Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-07-07

Checking

published

2-minute

How to Endorse Checks Explained: What You Need to Know

-

-

Checks aren’t the flashiest way to move money these days, but they are still a reliable part of everyday banking. Afterall, checks still show up in your mailbox, your birthday cards, and your tax refund envelopes. And when they do, you will want to know how to endorse a check. So, grab your favorite pen, and let’s discuss where checks come from, why endorsements matter, and how to endorse checks correctly.

What Types of Accounts Write Checks—and Who is Sending Them

Before we talk about who’s sending checks your way, let’s look at where they are coming from—specifically, the types of accounts that typically issue checks. Personal checking accounts are the most common, which people use to pay rent, send gifts, or cover everyday expenses. Companies use business checking accounts to pay employees, vendors, or issue refunds. Then, government accounts handle “official” disbursements. And finally, while it’s less common, some money market accounts also allow limited check-writing, though that’s more of a side feature than their main purpose.

Now, let’s discuss who commonly writes checks:

- Employers: Many companies use direct deposit, but some still issue paper paychecks—especially for contract workers or one-time payments.

- Government Agencies: Federal and state disbursements often arrive by check (think tax refunds, Social Security benefits, etc.).

- Insurance Companies: This includes claim payments, reimbursements, and settlements.

- Friends and Family: Whether it’s a birthday gift, IOU, or a shared vacation fund contribution, personal checks are still a thing (yep, Grandma still writes them).

- Yourself: Yes, you can write a check to yourself—usually to move money between accounts at different banks. It’s a simple way to transfer funds when electronic options aren’t available or convenient.

Even with the rise of mobile and online banking, checks continue to offer a reliable and traceable payment option.

Reasons You Might Need to Endorse a Check

Endorsing a check is your way of authorizing the bank to process it. You are essentially telling your bank, “Yes, this money is meant for me, and here’s what I want to do with it.”

You might need endorse checks to:

- Make a deposit into your account (both mobile and in-person)

- Cash your check at a bank or credit union

- Sign it over to someone else (a third party)

REMEMBER! No endorsement = no money movement. You must endorse your check so the bank can process it.

How to Endorse a Check (Examples Included)

There’s more than one way to endorse a check, depending on how you plan to use it. Here are the most common types of endorsements:

