Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

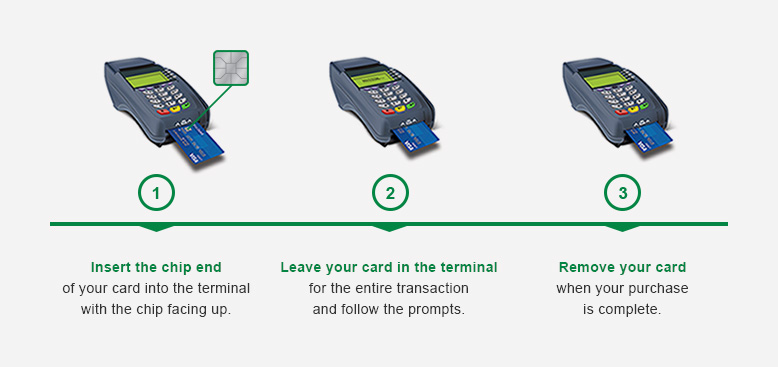

EMV Chip Technology

Learn more about how to use chip cards and the benefits of EMV chip technology below.

Increased security = decreased fraud

When used at a chip-activated terminal, your card’s chip generates a one-time use code that is needed for each transaction to be approved. This code is virtually impossible to counterfeit, which helps reduce fraud and adds greater security to the payment system.

Simple to use

Insert the chip card into the terminal and leave it there until the transaction is complete.

If the terminal is not chip-activated, you can still swipe your card using the magnetic stripe on the back of the card. Whether you insert or swipe, there’s never a need to worry. Visa’s Zero Liability Policy1 will protect you from any unauthorized transactions.

Accepted everywhere + extra benefits

Usable anywhere Visa® is accepted, your new chip card comes with these extra benefits:

- Comes at no additional cost

- Makes transactions simple and secure when you travel internationally

- Helps pave the way for safer mobile commerce, which helps ensure secure and convenient purchases in the future, no matter where or how you pay

Have questions? Read our FAQs.

Related FAQs

1 Visa’s Zero Liability policy covers U.S. issued cards only and does not apply to ATM transactions, PIN transactions not processed by VISA or certain commercial card transactions. Cardholders must notify card issuer promptly of any unauthorized use. Consult issuer for specific restrictions, limitations, and other details.