Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2025-08-15

Checking

published

4-minute

Payment Guide: How to Write a Check for Rent

-

-

Let’s face it—writing a check for rent may not spark joy, but it’s still a tried-and-true way to pay for your home sweet home. Even with so many digital payment options out there available, knowing how to write a check (the right way) is a financial skill you’ll never regret having. So, let’s make this easy and painless. Pens at the ready!

Why Checks Still Matter for Rent Payments

Writing a rent check is more than just a formality—it’s smart record-keeping. A check leaves a paper trail for both you and your landlord. Since they are trackable, checks can help you provide clear proof of payment, settle disputes, and even provide documentation for legal or tax purposes.

Plus, some landlords simply prefer paper rent payments!

What Do You Need to Write a Check?

Here’s what you should have ready before getting started:

- A checkbook from your bank, connected to either a checking account or money market account

- The date when rent is due

- The full legal name of your landlord or rental company

- The exact amount due for this period—no rounding up!

Step-by-Step: How to Write a Rent Check

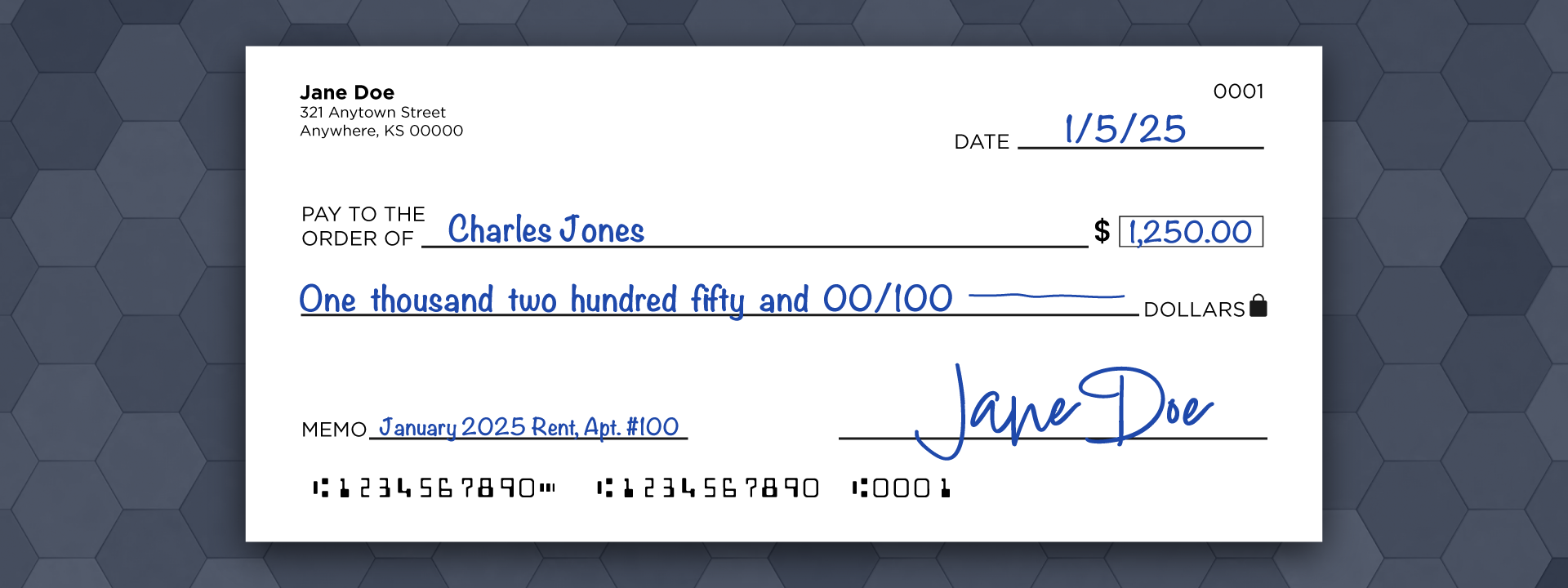

Follow these steps to make sure your check is filled out correctly every time, and view our check example below:

Step 1: Date the Check

In the top right corner, write today’s date (or the date you want payment processed). Do not post-date the check. This makes it harder to track your account balance, creates confusion, and could result in overdraft fees.