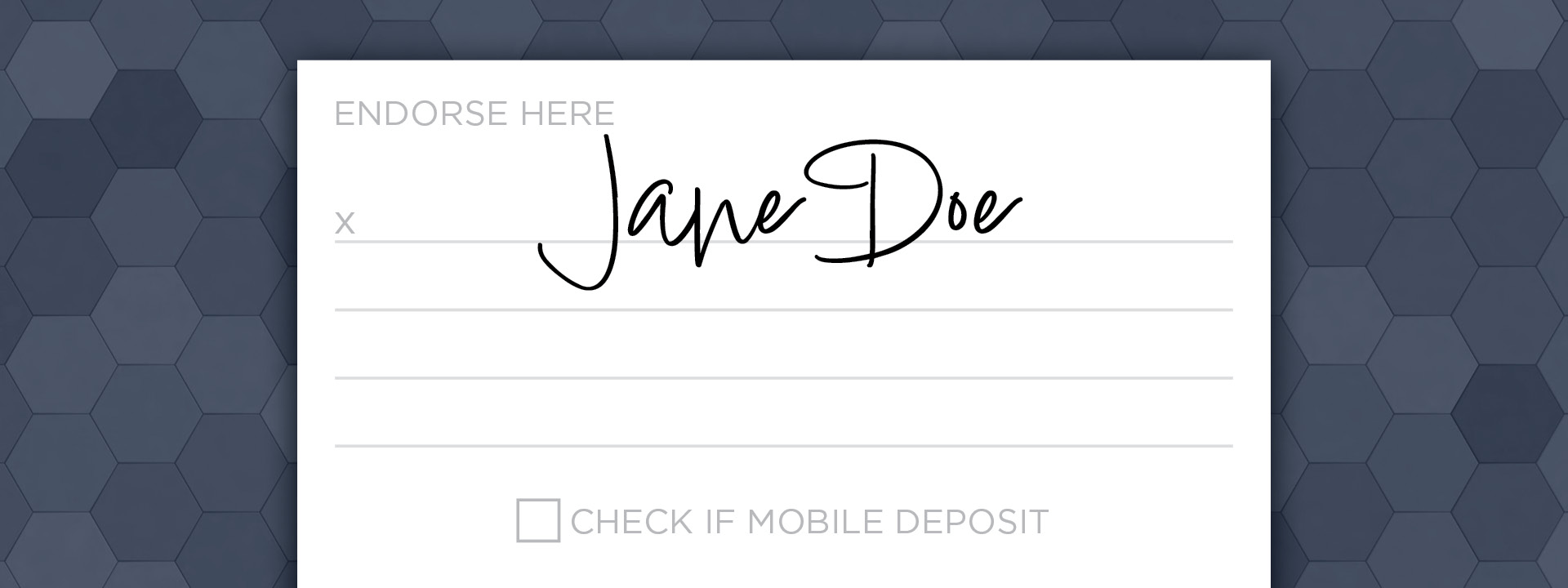

1. Blank Endorsement

- Use this endorsement when you are physically at a bank or ATM and ready to deposit or cash the check immediately.

- How to do blank endorsements: Simply sign your name on the back of the check…and that’s it!

- FYI: This is the least secure option—once signed, anyone can cash or deposit the check if it’s lost/stolen. So be sure to wait until you are at the bank or ready to deposit before you sign!

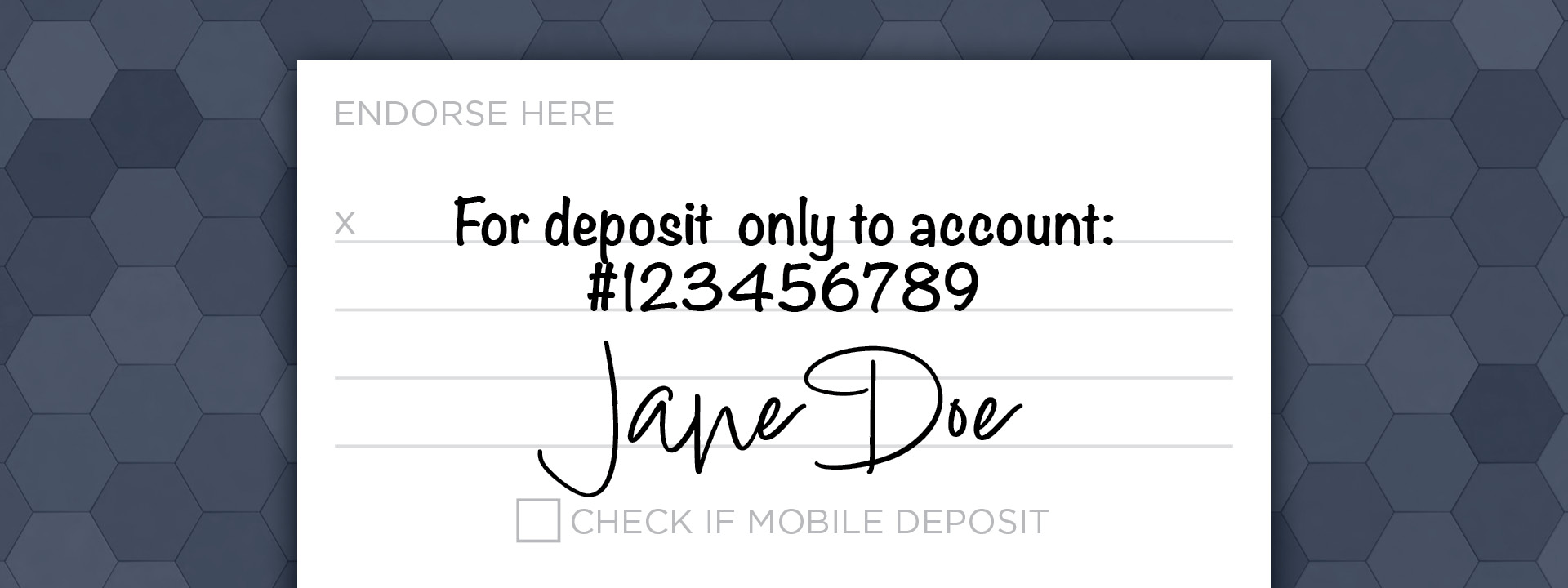

2. Restrictive Endorsement

- Use this endorsement when you want more security, typically when you aren’t handing your check directly to a bank teller.

