover your needs and plan ahead for the future.

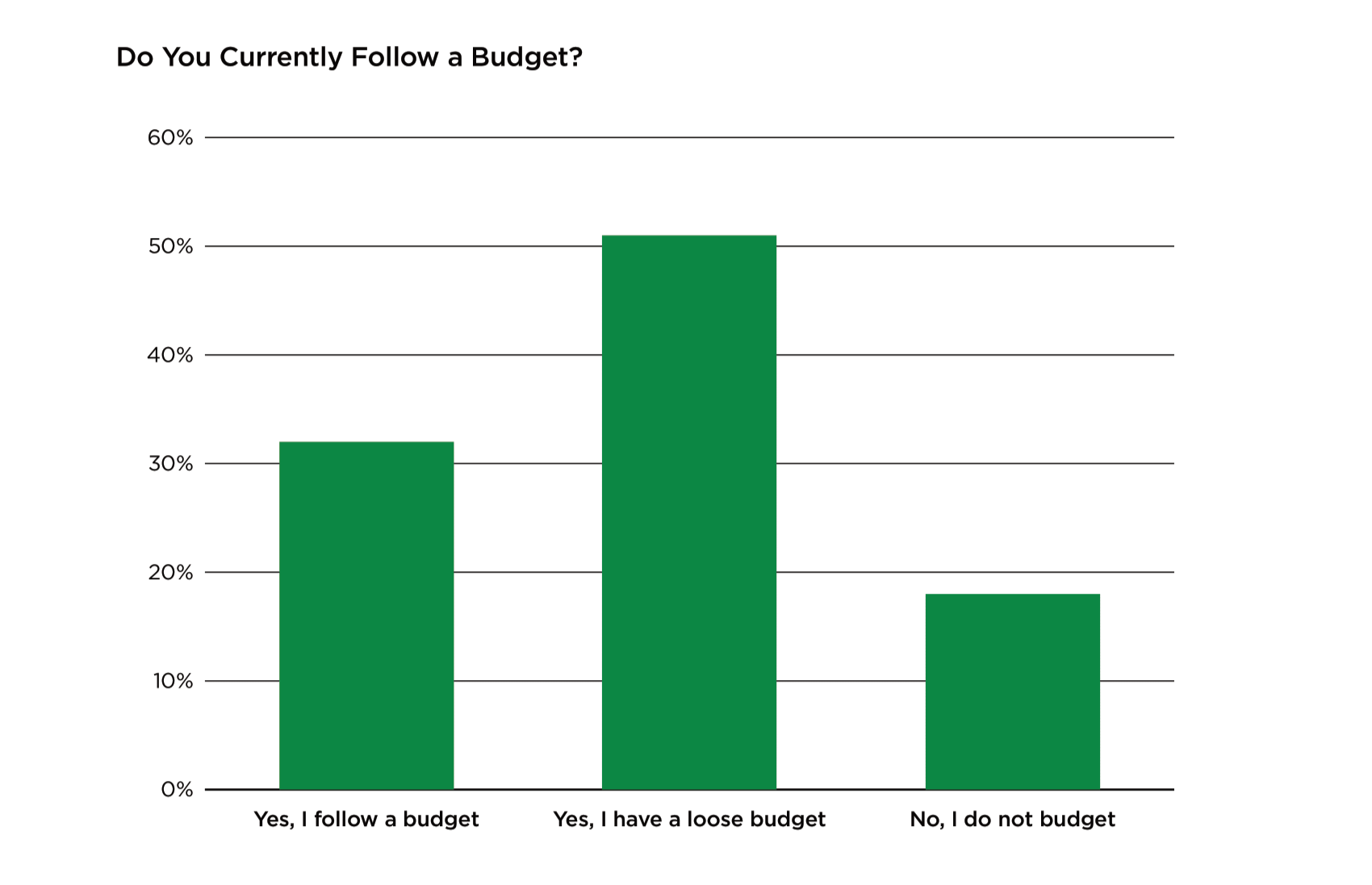

Keeping a budget also impacts your confidence in handling your own finances. According to our recent survey:

- 42.4% of respondents feel very confident managing their finances.

- 46.3% of respondents feel somewhat confident, meaning 88.7% of people report having at least some financial confidence.

- 9.6% of respondents feel not very confident, and 1.7% feel not very confident at all.

So, what is the relationship between budgeting and confidence? 83.1% of respondents said they follow some form of budget, whether it be strict or loose. This shows that people who feel confident managing their money are also more likely to keep a budget.

(See chart below).

Main Takeaway: Creating even a simple budget can reduce anxiety about your money and give you a clearer financial roadmap.

