Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2026-01-16

Savings

published

4-minute

Interest Earned Definition: What You Need to Know

-

-

Interest earned is the money you receive from a bank for keeping funds in an interest-bearing account. It is usually calculated as a percentage of your balance divided by the time period. The more you save (and the longer your money stays untouched), the more interest you can earn.

If you have ever wondered how interest is earned, how interest is calculated, or even asked “what is a good interest rate on a savings account,” keep reading for the answers to those questions and more.

Key Takeaways

- Interest earned is typically based on your account balance, interest rate (APY), and how often interest compounds.

- Banks calculate interest using your daily balance and pay it out monthly or quarterly, depending on the account.

- Learning how to earn interest on a savings account starts with choosing the right account and letting your money sit longer.

- A “good” interest rate on a savings account depends on market conditions, but higher APY and frequent compounding generally help you earn more.

What Is Interest Earned?

You can think of interest earned like a reward for saving money. When you deposit money into an interest-bearing account, the bank pays you interest because your funds are fueling their lending and banking activity.

You earn interest through accounts like:

If your main goal is to build savings over time, understanding how interest earned works can help you choose a banking setup that supports long-term financial growth.

How Is Interest Earned?

So, how is interest earned in real terms? For most savings accounts, interest is earned in small amounts every day based on your balance. Those daily amounts are then usually added up and deposited into your account monthly.

Top two factors impacting interest earnings:

- Your balance (how much money is in the account)

- Time (how long you keep it there)

The longer your money stays in the account—and the more consistently you add to it—the more interest you can earn over the course of the year.

How Is Interest Calculated?

If you are curious how interest is calculated, the simplest explanation is this: Interest is calculated using your balance and your interest rate, then applied over a specific period of time.

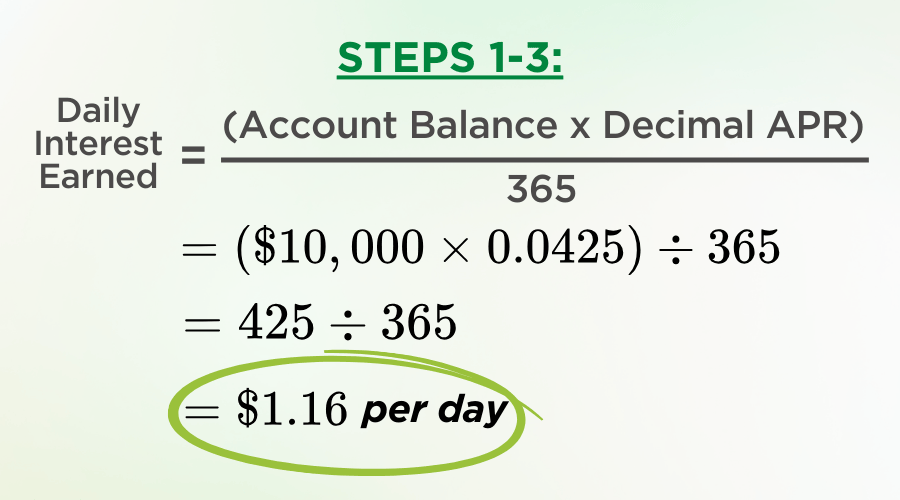

Most banks calculate savings interest daily using a formula like this:

Daily Interest Earned = (Account Balance x Interest Rate) ÷ 365

That daily amount is then accumulated and paid out, often once per month.

Example: How to Calculate Interest

If you have an account balance of $10,000 and an interest rate of 4.25% (as APR), then you need to:

- STEP 1: Convert APR to decimal by dividing it by 100.

4.45% APR = 0.0425

- STEP 2: Multiply your balance by your annual interest rate (the APR) to find your total annual interest earned.

Annual Interest Earned = $10,000 x 0.0425

- STEP 3: Divide the annual interest by 365 to find your daily interest.

So, with a $10,000 balance at 4.25% APR interest, you would earn approximately $1.16 each day.

- FYI -

If the interest rate is in APY, then you will have to convert it to APR first.

