Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2026-02-05

Savings

published

3-minute

Do You Pay Taxes on Interest from a Money Market Account?

-

-

Money market accounts offer a good way to earn interest while keeping your savings accessible. But before you count that interest as “extra money,” it helps to understand how it’s taxed.

In most cases, you pay taxes on interest earned from a money market account because it is usually treated as taxable interest income at the federal level. It may also be taxable at the state level, depending on where you live and the type of account.

Key Takeaways: Interest on Money Market Accounts

- Money market interest earned is usually taxable, even if you leave it in the account.

- Banks typically report your annual interest on Form 1099-INT if you meet reporting thresholds.

- Your tax rate depends on your income and filing status, not the bank’s rate.

- Money market accounts in certain tax-advantaged accounts (like some retirement accounts) may be treated differently.

Why is Money Market Interest Earned Usually Taxable?

A money market account is a deposit account that typically earns interest while still letting you access your money more easily than many long-term savings products.

Because the interest you earn is considered income, it generally counts as taxable interest—similar to what you’d earn from a traditional savings account or interest-bearing checking account.

But here’s one important detail: You may owe taxes on money market interest earned, EVEN IF you don’t withdraw it. If the interest is credited to your account, it typically counts as earned income for tax purposes.

How is Interest Earned from a Money Market Account Calculated?

Banks usually calculate money market interest based on your daily balance and the account’s annual percentage yield (APY).

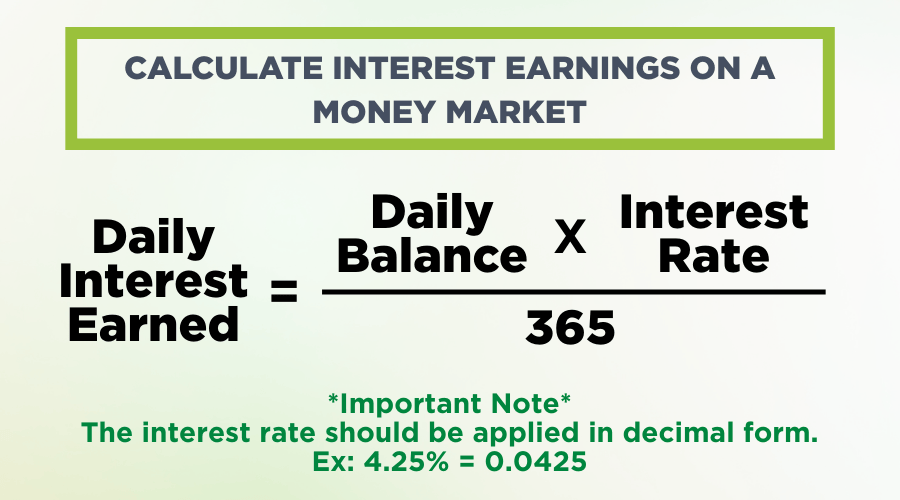

While the math can vary slightly by institution, money market interest earned is commonly calculated using a formula like:

That daily interest may then be credited monthly (or weekly, or daily, depending on your bank)—which is why your money market interest earnings may appear in small increments over time.

For a complete example of calculating your interest earnings on a money market account, check out our full guide: Interest Earned Definition.

When Do You Receive a Tax Form for Money Market Interest Earned?

Many banks issue Form 1099-INT to report interest earned during the year. Whether you receive this form depends on the amount of interest and reporting requirements. Typically, you should get a 1099-INT from your bank if you earn more than $10 in interest.

Even if you don’t receive a form, you may still be responsible for reporting taxable interest, so it’s always smart to track what you earned throughout the year.

Is Money Market Interest Taxed the Same as Savings Account Interest?

Most of the time, YES. A money market account and a savings account both typically earn taxable interest.

However, money market accounts may offer:

- Higher interest potential (depending on rates and balance tiers)

- Features like check-writing or debit access in some cases

- Different minimum balance requirements depending on the product

That’s why the main distinction is usually about account structure and earning potential, not how the IRS treats the interest.

What Impacts How Much Tax You Pay on Money Market Interest Earned?

Even though money market interest earned is generally taxable, the amount you actually owe depends on a few factors, including:

- Total income: Your taxable interest is added to other income, which can affect your overall tax bracket.

- Tax filing status: Single, married filing jointly, and head of household can ALL influence how much you pay.

- State tax rules: Some states will tax interest income normally, while others may not impose income tax at all.

- Bank account type: Interest from a standard money market deposit account is usually taxable. However, a money market product that is held within certain retirement accounts may have different tax treatment.

How to Plan Ahead for Tax Season on Your Money Market Earnings

Money market accounts can be a great way to earn interest while keeping funds accessible, especially if you’re building an emergency fund or saving for near-term goals.

To stay prepared at tax time, it helps to:

- Keep an eye on year-to-date interest earned in your bank’s online banking platform

- Save tax forms you receive from your bank

- Consider how your interest earnings fit into your overall financial plan

If your savings balance is significant, interest earned can add up—particularly when rates are higher. Therefore, it’s worth factoring taxes into your expectations!

Money Market Accounts at Academy Bank

If you are looking for a way to earn interest while keeping your savings accessible, a money market account from Academy Bank can be a smart option. It can help you grow your balance through interest earnings and give you flexibility for planned expenses or everyday savings goals.

To learn more about money market accounts and other interest-earning options, visit us online or stop by your local Academy Bank branch to speak with a member of our team.

FAQs About Taxes on Money Market Interest

Do you pay taxes on interest earned from a money market?

Yes. In most cases, money market interest earned is taxable income and may be subject to federal and state taxes.

Is money market interest earned taxable if I don’t withdraw it?

Usually, yes. If the interest is credited to your account, it’s typically considered earned and taxable.

How is interest earned calculated on a money market account?

You can calculate money market interest using your daily balance and the interest rate/APY. The bank adds your earnings to your account on a regular schedule, usually once a month.

Will I get a 1099 for money market interest earned?

Many banks issue Form 1099-INT when your interest earned meets reporting requirements. Even without a form, interest may still need to be reported.

Is money market interest taxed differently than savings interest?

Most of the time, NO. Both are typically treated as taxable interest income.

How can I reduce the taxes I owe on interest earned?

Taxes depend on your overall income and tax situation. For strategies specific to you, it may help to speak with a tax professional.

MONEY MARKET RESOURCES:

Open Personal Money Market Account

Open Business Money Market Account

Pros and Cons of Money Markets

Can Money Market Accounts Lose Money?

Best Ways to Manage a Money Market Account

Are Money Market Accounts FDIC Insured?

Minimum $25 deposit to open the Premier Money Market Account. A monthly service charge of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. Six (6) transactions per statement allowed. Excessive withdrawal fee of $10 per item over 6 withdrawals per statement cycle. Free eStatements or $5 paper statement monthly fee. Closing your account within 90 days of opening will result in a $25 early closure fee.

Minimum $25 deposit to open the Premier Business Money Market Account. A minimum balance fee of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. Free monthly eStatements or $5.00 paper statements. Excessive withdrawal fee of $10 per item over 6 withdrawals per statement cycle. Closing new accounts within 90 days of opening will result in a $25 early closure fee.