Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-07-31

Business Banking

published

4-minute

Small Business Lending Trends: How Business Owners Choose Banks

-

-

Small businesses make up a majority of American companies and employ millions of workers nationwide. However, running and growing these businesses often requires additional capital. Enter small business loans.

Academy Bank recently surveyed over 220 entrepreneurs to better understand how small business owners approach business lending. The survey explores the profiles of small business borrowers, their reasons for getting a business loan, and their service priorities. The data reveals some surprising patterns that challenge our common assumptions about small business lending. Keep reading to learn what today’s small business borrowers really want and what this means for the future of business lending.

For more insights and a closer look at the data, view the full report: “Business Loans and Banking Relationships: What Matters Most to Small Business Owners.”

Top Reasons Small Businesses Take Out Loans

Over the course of our research, one thing became clear—small business loans aren’t just common, they are essential. Nearly two-thirds (65.8%) of entrepreneurs surveyed have received business financing at some point, and most are running small operations with fewer than 50 employees AND modest annual revenue.

The majority of small business loans discussed—about 70%—are for $100,000 or less. These loans are helping drive growth, not just sustaining basic functions. Business owners are seeking funding to support key initiatives like purchasing equipment or inventory, expanding operations, managing cash flow gaps, and investing in marketing. These goals reflect a forward-thinking mindset: business owners are using credit thoughtfully to strengthen their position and accelerate their success.

In short, business financing isn’t a sign of struggle. Instead, it’s tool for progress.

A full breakdown of borrower habits and motivations is available in “Understanding Small Business Loans: Borrowing Trends & Purposes.”

Lending Preferences for Small Business Owners

Our survey also explored how small business owners apply for loans and what kind of lenders they prefer working with.

While digital tools are on the rise, most business owners still value in-person experiences. More than half applied for loans in a branch, and those who worked with a dedicated business banker also reported positive experiences. These results show that the human element still carries weight, especially for those who want personal guidance during the process.

Local banks play a key role in meeting these needs, with nearly 60% of respondents choosing to bank with a community or regional institution. But to earn long-term loyalty, especially from younger business owners, banks must be ready to adapt.

In fact, younger generations are charting a new course. A majority of Gen Z business owners (56%) and a large portion of Millennials (43.3%) prefer digital banking options—whether it’s applying online, using mobile tools, or managing their accounts virtually. This shift reflects broader generational expectations: speed, convenience, and customization.

As more Millennials and Gen Z entrepreneurs launch businesses, their digital-first mindset will continue to reshape the delivery of financial services. How can banks stay relevant? They need to deliver both priorities: strong personal relationships and seamless digital experiences for the next generation.

Detailed analysis of small business lending preferences: “How Small Business Owners Prefer to Borrow: Survey Findings.”

