Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-12-03

Credit

published

2-minute

Average American Credit Card Debt 2025 Statistics

-

-

For many Americans, staying on top of everyday finances has become harder than ever. Prices are up, budgets feel tighter, and high-interest debt can make financial goals feel out of reach. One of the biggest contributors to that pressure? Credit card debt.

To understand how Americans are using credit cards and coping with higher costs, Academy Bank reviewed the latest data and industry research on credit card usage and debt levels. So how many Americans have credit cards today? And how much debt do they carry? Let’s take a closer look.

How Many People Use Credit Cards in America?

Credit cards have become a standard part of financial management for adults living in the United States. People use them for day-to-day spending, unexpected costs, and everything in between. According to Federal Reserve data, 81% of U.S. adults had at least one credit card in 20241—that’s over 216 million Americans using credit in their regular financial toolkit.

But many people have more than one credit card. Experian reports that the average adult owns 7.1 credit cards and actively uses about 3.7 of them.2 This level of usage shows just how routine credit cards are in daily money management.

How many cardholders carry a balance from month to month? Nearly half (46%).3 Plus, a quarter of cardholders (23%) don’t have a clear plan for repayment, which is a sign that many households are struggling to pay off what they owe.

What is the Total Credit Card Debt in the United States in 2025?

Credit card debt continues to rise nationwide. By the second quarter of 2025, American adults collectively carried more than $1.21 trillion in credit card debt.4 This is one of the highest totals on record and an increase of 6.14% increase from the previous year. On an individual level, that translates to an average balance of about $5,595 per cardholder.

