Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-07-23

Business Banking

published

3-minute

How Small Business Owners Prefer to Borrow: Survey Findings

3

3-

-

Academy Bank recently surveyed over 220 small business owners to better understand their financial needs and borrowing patterns. Our earlier insights highlighted which small business owners take out loans and how they use borrowed funds. We found that the smallest companies by revenue and staff rely most heavily on business loans.

Now, we shift focus to the lending preferences of small business borrowers. Let’s take a closer look at their loan application experiences, banking relationships, and the generational shifts among entrepreneurs.

Small Business Loan Experience: How Business Owners Apply for Loans

The loan application experience plays a big role in how small business owners select a lender, and their chosen method helps reveal what they value in a lender:

- 52.7% applied in person

- 32.2% applied online

- 15.1% worked through a business banker or relationship manager

In short, small business owners value the personal touch of in-branch support and open dialogue about their needs. For financial institutions, this reinforces the need to invest in knowledgeable branch staff—even as digital tools continue to grow.

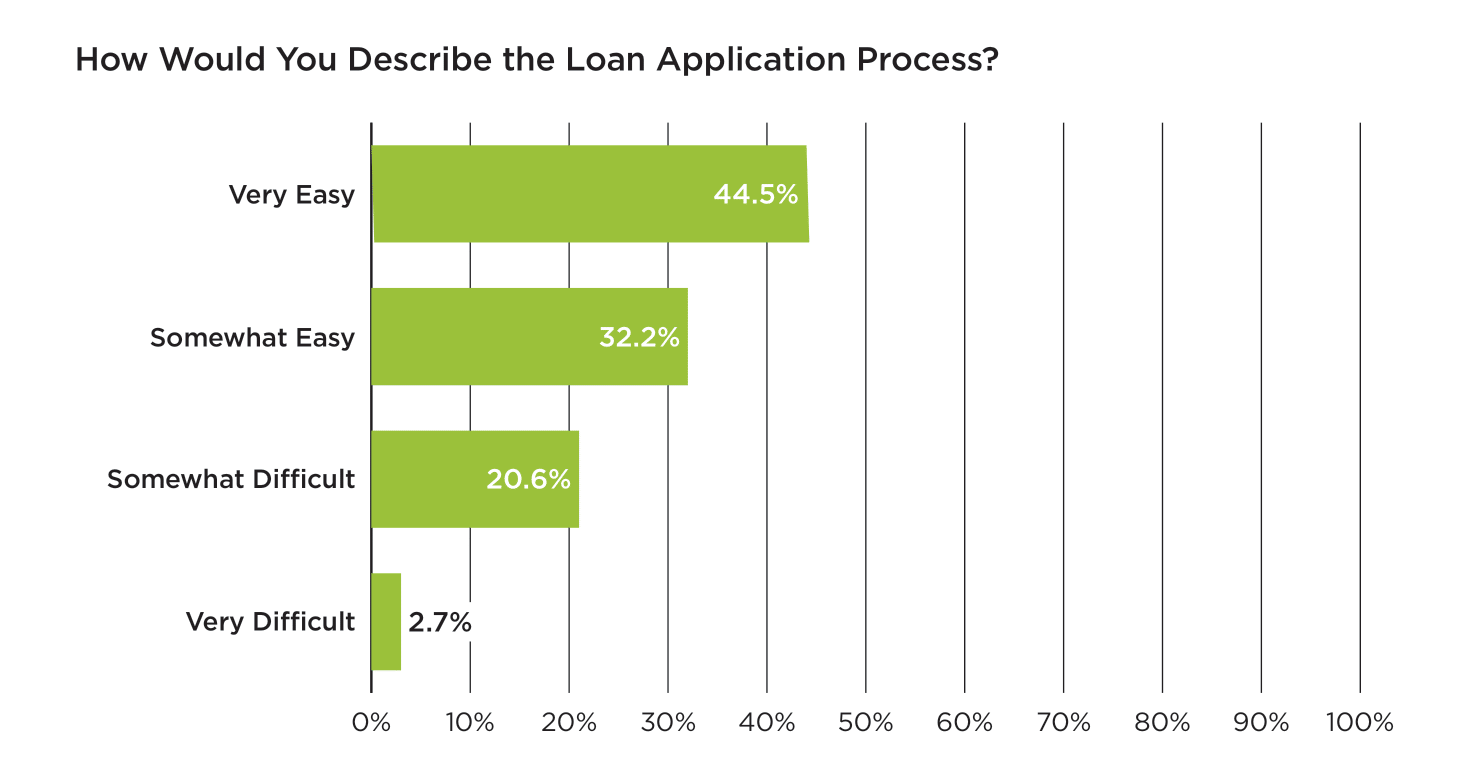

Encouragingly, 76.7% of respondents also reported that applying for a small business loan was either very easy or somewhat easy to navigate. That said, nearly a quarter found the experience at least somewhat difficult. This finding indicates that some borrowers still face challenges navigating the loan application process, leaving room for banks to improve their processes even further. (See the chart below for a full breakdown.)

Why Business Banking Relationships Matter

When it comes to choosing a business lender, most entrepreneurs prefer working with local banks. Here’s where small business owners are turning for their banking needs:

- 58.9% banked with a community or regional institution

- 31.5% went with a national bank

- 9.5% used an online-only lender

This trend suggests that business owners favor working with institutions embedded in their local economies. Community and regional banks are often seen as more responsive and familiar with the realities of running a small business.