Here’s how to do it:

APR = ((1 + APY)1/365 - 1) x 365

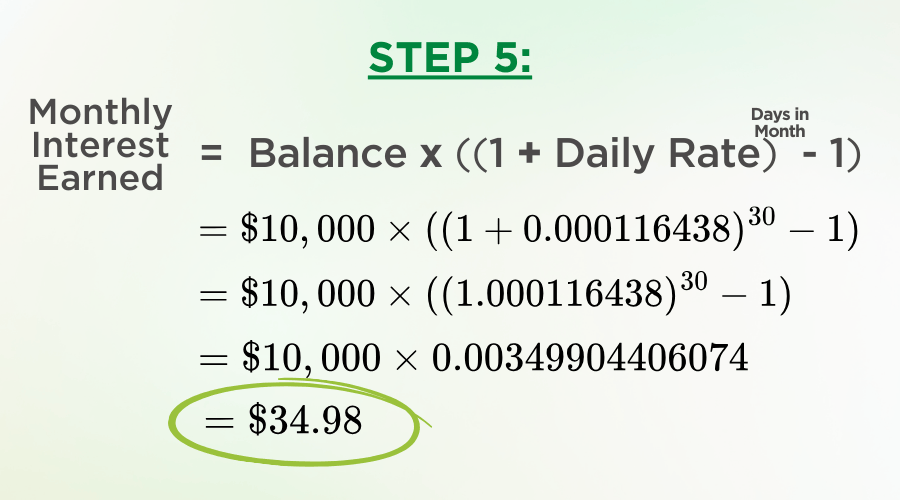

Now let’s say you want to learn your monthly earnings based on daily compounding. There are just 2 more steps!

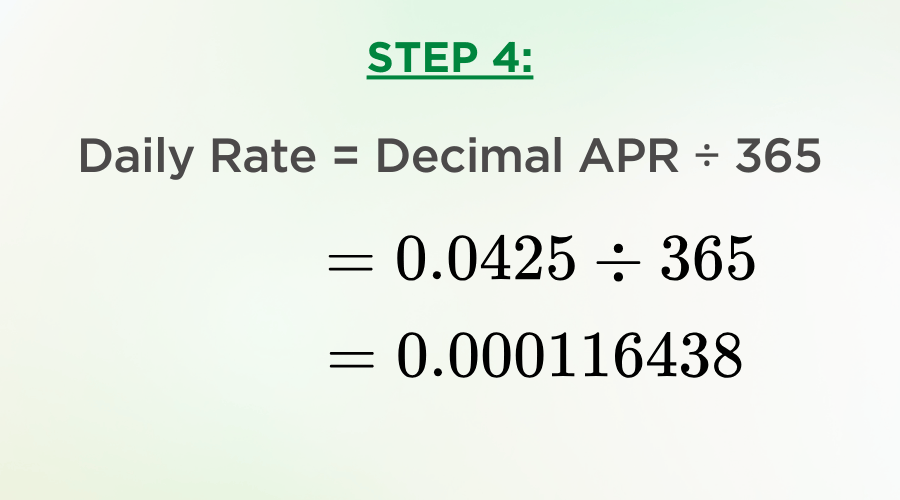

- STEP 4: Calculate the daily rate.

- STEP 5: Apply the formula.

While you typically won’t need to calculate interest manually, it still helps to understand the basic factors that influence what you earn!

Why APY Matters More than APR for Savings

Savings accounts typically use APY, not APR. Here’s the difference:

- APR (Annual Percentage Rate): Commonly tied to loans and borrowing

- APY (Annual Percentage Yield): Reflects what you earn in a year, including compounding

That means if two savings accounts advertise the same interest rate, the one with the higher APY is usually the better earner—because it’s factoring in how often interest is added back into the account.

What Does It Mean When Interest “Compounds?”

Compounding is one of the biggest reasons your savings can grow faster over time.

When your interest compounds, the bank adds your earned interest back into your balance. Then, the future interest is calculated based on that new, slightly larger amount.

In other words, compounding means you are earning:

- Interest on your savings

- PLUS interest on the interest you have already earned

When compounding happens more frequently (daily, monthly, etc.), your balance has greater growth potential.

How to Earn Interest on a Savings Account

If your goal is earning interest from your savings account, the best approach is fairly simple. Earn more interest by following these steps:

1. Choose an Interest-Bearing Savings Account

Not every savings account pays the same interest. Look for a savings option that offers a competitive APY and your money management style.