Step 2: Write the Recipient’s Name

On the line that says “PAY TO THE ORDER OF” line, write your landlord’s full legal name or the property management company name. Using the correct information ensures your payment can be handled without delays or disputes.

Keep in mind, some landlords use nicknames in conversation, but you need their legal name for the payment. So, if your landlord goes by “Chuck Jones,” you probably need to write “Charles Jones” on the check.

HELPFUL TIP: The specific name should be mentioned in your lease agreement.

Step 3: Write the Amount in Numbers

In the box next to the payee line, write the exact rent dollar amount numerically on the right-hand side, such as “$1,250.00”. Make sure your commas and periods are clearly different.

Step 4: Write the Amount in Words

This is where most people make mistakes, so take your time!

On the long line underneath the payee, spell out the dollar amount. For example: One thousand two hundred fifty and 00/100. The “00/100” represents the cents portion of the payment. And if there are no cents involved, you still need to include this to prevent tampering or fraud.

Step 5: Fill in the Memo Line

Don’t skip this step! The memo line is for extra information, such as “January 2025 Rent” or your apartment number. This can clarify what the payment is for, which is especially helpful if you ever need to go through your records.

Step 6: Sign the Check

The final line on your check is for your signature. Don’t forget to sign the check so it can be processed!

How to Deliver Your Rent Check Safely

So, you wrote a check successfully. Now what? It’s time to turn it in! Here are some methods to pay your rent:

- In Person: Hand your rent directly to your landlord or use a secure drop box if available.

- By Mail: Confirm the correct mailing address and send the check EARLY (delivery doesn’t happen instantly)! For extra assurance, consider certified mail.

Remember, paying rent on time is crucial. Late checks could result in fees or affect your standing as a tenant. Plan ahead and always use a secure method.

Pro Tips for Writing Checks for Rent

- Double-check the names and numbers before turning in the check.

- Use black or blue ink—never use pencil or erasable pens.

- Fill every blank to avoid unauthorized changes.

- Log each check transaction into your check register (the small booklet that comes with your checkbook). Your future self will be glad you did!

Common Rent Check Mistakes to Avoid

- Wrong Date: Never post-date (or write a future date). Instead, explain your situation to the landlord—discussing your timing issue may help you negotiate a new payment date.

- Misspelled Name: Double-check the payee details to avoid processing delays or future disputes.

- Incorrect Use of “And”: Only use "and" before the cents portion when writing out the dollar amount (e.g., "One thousand two hundred and 00/100" not "One thousand and two hundred dollars 00/100").

- Skipping the Memo Line: The memo field helps clarify what the check is for. Eliminate the guesswork for smart record-keeping.

- Overdrawing Your Account: Double-check your account balance before writing a rent check. An overdrawn account can lead to bounced checks and extra fees. (Learn more about avoiding overdrafts).

