Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-12-11

Home Mortgage

published

3-minute

Credit Card Debt vs. Cash-Out Refinance: 2025 Data Behind Debt Relief

-

-

Credit card debt is reaching new heights in America. Millions of households are carrying balances they can’t seem to pay down. But the real challenge isn’t just how much money they owe, it’s the obstacles that keep them from repaying their debts.

Academy Bank reviewed data and industry research to better understand: 1) what causes credit card debt, 2) what prevents Americans from paying it off, and 3) what solutions can help them break free. For homeowners facing high-interest debt, a cash-out refinance offers a practical way forward. Keep reading to learn more about the findings.

Credit Card Debt: A Growing Challenge for Americans

In many households, managing everyday finances is becoming more difficult. Prices are rising, budgets are shrinking, and high-interest debt is only making things worse. Credit cards play a major role in this pressure, with recent data revealing the full scope of this issue:

- Credit card ownership is widespread: 81% of U.S. adults—over 216 million people—have at least one credit card. On average, each American adult holds 7.1 cards and actively use about 3.7.1,2

- Unpaid balances are common: Nearly 46% of cardholders carry a balance month to month, and 23% lack a clear repayment plan.3

- Debt levels are reaching record highs: The total U.S. credit card debt soared to $1.21 trillion in Q2 2025, up 6.14% from last year.4 The average balance per cardholder is about $5,595.

- Generational trends: All age groups saw increases in balances since 2023, with Gen X carrying the highest average debt year over year.5

- Why debt is rising: Everyday essentials—not luxury spending—drive most balances. About 73% of credit card debt comes from covering necessities like car repairs, medical bills, household maintenance, and basic living costs.3

For a detailed breakdown, explore our first article in the series, “Average American Credit Card Debt Statistics 2025.”

What Keeps Americans from Paying Off Their Credit Card Debt?

Beyond the costs causing credit card debt, there’s the matter of paying it down, which comes with its own set of obstacles. Even when people want to eliminate their balances, they face roadblocks that slow their progress. For example, higher living expenses, limited savings, and growing interest charges can ALL make it harder for households to reach their financial goals.

Specifically, the American Household Credit Card Debt Study explains just how challenging paying off credit card debt can be. For many Americans, debt feels permanent: about 35% of people with revolving credit card debt say they will always carry a balance.6 And some households are in deeper trouble, with about 14% unable to afford minimum payments. What does this mean? Short-term financial setbacks have become long-term realities for millions of Americans.

