Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2025-08-18

Savings

published

3-minute

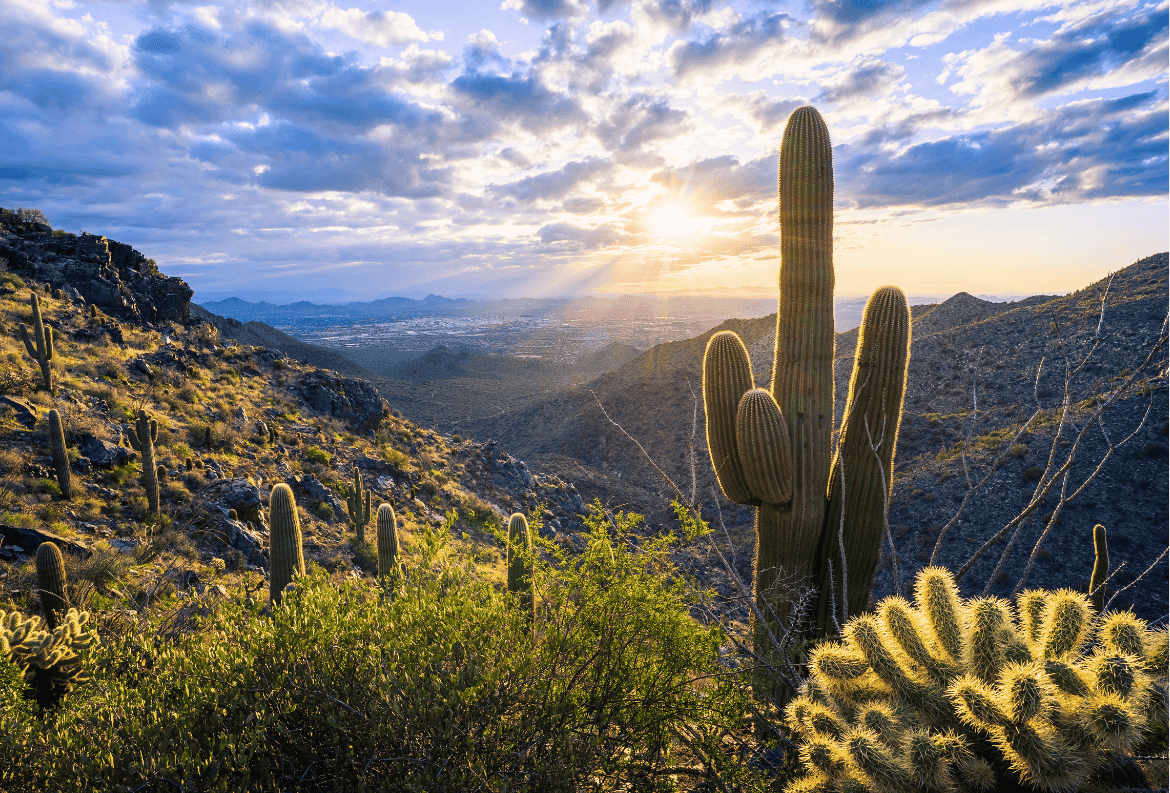

High-Yield Banking: Money Market Accounts in Scottsdale, AZ

-

-

This is Scottsdale, Arizona, where the sun shines 330+ days a year and there’s always something to do. From luxury resorts and golf courses to outdoor recreation and a standout food scene, Scottsdale residents know how to do leisure right. Therefore, it’s smart to have a financial plan that keeps up with your day-to-day lifestyle. Enter money market accounts. They offer the perfect balance of earning potential and easy access to your cash. But is it right for you? Keep reading to find out why money markets are a top savings solution for locals in Scottsdale, AZ.

Money Market Account Description

What is a money market account? It’s a deposit account that combines the benefits of savings and checking accounts. Available through banks and credit unions, money markets let you grow your savings while earning interest—often higher than other savings accounts. Together, these features make them a good choice for anyone who wants to build their funds without the risks of investing in the stock market.

How does a money market account work? Once you deposit funds into your money market account, you begin earning interest right away. Usually, money market interest is calculated daily and added to your balance monthly, meaning your money starts working for you almost immediately. In addition, money market accounts give you the flexibility to write checks and use a debit card (limited to six (6) transactions per month). It’s a practical, all-in-one account!

Why are Money Markets the Best Way to Save in Scottsdale, AZ?

Scottsdale has the benefits of city life but without the chaos of big metro areas like Los Angeles or even Phoenix. That means you are better equipped to leverage financial opportunities. Here’s why saving with a money market account is a great choice for residents living in “The Scottie.”