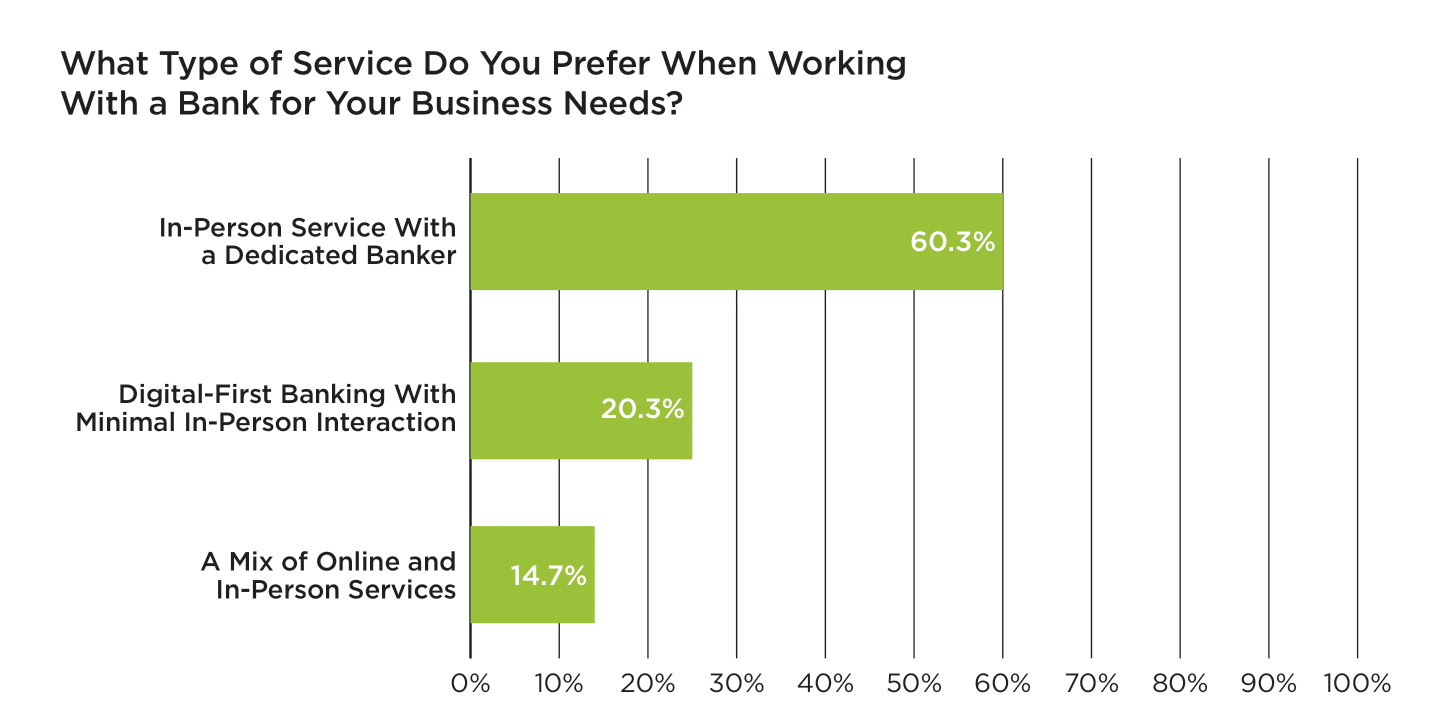

Above all, relationships matter. Business owners don’t just want access to funds—they want a trusted business banking partner who understands the unique needs of local entrepreneurs. Even as digital tools become more innovative, small business owners continue to prioritize connection and service.

Generational Shifts in Banking Preferences

Overall, there is a clear generational divide when it comes to digital banking adoption. Specifically, younger generations are more inclined to apply through online and mobile channels. This breakdown by age group shows how digital preferences increase with each younger generation of business owners:

- Gen Z (18–29): 56% prefer some form of digital banking

- Millennials (30–44): 43.3% prefer some form of digital banking

- Gen X (45–60): 28.6% prefer some form of digital banking

- Baby Boomers (61+): 17.7% prefer some form of digital banking

This generational shift is a signal: As younger entrepreneurs become the next wave of business leaders, banks must adapt. They need to offer more tailored, tech-driven solutions, especially since personalized digital experiences won’t be optional—they will be expected.

To stay competitive both today and in the future, must support both traditional and digital-first business owners.

What This Means for Business Lending at Academy Bank

At Academy Bank, we take these insights seriously—and we are proud to provide business owners with flexible options, expert guidance, and relationships they can count on.

That’s why our dedicated business bankers take the time to understand your goals and challenges. Whether you are launching a new venture or expanding an existing one, our team is here to help—with support available both in person and online.

Here are three popular small business loan options:

- Business Line of Credit: Tap into flexible funds as needed for your working capital, inventory, or short-term needs.

- Business Term Loan: Receive a lump sum of business funds to support big purchases, expansions, or upgrades.

- SBA Loan: Enjoy lower rates and longer repayment term with business loans backed by the U.S. Small Business Administration.

Ready to find the best business loan for you? Get personalized small business banking support at Academy Bank.

In our next article, we will explore the biggest priorities for small business borrowers, and we will tie together all of our survey findings. For a closer look at the full survey results, check out our full report: “Business Loans and Banking Relationships: What Matters Most to Small Business Owners.”

All loans and lines of credit subject to credit approval and require automatic payment deduction from an Academy Bank business checking account. Origination and annual fees may apply.