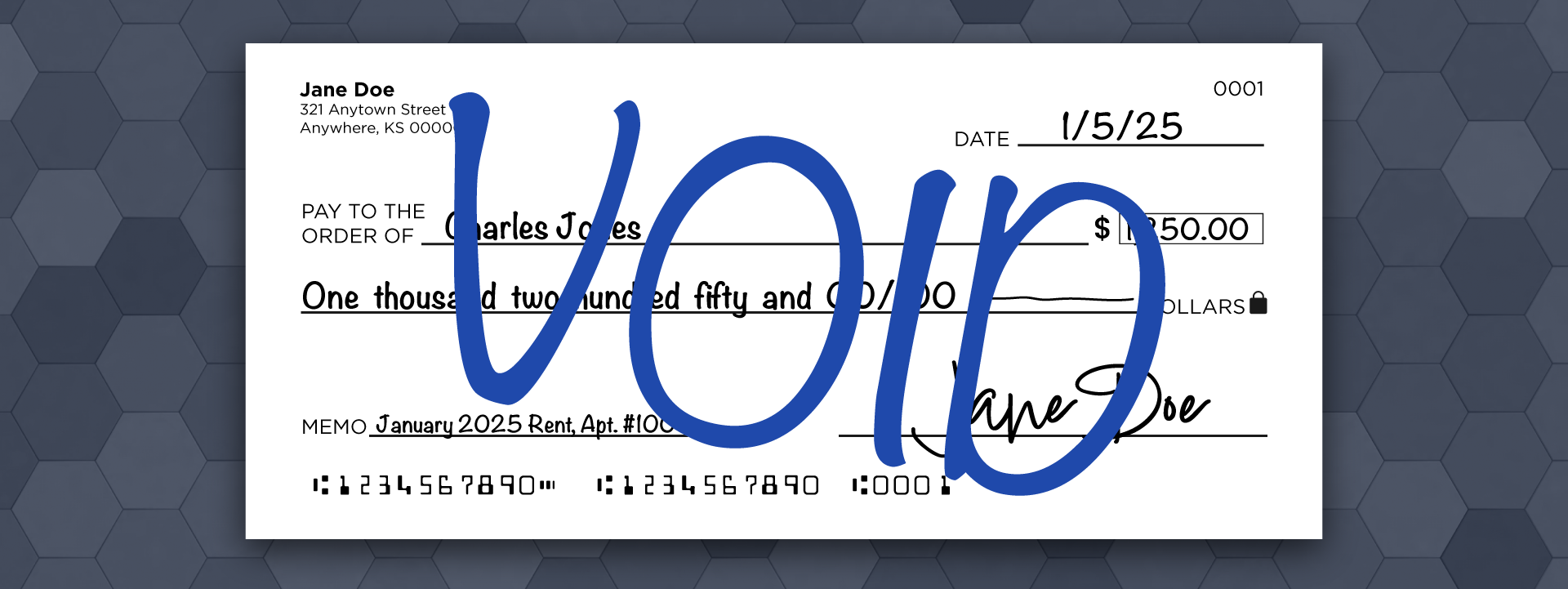

If you make a mistake, write “VOID” across the check and start a new one. If you don’t write “VOID,” the check could still be processed if it falls into the wrong hands, which could cause confusion and unexpected charges.

Check-Writing: Frequently Asked Questions

Can I pay my rent with a cashier’s check or money order?

Usually yes, but confirm with your landlord or management company. They have their own preferences.

What if my landlord asks for a personal check only?

Your main option is to follow their instructions unless otherwise stated in your lease.

What do I do if I make a mistake on the check?

Never try to correct it with white-out or crossing it out. Void the check and write a new one.

What Types of Bank Accounts Let You Write Checks?

At Academy Bank, you can write checks from two types of bank accounts: checking accounts and money market accounts. So, whether you need the everyday flexibility of a checking account or the added savings power of a money market account, you have the option to write checks for rent. Here’s what you need to know about each account:

- Checking Accounts1: Academy Bank offers several checking options that come with check-writing privileges and online bill-pay—whichever you prefer.

- Money Market Accounts2: If you want a mix of savings and flexibility, money markets let you write checks while still earning interest. Transactions are limited to six (6) per month.

How to Order Checks from Academy Bank

Getting a new checkbook is fast and simple:

- OPTION 1—Speak with a Personal Banker: Visit or call any Academy Bank branch for help placing a check order. (Find Banks Near Me).

- OPTION 2—Order Checks Online:

- Log in to Academy Bank’s online banking portal.

- Click “Services” in the menu on the left side.

- Select “Order Checks” and follow the prompts.

Remember, double-check your details (pun intended), and let us handle the rest. It’s that easy!

FURTHER READING: How to Endorse Checks.

1 Each checking account product is different. Terms and conditions apply. An opening deposit is required. A monthly service charge may apply. Free monthly eStatement or $5 paper statement applies. Closing new accounts within 90 days of opening will result in a $25 early closure fee.

2 Minimum $25 deposit to open the Premier Money Market Account. A monthly service charge of $10 will be imposed every month or statement period if the balance in the account falls below $1,000 on any day of the month or statement period. Six (6) transactions per statement allowed. Excessive withdrawal fee of $10 per item over 6 withdrawals per statement cycle. Free eStatements or $5 paper statement monthly fee. Closing your account within 90 days of opening will result in a $25 early closure fee.