Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-07-09

Business Banking

published

4-minute

Understanding Small Business Loans: Borrowing Trends & Purposes

-

-

Small businesses are the backbone of the American economy. From one-person shops to companies with dozens of employees, these businesses create jobs, spark innovation, and strengthen communities. But behind the success of many small businesses lies a common financial resource: business loans.

So how do business owners borrow money? Academy Bank surveyed over 220 small business owners to find out. Here’s a closer look at the profiles of small business borrowers and their strategies for using business financing. The data tells a compelling story about who is borrowing and why.

Profiles of Small Business Borrowers: Who Takes Out Business Loans?

Business loans aren't only for big corporations. Our survey found that nearly two-thirds of small business owners (65.8%) have used business financing some point. This suggests that borrowing money is a normal part of running a small business—whether you are just starting out, maintaining steady operations, or planning your next big expansion.

But what about business size? Among the respondents who have received funding, their companies vary in size. Here’s a breakdown of loan recipients by staff count:

- Sole Proprietors: 24%

- 2-10 Employees: 32.2%

- 11-50 Employees: 21.9%

- 51-99 Employees: 11.6%

- 100+ Employees: 10.3%

What's interesting here is that the smallest businesses—those with the fewest employees—are the most likely to seek out loans. In fact, nearly 80% of loan recipients have 50 employees or fewer, and roughly 56% have 1-10 employees.