1. High Interest Rates for High-Heat Living

Summer temperatures in Scottsdale regularly hit 105°F, but your savings should be even hotter. Money market savings accounts offer higher interest rates than traditional savings accounts—sometimes double or triple the returns. So, while the desert heat can wear you out, these high-yield accounts keep going. Bottom line: If you're tough enough to live here, your money should be tough enough to grow here.

2. Secure Savings in a Pricey Market

Scottsdale's median home price recently hit $910,000, and everything from groceries to gas is pricier than in most U.S. towns. Therefore, when expenses are this steep, you need savings you can actually count on. Money market accounts deliver that reliability—they are FDIC insured up to $250,000. This means your money is protected even if your bank fails. Plus, unlike riskier alternatives including stocks, money markets give you steady returns.

3. On-the-Go Banking in Scottsdale

Having access to a car is a MUST in Scottsdale. Everything is spread out—from hiking trails and golf courses to art galleries and spa appointments. Just as you rely on the ability to get around town easily, you should be able to access your savings just as effortlessly. Money market accounts give you multiple ways to reach your funds: debit cards for quick purchases, check writing for larger expenses, online transfers for paying bills, and other methods. Having such flexibility makes these accounts a key staple for Scottsdale’s active, on-the-go residents.

4. Diversified Savings Strategy

In Scottsdale, the dining options are just as diverse as they are delicious. Whether it’s Southwestern dishes, fresh farm-to-table meals, or quick bites at trendy cafés, you pick different spots for different cravings. The same idea applies to your financial strategy—you shouldn’t rely on just one approach.

Diversifying your financial portfolio with a money market account is a smart way to manage risk and boost returns. These bank accounts offer a stable method for earning interest, and they also pair well with other investments like stocks or bonds for greater performance.

5. Goal-Focused Savings

Every Scottsdale resident has a wish list—a new AC system before summer hits, season tickets to the Suns, or college savings for the kids. Money market accounts are perfect for savings because they help you reach short-term financial goals. Need to upgrade your car? Are you considering a golf club membership? Choose a money market account! Your money grows steadily and stays available when you are ready to buy.

How to Open a Money Market Account in Scottsdale

Looking to build your savings? Opening a Scottsdale money market account is easier than you think:

- STEP 1: Collect Your Documents — Make sure you have a valid ID (like a driver’s license), proof of address, and your social security number.

- STEP 2: Pick the Best Money Market Account — Select the option that fits your savings strategy. You have choices! For example, Academy Bank offers accounts like the Premier Money Market Account, Money Market IRA for retirement savings, and a Business Money Market Account.

- STEP 3: Apply In-Person or Online — You can visit a bank in Scottsdale or complete your application online.

- STEP 4: Make Your First Deposit — Fund your money market account to get started.

- STEP 5: Earn Savings Interest — Once your account is active, sit back and relax while your balance grows!

Find the Best Money Market Accounts in Scottsdale, Arizona

At Academy Bank, we’re not just bankers—we’re your neighbors, friends, and financial partners. As a local bank in Scottsdale, “The West’s Most Western Town,” we understand our community in eastern Maricopa County and are committed to offering personalized support every step of the way. This includes our friends living across North Scottsdale, South Scottsdale, McCormick Ranch, Arcadia, Paradise Valley, Old Town Scottsdale, and more!

Select from three Academy Bank money market accounts:

- Premier Money Market Account1 — Benefit from high money market interest rates while keeping your funds easily accessible.

- Money Market IRA2 — Save for retirement with an account built with stability and flexibility.

- Business Money Market Account3 — Created for local Scottsdale business owners looking to maximize cash reserves.

When you choose Academy Bank, you are setting yourself up for financial success—and supporting the Scottsdale community as well!

Need help planning ahead? Here are some easy ways to calculate compound interest and reaching savings goals.

1 Minimum $25 deposit to open the Premier Money Market Account. A monthly service charge of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. Six (6) transactions per statement allowed. Excessive withdrawal fee of $10 per item over 6 withdrawals per statement cycle. Free eStatements or $5 paper statement monthly fee. Closing your account within 90 days of opening will result in a $25 early closure fee.

2 A minimum deposit of $25 is required to open a Premier Money Market IRA account. Debit cards, ATM cards, or checks are not available because IRS regulations require withdrawals to be properly coded for IRS reporting requirements. A minimum balance fee of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. You will have view or inquiry only access to Digital Banking. An account statement will be provided monthly. You are limited per the IRS regulation regarding contributions based on age, income, and other factors. Early or premature withdrawals from an IRA may be subject to a 10% early withdrawal tax from the IRS. Closing your account within 90 days of opening will result in a $25 early closure fee.

3 Minimum $25 deposit to open the Business Money Market Account. A monthly service charge of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. Free monthly eStatement or $5 paper statement. Excessive withdrawal fee of $10 per item over 6 withdrawals per statement cycle. Closing new accounts within 90 days of opening will result in a $25 early closure fee.