2. Build Your Balance Slowly and Consistently

Even small deposits add up. Setting up recurring transfers—even $10 or $25 per week—can help you grow both your balance and your interest earned.

3. Leave Your Money in Place Longer

Interest earned depends heavily on the time that passes. If your balance stays steady (instead of being withdrawn frequently), you typically earn more over the long run.

4. Consider a CD Account for Higher Fixed Interest

If you don’t need immediate access to your funds, a certificate of deposit (CD) can help you lock in a fixed rate for a set period of time.

Standard savings accounts are generally designed for flexible access, while CDs are designed for structured saving. Both can play a role—depending on your goals.

What Is a Good Interest Rate on a Savings Account?

A “good” interest rate on a savings account depends on what is happening in the broader economy, and savings rates can change.

That said, a good interest rate on a savings account typically means:

- The rate is competitive compared to other banks

- The APY helps your savings grow without added complexity

- You can realistically maintain the balance needed to earn the advertised rate special

It’s also important to consider the account experience beyond the rate—such as online banking tools, account access, easy transfers, and how the bank supports your long-term savings goals.

Interest Earned vs. Accrued Interest: What’s the Difference?

These two phrases are closely related, but they aren’t always used the same way.

“Interest earned” is the money you gain from saving or investing. “Accrued interest,” on the other hand, is interest that has been accumulating but hasn’t been paid out yet.

For example, your savings account may earn interest daily, but you might not see the deposit until the end of the month. That interest was accrued during the month—and then credited later.

This is also why your account might show growth even if you didn’t deposit anything new: your balance is increasing from interest earned behind the scenes.

Use Academy Bank’s Compound Interest Calculator to Estimate Interest Earned

How interest is calculated can greatly affect your savings. The more often interest is compounded, or added to your account, the more you earn. This compound interest calculator demonstrates how compounding can affect your savings (and how interest on your interest really adds up)!

Even a basic estimate can make it easier to set realistic savings goals and understand how your money can grow when it’s stored in an interest-bearing account.

Maximize Savings Interest with Academy Bank

The interest you earn may seem like a small detail, but it can gradually play a meaningful role in building savings and improving your financial stability. Whether you are saving for an emergency fund, planning ahead for a big purchase, or simply trying to make smarter use of your money, understanding how to calculate interest can help you choose the right account for your goals.

At Academy Bank, we offer savings solutions designed to help you build momentum—so your money can work harder while you stay in control of your financial future. This includes money market accounts,1 certificates of deposit,2 and standard savings accounts.3

Visit us online or stop by your local Academy Bank branch to explore savings options and start earning interest with confidence.

FAQs About Earned Interest

How do you earn interest on savings?

Interest is earned when a bank pays you a percentage of your account balance over time, typically in an interest-bearing savings account, CD, or money market account. To earn the most interest, keep your money in the account long enough for it to build and compound.

How do you calculate interest?

Savings interest is usually calculated daily based on your balance and interest rate, then deposited into your account monthly depending on the account terms.

What is a good savings account interest rate?

A good savings account interest rate is one that is competitive for the current market and offers a strong APY compared to similar savings accounts.

Does interest earned depend on how often it compounds?

Yes. The frequency of compounding affects how much total interest you earn. This is because the interest added to your balance starts earning its own interest. The more often this cycle repeats, the more your earnings can grow!

Can checking accounts earn interest?

Some checking accounts can earn interest, but many are designed primarily for everyday spending. If interest is a priority for you, a money market account or CD may be a better fit.

1 Minimum $25 deposit to open the Premier Money Market Account. A monthly service charge of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. Six (6) transactions per statement allowed. Excessive withdrawal fee of $10 per item over 6 withdrawals per statement cycle. Free eStatements or $5 paper statement monthly fee. Closing your account within 90 days of opening will result in a $25 early closure fee.

2 $500 minimum opening deposit required. A penalty may be imposed for early withdrawal. CD rates are subject to change at any time and are not guaranteed until CD is opened. Fees charged to the account could reduce earnings on the account.

3 Opening deposit required. Subject to monthly service charge. Closing new accounts within 90 days of opening will result in a $25 early closure fee. If account is closed prior to the interest payment date, no interest will be paid.