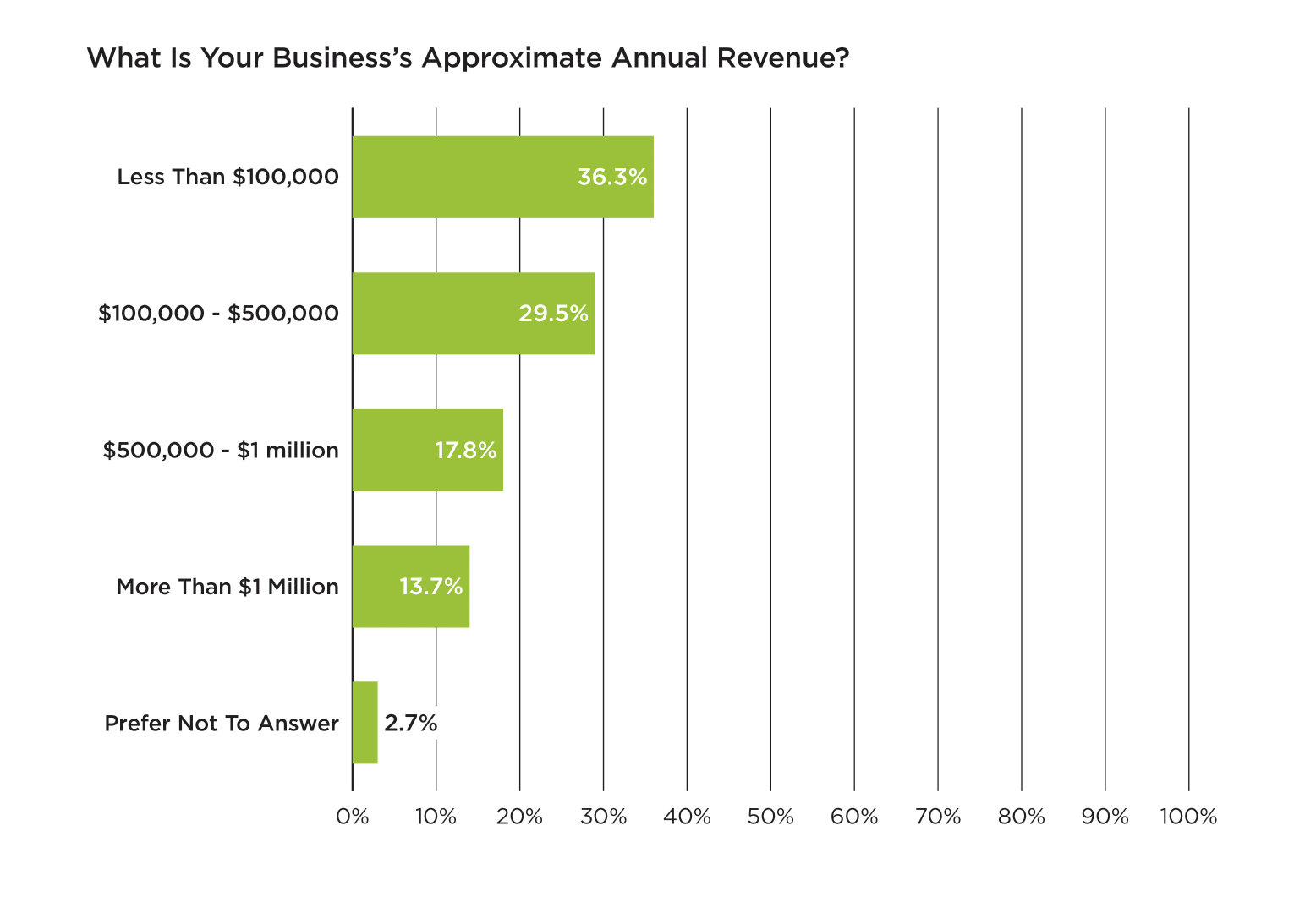

A pattern becomes even clearer when we look at annual revenue. Small companies with lower earnings are significantly more likely to turn to business loans than their higher-earning counterparts. (See Graph Below). This makes sense—companies who are still building their revenue streams need external financing to bridge gaps, invest in growth opportunities, or manage cash flow challenges.

Meanwhile, businesses with higher annual revenue typically have more cash reserves and established credit lines, making them less dependent on traditional business loans. This trend reinforces what we see with staff count: businesses in earlier stages of growth tend to rely more heavily on business loans to fuel their development.

Small Business Loan Amounts

Most small businesses don't require large sums of money to achieve their goals. Our survey found that 69.9% of respondents borrowed $100,000 or less for their business needs.

So, how much are small businesses actually borrowing?

- $100,000 or Less: 69.9%

- $100,001 - $500,000: 23.3%

- $500,000+: 6.8%

These amounts reflect the practical reality of small business financing. Most owners are looking for enough capital to solve specific problems or take advantage of immediate opportunities, rather than funding costly expansions or acquisitions. Ultimately, smaller businesses with lower revenue require smaller loan amounts to make meaningful improvements.