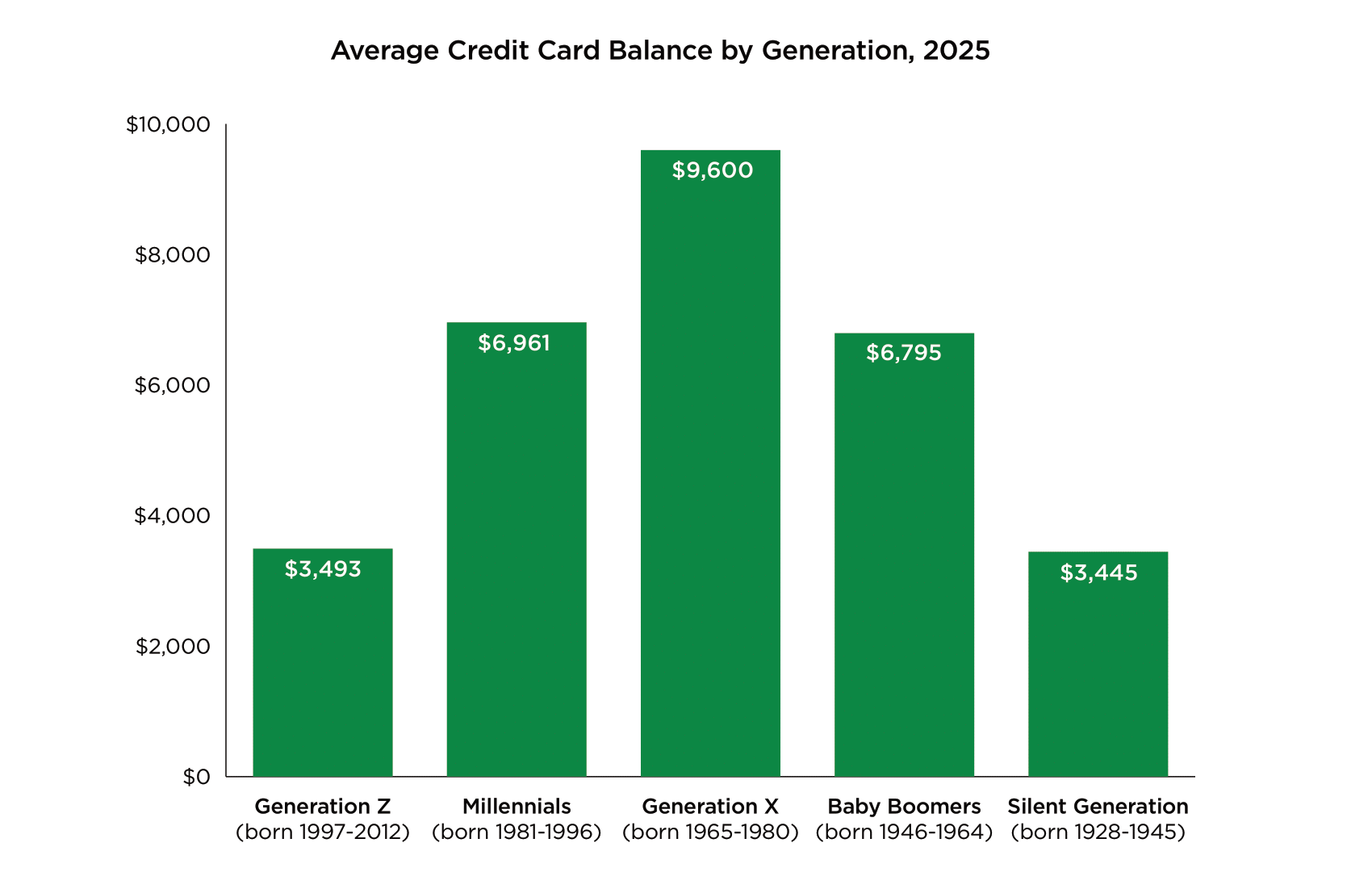

Looking across generational trends, every age group increased their average credit card balance between 2023 and 2025. Among those generations, Gen X has consistently carried the highest average credit card debt in recent years.5 (See graph below).

Why is Credit Card Debt Increasing?

It’s no surprise that increased living costs are putting pressure on household budgets. For many people, credit cards have become a financial cushion when cash runs short. Bankrate’s 2025 Credit Card Debt Report found that 46% of U.S. adults who have credit cards are currently carrying a balance,3 often because it’s the only way to cover everyday necessities.

