Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2025-07-10

Financial Health

published

4-minute

How to Calculate Debt-to-Income Ratio

-

-

Whether you are applying for a loan, shopping for a mortgage, or simply taking stock of your finances, understanding your debt-to-income ratio (DTI) is an essential part of the process. This simple percentage plays a big role in how lenders evaluate your creditworthiness—and it can help you make more informed decisions about your own financial goals. Keep reading to learn more about what DTI is, how to calculate it, why it matters, and how to improve it over time.

What Is Debt-to-Income Ratio?

Your debt-to-income ratio compares how much you owe each month (debts), to how much you earn (income). Lenders use DTI to assess risk: a high ratio may suggest that you are stretched too thin financially, while a lower ratio suggests you have room in your budget for additional obligations.

There are two common types of DTI:

- Front-End DTI: Also known as your “housing ratio,” this includes only housing-related costs (like mortgage payments, property taxes, and homeowners insurance).

- Back-End DTI: This is the most widely used version and includes all recurring monthly debts, such as credit cards, car loans, student loans, and housing expenses.

When most people refer to “DTI,” they mean the back-end ratio, which gives a fuller picture of your financial obligations.

Why Lenders Care About DTI

Financial institutions use your debt-to-income ratio to determine how much you can responsibly borrow. Even if you have a good credit score, a high DTI might still indicate that your income is already committed to too many other payments.

A lower DTI shows that you have a healthy balance between debt and income. This not only improves your chances of being approved for a loan, but it can also help you qualify for better terms—like lower interest rates or higher borrowing limits.

In general, many lenders look for a back-end DTI of 36% or lower to approve new credit, though requirements can vary depending on the loan type.

How to Calculate Your Debt-to-Income Ratio

Calculating your DTI is straightforward if you know your monthly debts and gross income. Here’s how to do it:

STEP 1: Add Up Your Monthly Debt Payments

Include all recurring debt obligations, such as:

- Monthly rent or mortgage payments

- Minimum credit card payments

- Car loans

- Student loans

- Personal loans

- Child support payments or alimony

Do not include discretionary expenses like utilities, groceries, or subscriptions; DTI focuses only on fixed debt.

STEP 2: Calculate Your Gross Monthly Income

Gross income is your income before taxes or deductions. This might include:

- Salary or hourly wages

- Bonuses or commissions

- Self-employment income

- Rental income

- Child support payments or alimony received

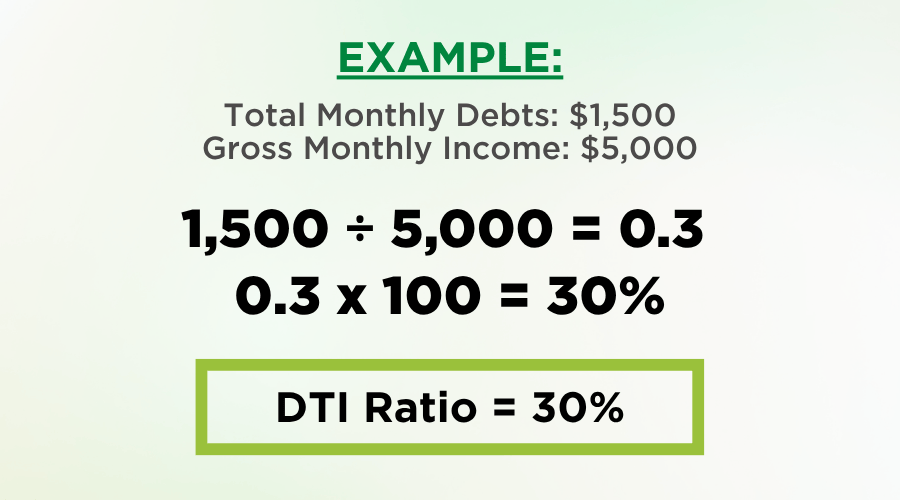

STEP 3: Divide and Convert to a Percentage

Take your total monthly debt and divide it by your gross monthly income. Then, multiply the result by 100 to get your DTI percentage.

DTI Ratio = (Total Monthly Debt Payments ÷ Gross Monthly Income) x 100

For instance, let’s say your total monthly income is $5,000, and your total monthly debts are $1,500. The calculation would look something like this:

What is a Good Debt-to-Income Ratio?

As a general guideline:

- Below 36%: Healthy DTI. You’re likely in a strong position to take on new debt.

- 36-43%: Acceptable range, though you may face some restrictions depending on the lender.

- Above 43%: May be considered high. Lenders might see you as a greater risk, especially for larger loans like mortgages.

- Above 50%: Often too high to qualify for new credit without improving your financial situation.

Keep in mind that mortgage lenders in particular may use more strict or more flexible DTI thresholds based on the loan program and your overall credit profile.

How DTI Affects Loan Applications

Your DTI influences not only your chances of receiving loan approval, but also how much you can borrow. For example, if your DTI is too high, you may need to lower your loan amount, bring in a co-signer, or consider a loan with a longer repayment term to reduce the monthly payment.

Additionally, a strong DTI could lead to more favorable interest rates. Lenders see lower DTI ratios as less risky, which can translate into better borrowing conditions for you.

How to Improve Your DTI

If your current DTI ratio is higher than you would like, don’t worry! You can improve it ratio with a few smart financial moves.

One of the most effective ways is to focus on paying down your existing debt. High-interest debts, like credit cards, are a good place to start—making extra payments, even small ones, can have a meaningful impact over time. As your balances decrease, so do your monthly minimums, which helps lower your overall debt obligations.

Another approach is to increase your income. That could mean picking up extra hours at work, exploring freelance opportunities, or starting a side hustle. When you bring in more money each month, it improves your gross income, which strengthens your DTI ratio.

In the meantime, it’s smart to avoid taking on any new debt. For example, holding off on new credit cards or loans gives you the space to focus on reducing what you already owe. Refinancing or consolidating debt may also help, especially if you can lower your interest rates or extend your repayment term to make the payments more manageable.

No matter how you choose to approach it, keep an eye on your DTI as you make progress. This is particularly important if you plan to apply for a loan or make a major financial move in the near future.

Debt-to-Income and Your Overall Financial Wellness

While DTI is primarily used for lending decisions, it’s also a helpful personal finance tool. Monitoring your ratio can provide insights into your financial habits and also signal potential issues before they impact your credit.

A low DTI means you are living within your means and keeping debt manageable—both important factors in long-term financial stability.

Smart Debt-to-Income Ratio Decisions Start with Academy Bank

Understanding your debt-to-income ratio is one of the smartest steps you can take toward better financial health. Whether you’re preparing for a major purchase, applying for a loan, or just want to understand your financial standing, Academy Bank can help.

Our team is here to answer your questions, walk you through the prequalification process, and offer tools like financial calculators and online banking features to keep your finances on track.

Visit us online or stop by your local banking center to learn more.

LENDING OPTIONS AT ACADEMY BANK:

Compare Home Loans

Compare Business Loans

HELOC Loans

Personal Loans

Personal Credit Cards

Subject to credit approval. Each loan product has specific terms, conditions, and eligibility requirements. Fees apply.