Top Reasons to Get a Business Loan

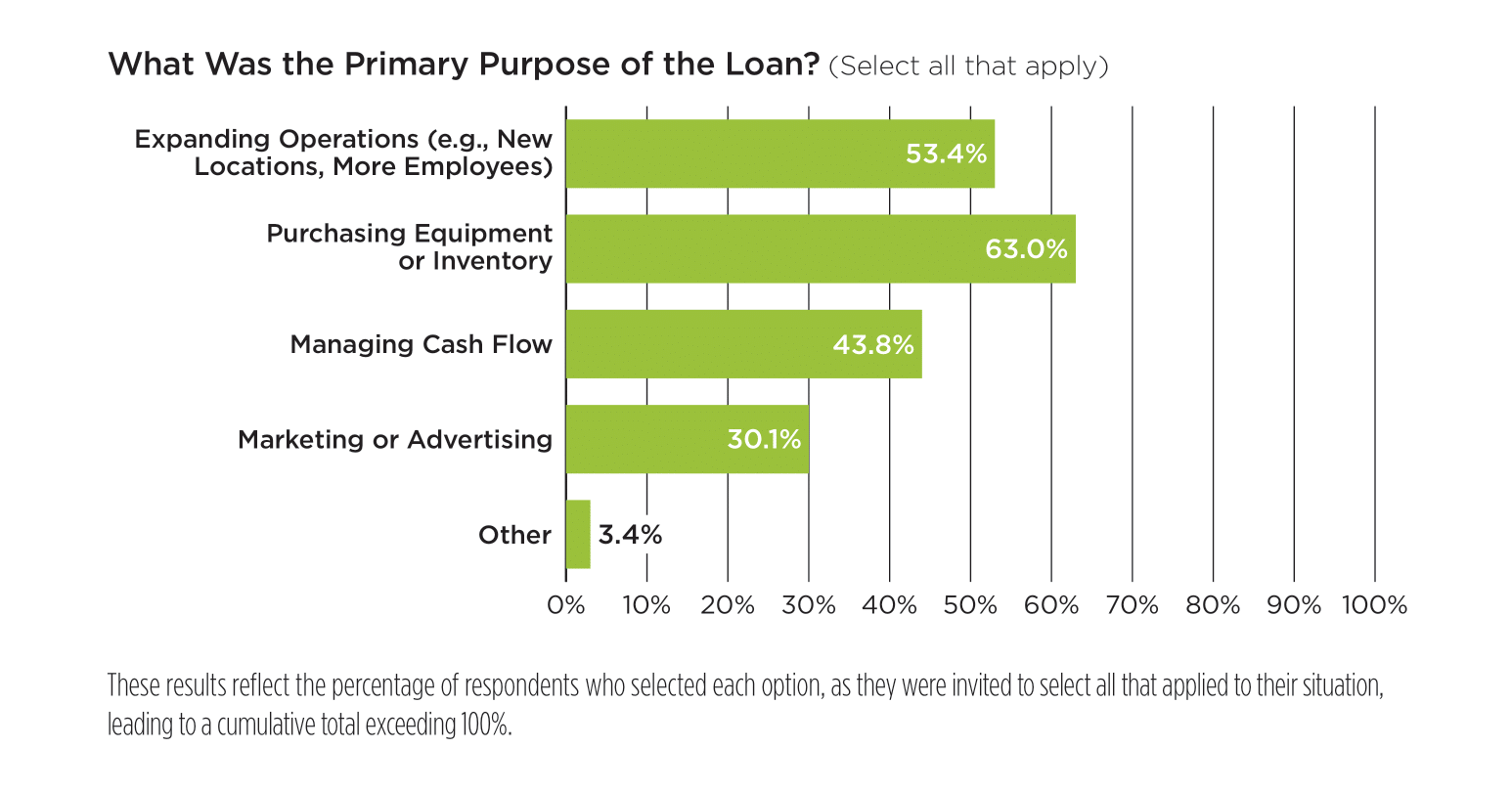

When asked why they took out loans, the business owners revealed something encouraging: most aren't borrowing money because they are struggling. Instead, they are using loans as growth tools to build stronger, more successful businesses.

In addition, many respondents selected multiple reasons for borrowing. This highlights that small businesses juggle several financial needs and purposes at the same time. Let’s explore the leading reasons behind small business borrowing:

LOAN PURPOSE 1: Purchasing Equipment or Inventory (63.0%)

Business owners know that outdated equipment and bare-bones inventory hold them back from bigger opportunities. A bakery owner might finally spring for that commercial mixer that can handle triple the volume, or a local shop owner might stock up on seasonal merchandise ahead of the busy holiday rush. These purchases aren't just “nice-to-haves”—they are revenue makers that often pay for themselves within months.

Ultimately, if you can serve more customers faster and better, your loan becomes an investment, not an expense.

LOAN PURPOSE 2: Expanding Operations (53.4%)

Growth opportunities don't wait for your savings account to catch up! Business owners see a chance to expand, and they take it. There could be demand for a second location or the need to hire staff to handle increased orders. Borrowing money now means you don’t have to wait 5 years to save up the money.

For example, a successful food truck owner might use a loan to open their first brick-and-mortar restaurant, or a freelance consultant might hire employees to take on bigger contracts. The smartest business owners know that timing matters in business, and loans help them strike while the iron is hot.

LOAN PURPOSE 3: Managing Cash Flow (43.8%)

Cash flow is tricky. There’s often a gap between when businesses earn money and when they have to spend it. Picture a wedding photographer who books most of their work in spring and summer but still has bills to pay in January. Or a contractor who completes a big project but won't get paid for 30 days while materials and labor costs are due immediately. In these cases, small business loans aren't simply a response to a crisis—they are tools for stability when income and expenses are out of sync.

LOAN PURPOSE 4: Marketing or Advertising (30.1%)

Sometimes you need to spend money to make money, and marketing-related loans help businesses get noticed in a crowded marketplace. Whether it's launching a social media campaign, attending industry trade shows, or finally building a professional website, these investments connect businesses with potential clients they might not reach otherwise. After all, great products don't sell themselves—you have to tell people about them!

Business Lending at Academy Bank

Looking for the best bank for small business? Academy Bank is your one-stop-shop for all business banking needs. From checking accounts to treasury management solutions, we offer tools that drive business success..

And for entrepreneurs searching for business loans, we treat lending like a partnership. Our team works with you to find the right solution that fits your business and your goals.

Our best loans for small businesses include:

- Business Term Loans: These “traditional” business loans provide a lump sum of money you repay over time.

- Business Lines of Credit: A popular choice that gives you access to funds when you need them—perfect for covering cash flow or short-term expenses.

- SBA Loans: Different types of government-back loans that offer competitive loan rates. They are especially helpful for startups or businesses that require extra support to qualify for a loan.

Remember, growth waits for no one, and neither should you! Talk to a business banker or apply for a small business loan today.

Stay tuned for our next article, where we will highlight the experiences and preferences of small business owners throughout the lending process. And to explore our complete set of survey insights, read our full report: “Business Loans and Banking Relationships: What Matters Most to Small Business Owners.”

All loans and lines of credit subject to credit approval and require automatic payment deduction from an Academy Bank business checking account. Origination and annual fees may apply.