- How to do restrictive endorsements: Write “For deposit only to account #123456789 [insert your account number]” and your signature underneath.

- FYI: This method limits the check so it can only be deposited into your specific account.

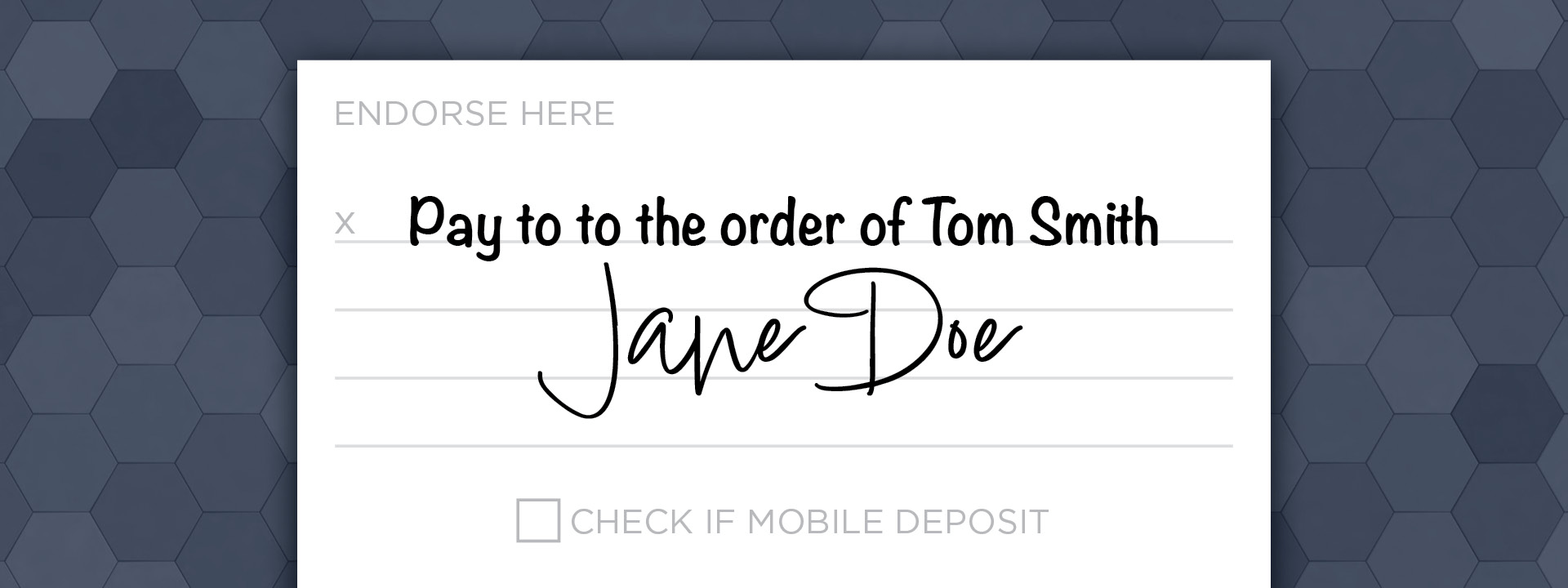

3. Third-Party Endorsement

- Use this endorsement when you want to sign the check over to someone else so they can deposit or cash it on your behalf.

- How to do third-party endorsements: Write “Pay to the order of [Their Name],” then sign your name underneath.

- FYI: Not all banks accept third-party checks. Some may require both you and the payee to be present when endorsing checks to someone else.