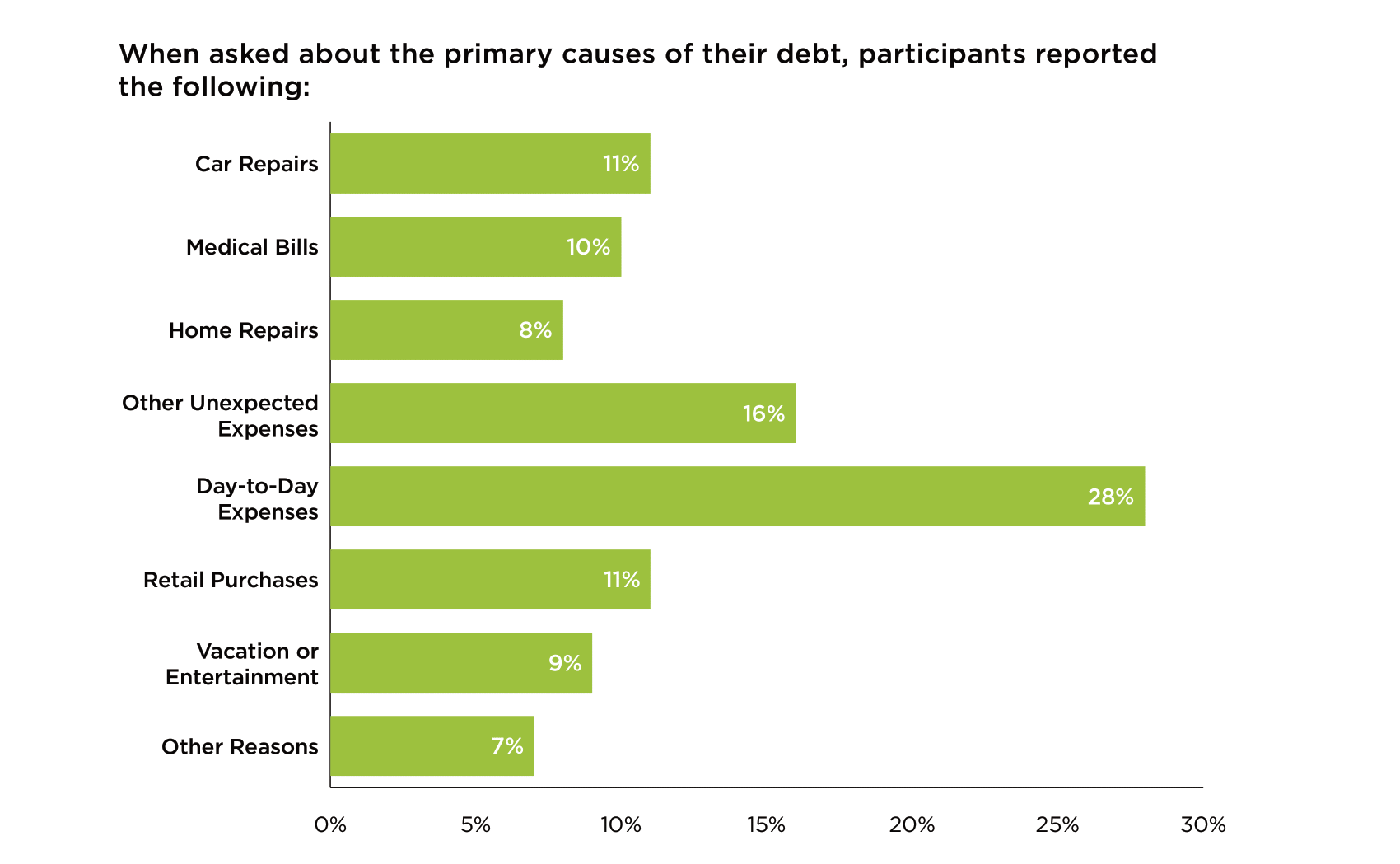

Across our data review, we found that essential costs—like car repairs, medical bills, home repairs, unexpected expenses, and everyday living—make up nearly three-quarters (73%) of credit card balances nationwide.3 What does this mean? The majority of debt isn’t coming from big splurges; people are just trying to get by to cover their basic needs.

How to Manage High-Interest Debt at Academy Bank

With so many Americans feeling the strain of rising credit card balances, it makes a major difference to have reliable options and personalized support. At Academy Bank, we understand how overwhelming high-interest debt can feel, and we are committed to helping our clients create a better path forward!

Here are several tools and services designed to help manage and reduce debt:

- Cash-Out Refinance: Homeowners can use their home equity to consolidate expensive debts into a single monthly payment—typically with a lower interest rate. This can make monthly payments more manageable and break the cycle of high-interest credit card debt.

- Personal Debt Consolidation Loan: Not a homeowner? No Problem! Our Express Loan lets you roll multiple debts into one fixed-rate personal loan. This creates a predictable payoff schedule and lowers the interest you are paying overall.

- My Finance360: This all-in-one financial dashboard gives you helpful tools for tracking debt, making budgets, monitoring income, setting financial goals, and more. It’s designed to help you stay in control of your money!

- Online Financial Calculators: Sometimes, understanding your options is easier once you see the numbers. Explore our online calculator tools for debt:

- Managing Debt Calculator: Estimate your total debt and monthly payment obligations.

- Credit Card Payoff Calculator: See how long repayment will take.

- Personal Debt Consolidation Calculator: Determine if combining your debts into one loan will make sense for you.

- Mortgage Rate Refinance Calculator: Review current mortgage rates and evaluate whether refinancing could help.

Are you ready to tackle your credit card debt? You don’t have to navigate it alone. Whether you want to speak with a mortgage loan officer about a cash-out refi, talk through personal loan options with a local banker, or explore your options online, Academy Bank is here to help!

Stay tuned for our next article, where we will discuss the biggest challenges people face when paying off debt and how high interest rates impact long-term finances.

The Cash-Out Refinance loan product is subject to credit approval. Specific terms and conditions apply. Fees apply.

The Express Loan is subject to credit approval. Restrictions apply. Direct deposit relationship required. Origination fee, 10% or $100, whichever is less. Annual Percentage Rate (APR) is based on credit score. Only one personal loan allowed to any borrower at any time. Loan terms are based on the loan