Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2025-11-18

Commercial Banking

published

2-minute

The Role of Sponsor-Backed Lending & Senior Debt in Business Success

-

-

Companies need more than traditional bank loans, especially if they are looking to expand, change ownership, or purchase another company. That’s where financial sponsor lending and senior debt come into play. As a niche area of commercial banking, it calls for specialized expertise and market insight. Academy Bank has excelled in this area for 25 years, delivering results and building trusted relationships with financial sponsors and businesses. Let’s take a closer look at how sponsor lending and senior loans work together to fuel business growth.

What is Financial Sponsor Lending?

Sponsor lending—also called “private equity lending” or “sponsored-backed lending”—is a form of commercial financing designed to help private equity firms, family offices, and other investment sponsors fund strategic deals. Specifically, it allows them to acquire, grow, or transition businesses for success. Unlike traditional commercial loans that are secured by physical assets (e.g., real estate, equipment, or inventory), financial sponsor lending is typically based on the cash flow and earnings of the business.

Key characteristics of sponsor-backed lending include:

- Cash-Flow-Based Underwriting: Lenders review the company’s earnings and cash flow rather than just physical assets. This gives profitable companies access to business lending even if they don’t have significant collateral.

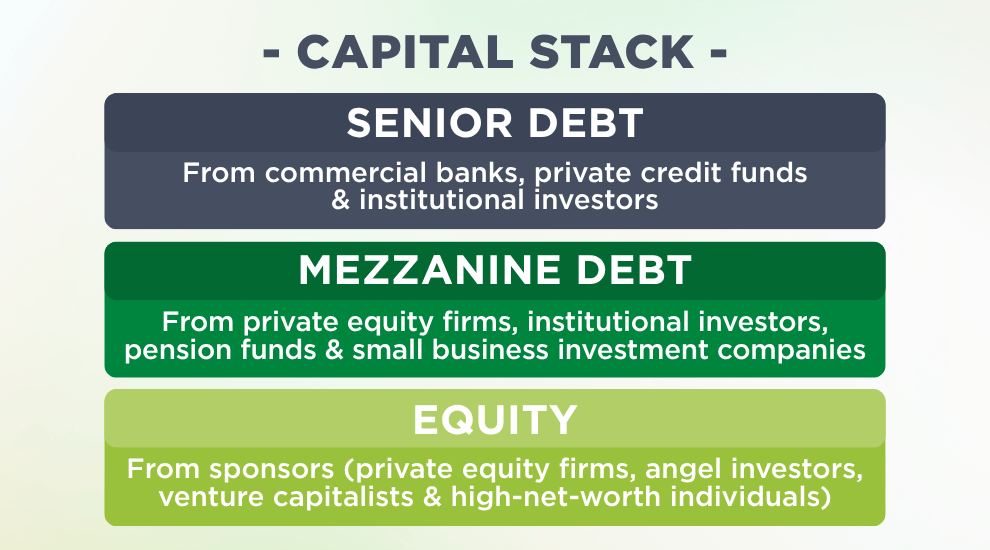

- High-Leverage Financing: The transactions typically combine multiple layers of funding to complete the deal, with senior debt forming a significant part of the capital stack. (See diagram below).

- Collaborative Partnerships: Lenders and sponsors work closely together, designing deals that balance risk and return. The structure ensures both parties agree on repayment schedules and development plans.

- Specialized Expertise Required: Because sponsor lending deals are complex, they need experienced lenders who can analyze cash flow, manage risk, and create loan structures that are customized for each business.

What Types of Companies Use Sponsor Lending?

Sponsor-backed lending is mainly used by established, profitable companies with proven track records of consistent earnings and cash flow. Their steady performance gives lenders and investors the confidence to put together larger, more advanced deals.

Financial sponsor lending is common among major business milestones:

- Acquisitions: When a company grows by purchasing another business.

- Ownership Transitions: When a business is sold to investors or passed to the next generation of a family.

- Expansions: When a company enters a new market or increases its operations.

On the other hand, early-stage startups are less suited for sponsor-backed loans because they tend to have less predictable cash flow. Instead, they are better candidates for venture capital or angel investment funding.

What is Senior Debt and How Does It Fit with the Capital Stack?

Senior debt is the first layer of most sponsored deals. It’s called “senior” because it takes top priority in both lien position and repayment if the borrower ever faces financial trouble. Therefore, senior lenders are repaid before all other creditors and investors. This funding is considered the safest and least expensive form of borrowing within a deal’s capital structure, making it a preferred starting point for sponsors as they develop a deal.

In a typical acquisition or ownership transition, a financial sponsor may use a combination of:

By maximizing senior debt, sponsors can reduce the amount of equity they need to invest, making their capital go further. This approach gives businesses enough financial flexibility to grow.

How senior debt, mezzanine debt, and equity work together:

- STEP 1: A financial sponsor identifies a profitable business to acquire or support during a transition.

- STEP 2: The lender (like Academy Bank) provides senior debt primarily based on the borrower’s cash flow and proven earnings.

- STEP 3: The sponsor adds mezzanine or equity funds to complete the financing needed for the transaction.

- STEP 4: The target business continues operating and developing, while their cash flow repays the senior debt over time.

The result? Borrowers access larger business loans without depleting their equity, sponsors maximize their investments, and lenders benefit from reduced risk. In the end, the structure supports healthy business growth and long-term stability.

Academy Bank Specializes in Sponsor-Backed Lending

Financial sponsor lending demands more than traditional business banking familiarity. It requires experience in cash-flow-based underwriting, advanced transaction structuring, and the ability to move quickly on complex deals. Many regional and community banks do not have the specialized knowledge or dedicated teams to handle these transactions effectively.

Academy Bank is uniquely positioned to bridge this gap with decades of proven expertise in sponsor-backed lending. As a family-owned bank, we are built differently. We provide the personal and relationship-driven service of a community bank, along with the nationwide footprint and advanced resources you would expect from a larger institution. This combination allows us to deliver:

- Speed and Certainty: We understand sponsor timelines and create deals for successful closings.

- Customized Senior Debt Solutions: Our tailored financing structures are designed around each company’s cash flow profile and growth objectives.

- Partnership Mentality: We collaborate with sponsors at every stage, from initial term sheets to closing and beyond.

Whether you are a private equity firm seeking a reliable senior debt partner, a family office managing a succession, or an established business planning your next major acquisition, Academy Bank has a strong history of success in sponsor-backed loans.

Ready to discuss your next opportunity? Our Commercial Lending & Commercial Banking team serves clients and businesses across the country. Let’s explore different senior debt offerings built for your goals!

Subject to credit approval. Loan programs are subject to terms, conditions and product eligibility.