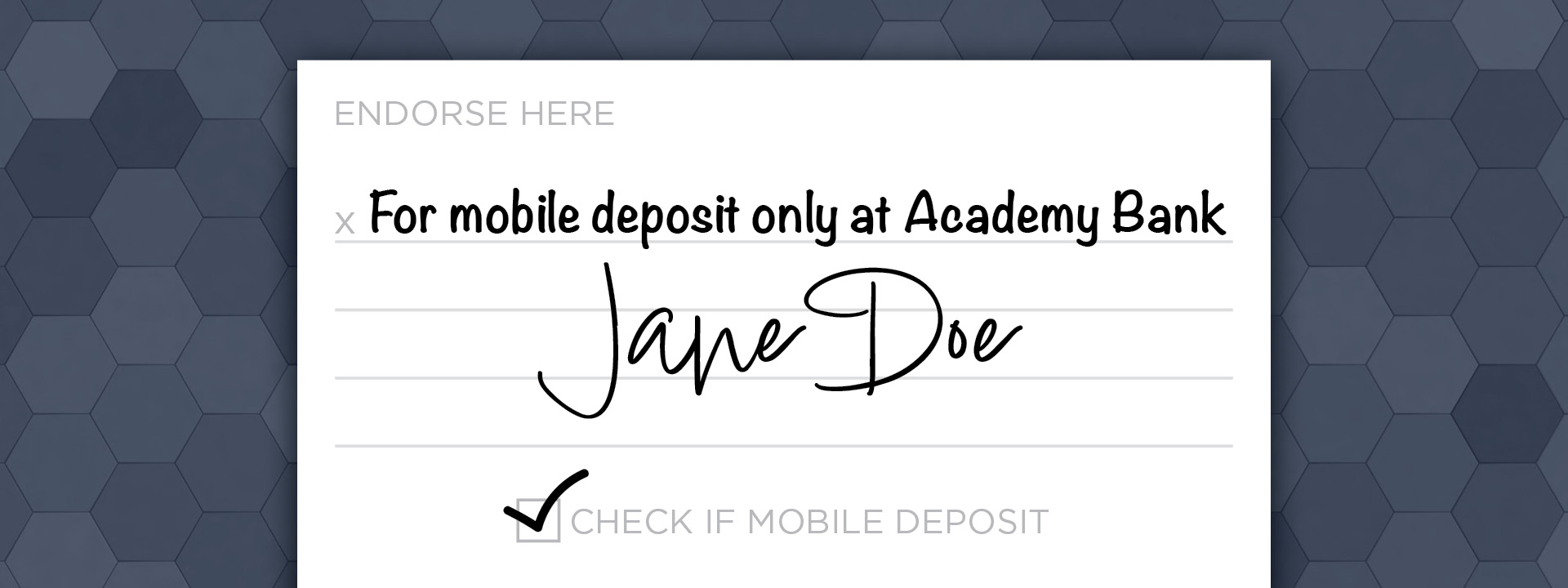

4. Mobile Deposit Endorsement

- Use this endorsement when you want to deposit a check using your institution’s mobile banking app.

- How to do mobile deposit endorsements: Write “For mobile deposit only at [Bank Name]” and provide your signature.

- FYI: Be sure to follow your bank’s specific mobile deposit instructions. Some may require you to check a box or include your checking account number.

Do You Have to Date a Check When You Endorse It?

Surprisingly, no. You do not need to include the date when endorsing checks. Why? Banks use the date written on the front side of your check to process everything.

That said, some banks—especially for mobile deposits—may ask for additional details. ALWAYS follow your bank’s specific instructions to avoid delays.

Deposit Checks with Academy Bank

At our bank, check deposits are easy as pie (and way less sticky)! Whether you are using our mobile app*, visiting our network of ATMs, or stopping by a branch, our team is here to help you handle your money, your way. Plus, Academy Bank accounts come with built-in fraud protection and personalized support—one less thing for you to worry about.

Ready to simplify your banking experience? Open a checking account today (personal and business banking options available), explore our deposit solutions, order checks online through digital banking, or visit your local banking center. (Find Banks Near Me).

* Message and data rates charged by your mobile phone carrier may apply.

Each checking account product is different. An opening deposit is required. A monthly service charge may apply. Free monthly eStatement or $5 paper statement applies. Closing new accounts within 90 days of opening will result in a $25 early closure fee.

New Money Market accounts are subject to an opening deposit, monthly service charge and paper statement fees. Transaction restrictions apply. Closing new accounts within 90 days of opening will result in a $25 early closure fee.