What Business Owners Value Most in a Bank

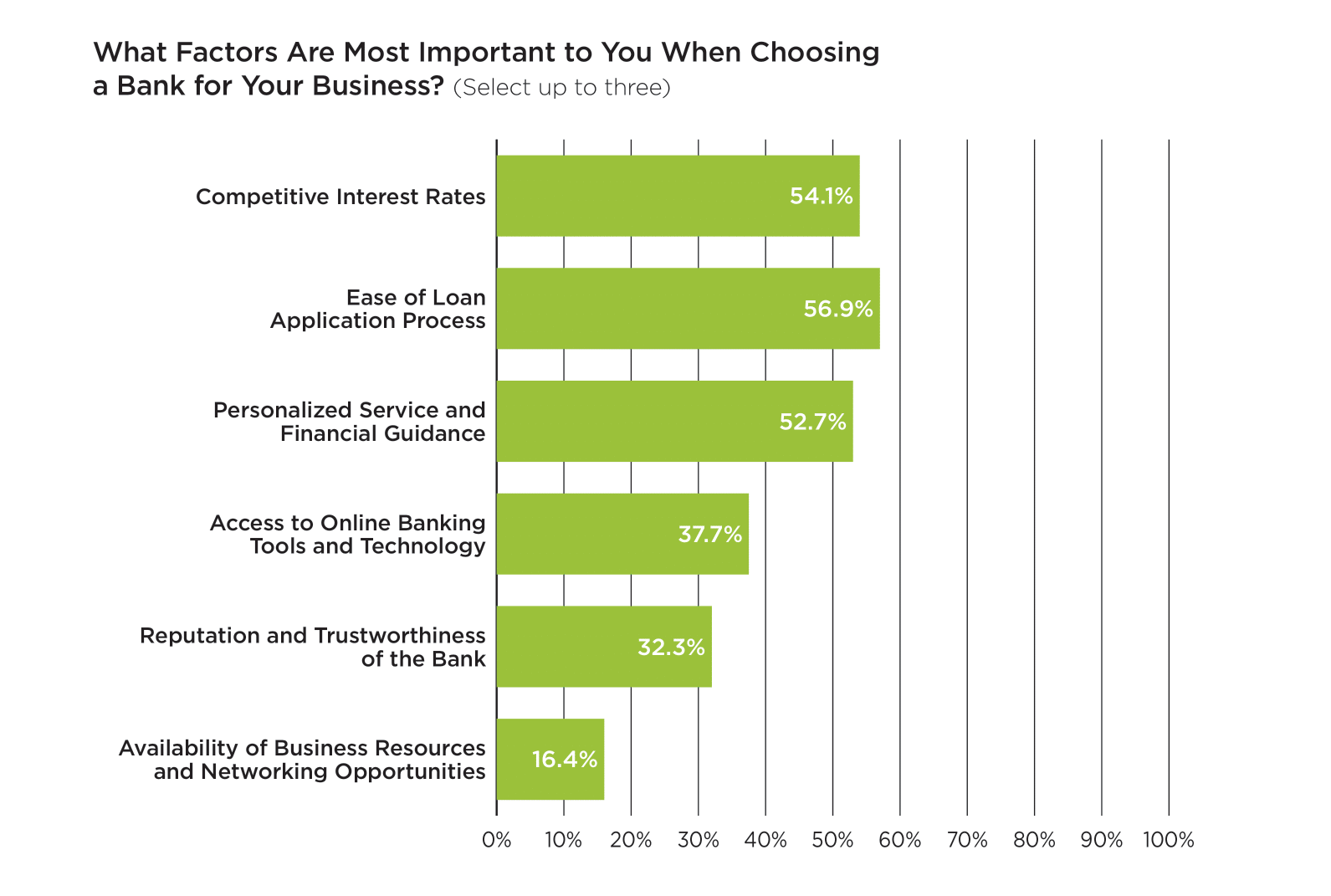

When it comes to selecting the best bank for small business, entrepreneurs know exactly what they are looking for. Here are the results from our final survey question:

The top priority? An easy loan application process—selected by 56.9% of respondents. This reinforces earlier findings that accessibility and clarity matter. Business owners don’t want to jump through hoops to get funding, and they certainly don’t want to be buried in paperwork. They would rather spend their time growing their business.

Close behind is competitive interest rates (54.1%), which reflect the practical side of borrowing. Business owners are focused on keeping their long-term costs low, especially if they plan to borrow more than once. It’s a reminder that banks need to be transparent and competitive to earn the loyalty of small business owners.

Beyond speed and long-term savings, there’s another top priority: personalized service and financial guidance. Over half of business owners (52.7%) want tailored guidance and support—not one-size-fits-all solutions. This speaks to the value of strong relationships and reliable advice. Afterall, many small business owners are navigating unfamiliar territory, and they want to work with bankers who understand their goals.

Technology also plays a role. While it doesn’t top the list, 37.7% of respondents selected online banking tools and technology as a key factor. That number jumps even higher when looking at younger entrepreneurs, who increasingly expect digital access to be fast, reliable, and user-friendly.

Finally, other considerations like the bank’s reputation and trustworthiness (32.3%) and access to business resources or networking opportunities (16.4%) round out the list. This reminds us that credibility and community still carry weight, even if it’s not a priority.

The takeaway? Choosing a business bank is a multi-layered decision. Small business owners want banking partners who make life easier, offer fair rates, and take the time to understand their financial needs. While factors like reputation matter to some entrepreneurs, they rank lower on the list. This suggests trust is earned through experience, not just image.

Ultimately, banks that deliver the top priorities are the ones best positioned to win and retain small business clients.

Key Insights on Small Business Loans

So, what do these findings mean for small business owners and banks? Here are the most important takeaways:

- Borrowing is a normal business strategy: Most small business owners use loans to support their broader business plans—not just a last resort.

- Small businesses need external funding the most: Companies with fewer employees and lower revenue tend to rely more heavily on loans to fuel development.

- Small loan amounts can create big impact: Most loans surveyed are relatively small ($100,000 or less), but they lead to meaningful business improvements.

- Growth drives borrowing decisions: The top business loan uses are equipment purchases, expansion, and cash flow management.

- Personal relationships still matter most: Despite digital options, business owners prefer in-person applications and local banks that understand their communities.

- A generational shift is coming: Younger entrepreneurs increasingly expect digital-first business banking experiences.

- Easy processes beat everything: Simple loan applications matter more than bank reputation or any additional features.

- A dual approach is essential: Banks must serve both relationship-focused business owners and digitally-native younger entrepreneurs.

- Banks should position themselves as growth partners: Success comes from being strategic advisors, not just lenders.

Academy Bank for Small Businesses

At Academy Bank, we know that every small business is different—that's why we take a personalized approach to everything we do. Our local banking experts live and work in your community, so we understand the challenges and opportunities you face each day.

What sets us apart:

- Simple, streamlined applications that respect your time.

- Face-to-face guidance from experienced business bankers who know your market.

- Flexible lending solutions designed around your specific goals.

Our small business lending options include:

- Business Line of Credit: Offers on-demand access to funds for everyday business needs like inventory, payroll, or short-term expenses.

- Business Term Loan: Provides a lump sum of money for larger investments such as equipment, renovations, or expansion.

- SBA Loan: Government-backed loan with competitive interest rates and longer repayment terms.

Grow your business with Academy Bank! Connect with a business banker today or learn more about your options online.

MORE BUSINESS SOLUTIONS:

Business Lending

Business Checking

Business Savings

Treasury Management Services

Business Lending

Business Checking

Business Savings

Treasury Management Services

All loans and lines of credit subject to credit approval and require automatic payment deduction from an Academy Bank business checking account. Origination and annual fees may apply.