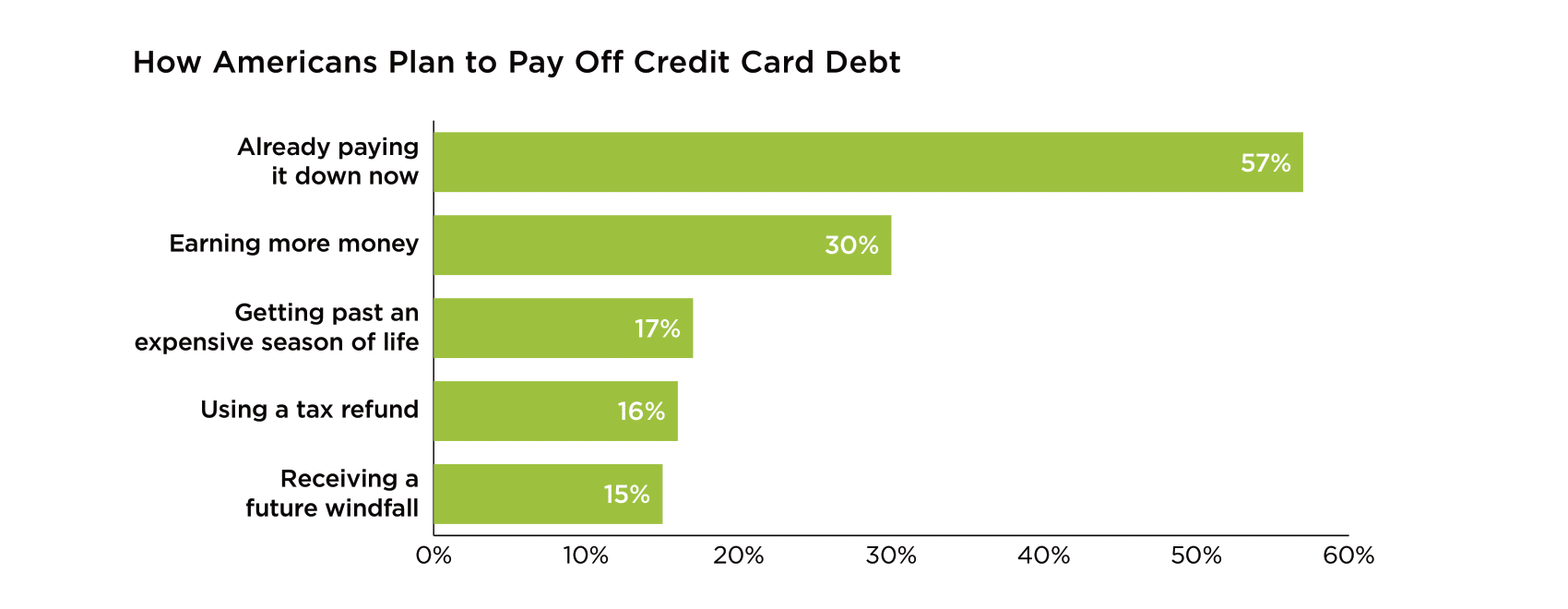

The graph below also tells an important story. While most people (57%) are actively working to reduce their debt, others are waiting until their finances improve. For many, that means getting through a particularly costly season, receiving a tax refund or windfall, or earning more money down the road. Notably, this waiting game extends to households earning over $100,000 annually, demonstrating that credit card debt continues to be a universal financial hurdle in America.

This data reveals a major issue. Many people are unable to make progress today, and they are depending on factors beyond their control to fix the problem.

How Do High Interest Rates Impact Debt?

The real challenge of credit card debt isn’t just the amount you owe—it’s the interest charges that come with it.

Today’s credit card rates are among the highest on record. In October 2025, the median credit card interest rate was over 25%.7 And for reference, anything above 8% is considered “high.”8 At these elevated rates, most of your repayment is consumed by interest, so consistent efforts barely chip away at the actual balance.

This creates a frustrating cycle: the higher the rate, the slower the progress. For many people, that means your debt sticks around for far longer than expected. And when emergency costs or income variability enter the picture, it becomes even harder for Americans to manage their card payments.

Finally, beyond the financial strain, living with debt often brings stress and worry. It can impact your sleep, increase anxiety, and even impact your relationships and overall well-being. The unwelcome side effects and constant pressure really start to define not just what you owe—but how you live.

Cash-Out Refinance for Debt Relief: A Smart Option

So how can Americans break the cycle of high-interest debt? For homeowners, cash-out refinancing offers a practical solution.

What is a cash-out refinance? A “cash-out refi” is a lending option where you replace your current home loan with a new, larger one. Because your new loan exceeds your old mortgage balance, you receive the difference in cash. That money can be used to pay off high-interest credit card debt, giving you breathing room and a clear path to eliminating debt.