Popular Budgeting Strategies and Tools

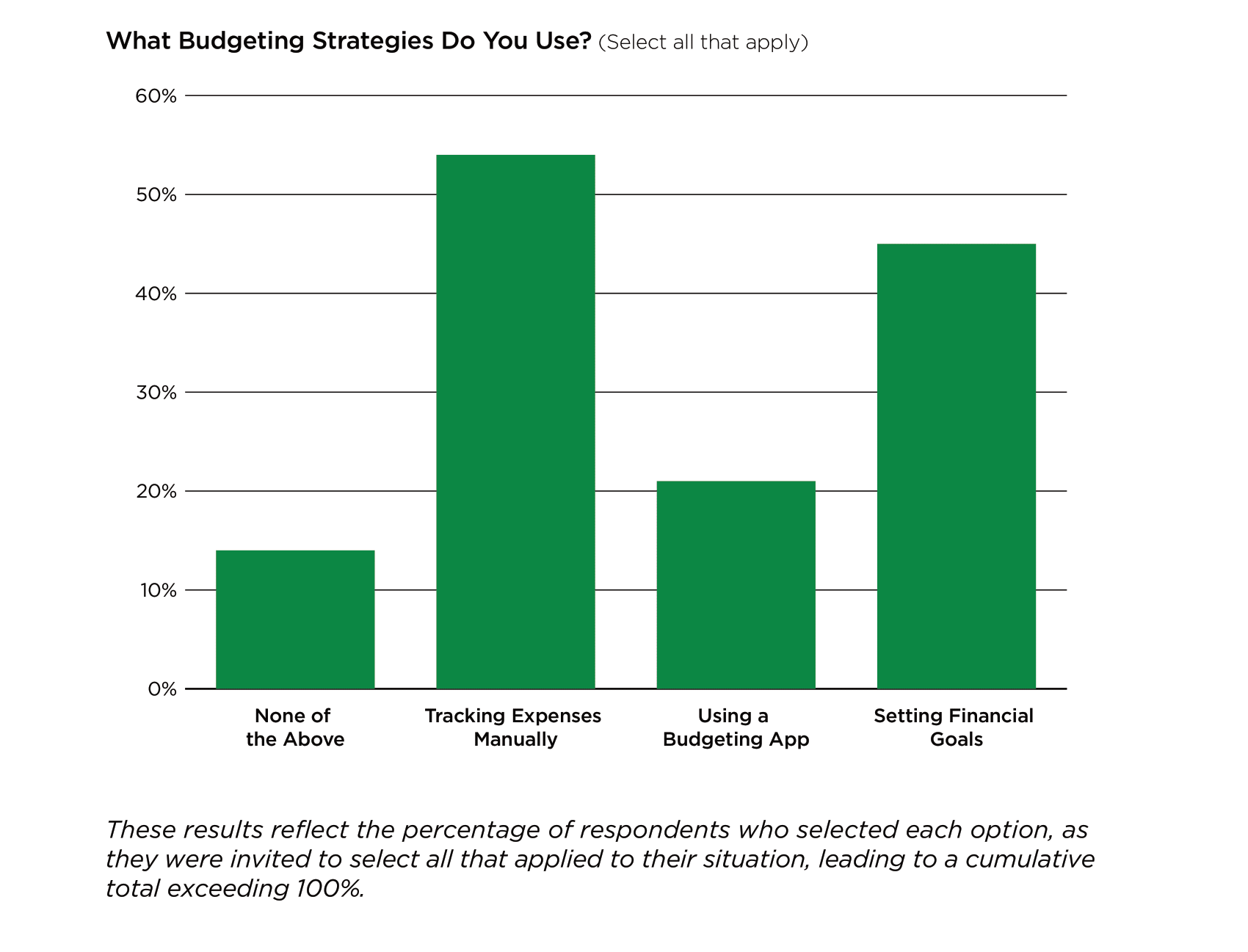

When we took a closer look at the respondents who followed a budget, some common strategies stood out:

(See chart below for a detailed breakdown).

STRATEGY 1: Tracking Expenses Manually (53.8%)

Many people still prefer the “traditional” approach of logging expenses by hand. Using spreadsheets or notebooks is a popular strategy because it gives you instant visibility and helps you truly understand your spending habits. Whenever you are actively engaged with every dollar you use, you become more aware of your spending choices.

STRATEGY 2: Setting Financial Goals (45%)

Goals give your budget purpose and direction. Whether you are saving for that dream vacation, building an emergency fund, or tackling debt, having clear objectives keeps you focused and motivated. That's because when you know exactly what you are working toward, it’s easier to prioritize spending and sticking to a plan. And the best part? You feel a sense of accomplishment in the end.

STRATEGY 3: Using a Budgeting App (20.9%)

While they are slightly less common than manually tracking expenses and setting goals, apps for budgeting are growing in popularity. They automate the tedious parts of budgeting, like categorizing expenses and tracking progress towards goals. Plus, their helpful features make it easier for users to organize their finances and create better money habits.

How to Build a Better Budget with Academy Bank

To make budgeting easier and more accessible, Academy Bank offers several tools that simplify financial management and help you build lasting confidence:

- My Finance 360: This free, personal money management tool is available through our online and mobile banking platforms. With My Finance360, you can set budgets, track spending, and handle debt. Plus, you can even link your external bank accounts to oversee your money in one convenient place.

- Savings Goal Calculator: If you have specific milestones in mind, this resource calculates how much you need to save and the time it will take to get there.

- Home Budget Calculator: Want to know exactly where your money is going? Just input your income and expenses into this monthly budget calculator to get a detailed breakdown. You will find areas for improvement and receive insightful reports that highlight any wasteful spending.

- Checkbook Balancer: If you need to learn how to balance your checkbook, this tool simplifies the process and helps manage your budget.

- Financial Advice: Our online financial education and blog platforms offer tips and strategies to make smarter money decisions. Whether you are saving for retirement or learning how to use credit responsibly, you will find practical advice for any stage of your life.

Not following a budget yet? It’s never too late to begin! With the right resources and strategies, you can create a budget that works for you and sets you up for success.

Explore our next article, where we will explore the rise of budgeting apps and their best features. And for a deeper understanding of our research findings, check out the budgeting survey results!

Message and data rates charged by your mobile carrier may apply.