Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

Viewing Credit Reports

For more information or to speak with a Financial Education Specialist, please contact us at FinancialEducationAB@academybank.com.

At Academy Bank, we’re here to make your digital banking experience easier. From checking accounts to building your credit, we strive to make banking fast, easy and personal.

How to Order a Free Credit Report

You are entitled to one free credit report from each agency every 12 months. Order one report from a different agency every four months to monitor your credit year-round for free. Each agency may have different credit scores, so check for accuracy and consistency.

You can also click here to view tips from Academy Bank on how to manage, understand, and improve your credit score.

To get your free report, visit the three bureaus listed below. Or order a report through www.annualcreditreport.com

- TransUnion www.transunion.com

- Experian www.experian.com

- Equifax www.equifax.com

If you notice any errors within your credit report, be sure to raise the appropriate flags to the credit bureau to have the mistakes corrected.

What to Review in Your Report

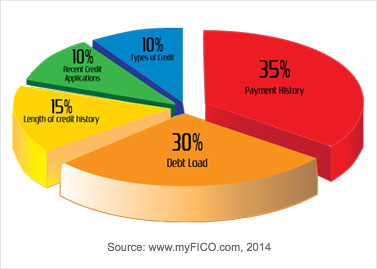

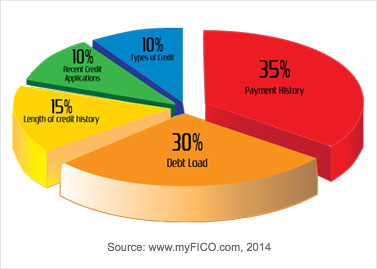

The FICO score in your credit report has five main factors. These five factors include:

- 10% types of credit

- 10% recent credit applications

- 15% length of credit history

- 30% debt load

- 35% payment history

The chart below breaks these categories down for a better understanding.

Additional items to review in your report:

- Closed accounts

- Collections

- Public records such as bankruptcies and tax liens

If you see errors on your report, like accounts you didn't open or debts you didn't incur, you may be a victim of identify theft. Learn more about identity theft and what to do if you're a victim here.

Quick Links

Related Blog

Resources