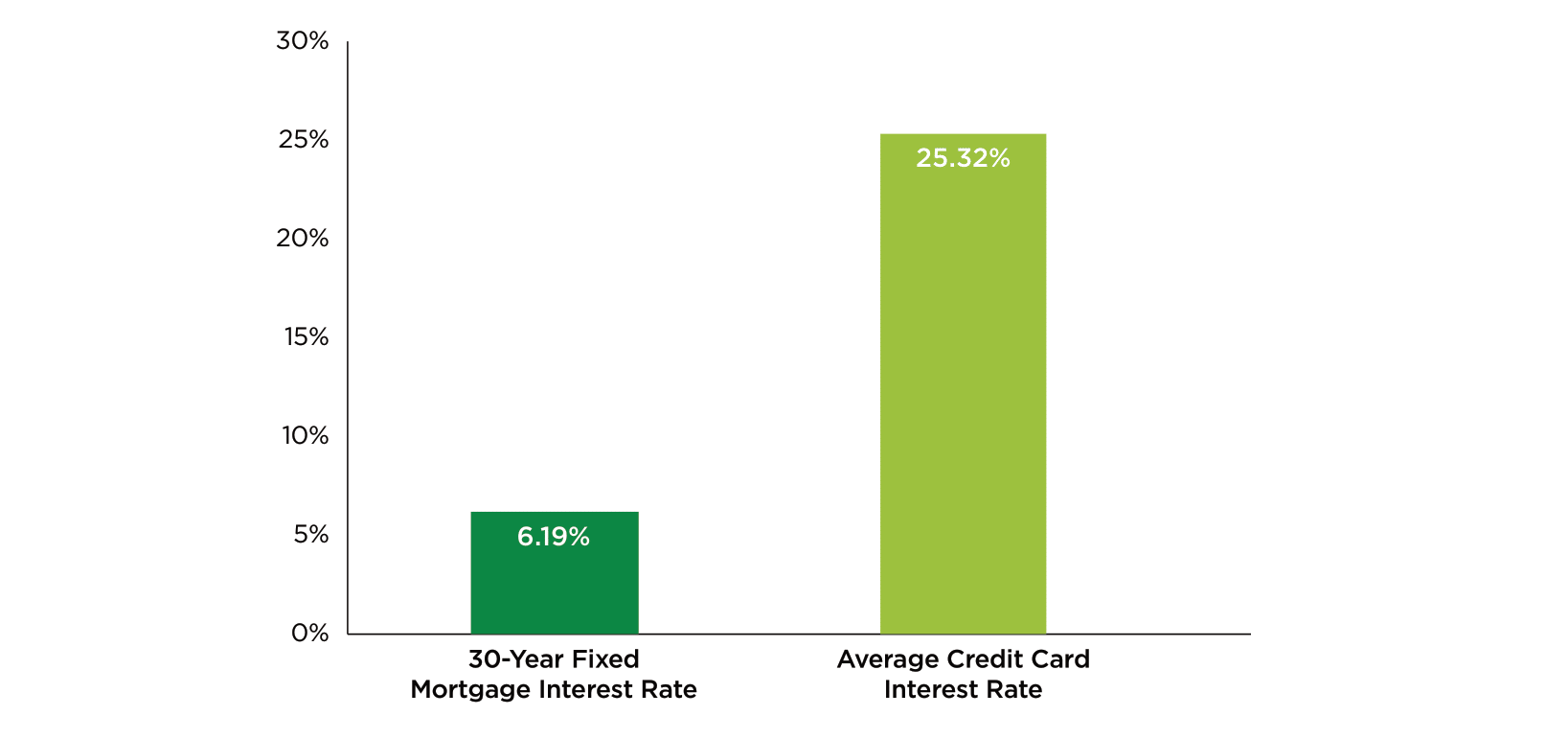

Why is this effective? Mortgage interest rates are MUCH lower than credit cards rates. This means you spend less money on interest payments and reduce balances faster.

To put this in perspective, let’s revisit the interest rates we discussed earlier. As mentioned, the median credit card interest rate was 25% in October. And during the same time frame, the average 30-year mortgage rate was 6.19%. The gap between both rates is nearly 19%, a difference that can save borrowers thousands of dollars in interest over time. 7,9

And the best part? Current market conditions are on your side! The Federal Reserve recently cut rates, creating a prime opportunity to explore mortgage refinance options. Together with rising home values, owners are finding themselves with more equity to tap into.

The trend speaks for itself. Cash-out refis peaked earlier in 2025, with the average borrower receiving $94,000.10 Since the typical American carries $5,595 in credit card debt, a cash-out refi offers more than enough to eliminate debt.

Academy Bank’s Best Cash-Out Refinance

Bottom Line: If you own a home and feel stuck in a cycle of credit card debt, a cash-out refinance could be your way out. At Academy Bank, we understand how overwhelming this situation can feel, and we’re here to help.

How does Academy Bank provide the best cash-out refinance experience for clients?

- Quick approvals so you can access funds sooner

- Competitive refinance rates to save more money

- Flexible loan offerings, including fixed and adjustable-rate options

- Simplified cash-out refinance process, from application through closing

- Personalized support from dedicated mortgage loan advisors

Ready to take the next step? Contact Academy Bank today to explore your cash-out refinance options and enjoy the benefits of debt relief!

Subject to credit approval. The Cash-Out Refinance loan product has specific terms and conditions. Fees apply.