Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

not featured

2022-05-13

Home Mortgage

published

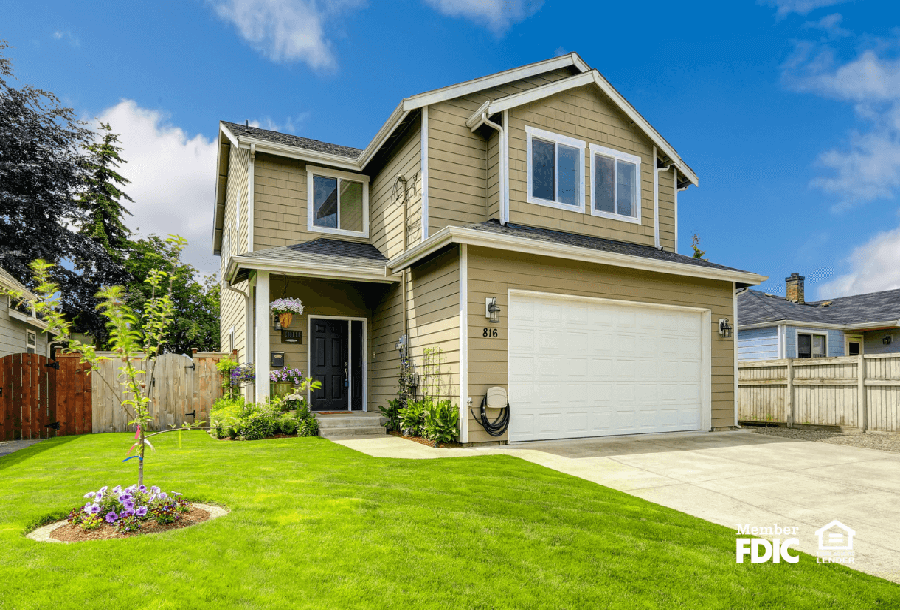

Homeowner’s Equity Is Growing — Here’s How a HELOC Can Help You Leverage Those Gains

-

-

Despite all the volatility in the stock market and with interest rates, homeowners are well positioned to ride out ensuing storms and even come out stronger in the months ahead. In the second quarter of 2021, American homeowners with mortgages gained a collective $2.9 trillion in equity — representing a nearly 30% year-over-year increase.1 Many would be wise to consider a Home Equity Line of Credit (HELOC) to leverage those gains.

Whether looking to fund a home improvement project or other major expenses, or simply safeguard against rising inflation, a HELOC can meet a range of immediate and ongoing needs. And because of today’s soaring property values, you may be eligible for more credit than you realize.

Learn more about HELOCs, how they work, and how they can benefit you.

How Does a HELOC Work?

A HELOC is based on the equity in your home, which serves as collateral. Instead of a loan, you receive a revolving line of credit — as much as 85% of your available home equity — that functions similar to a credit card. You can borrow money as needed until you’ve maxed out the line of credit. You don’t lose your current mortgage rate and you don’t have to pay much, if anything, in closing costs. Plus, as you repay your outstanding HELOC balance, the amount of available credit is replenished.

And although a HELOC resembles a credit card, it differs significantly insofar as it is a form of secured debt. With your home serving as collateral, you can count on considerably lower interest rates. Today, the average credit card interest rate is 14%, whereas the average HELOC rate is less than 5%.

For comparison, cash out refinancing has been a popular option in recent years due to record low interest rates. With a cash out refinance, you take out a new mortgage for more than you owe on your existing one – and keep the difference in cash. However, with rising interest rates, cash-out options are less attractive as you end up with a higher rate increasing your monthly payment as you are taking out a larger amount than your current mortgage at a higher rate.

What Does This Mean For Homeowners?

Home values are at an all-time high, with most Americans seeing their home equity grow. This is promising news, but if the last couple of years have taught us anything, it’s that circumstances can change quickly and drastically. Amid stubborn inflation and rising mortgage rates, the housing market is likely to cool in the coming months. It’s certainly conceivable that home values will see a dip, and thus, home equity, a decrease. For homeowners in need of cash, now may be the time to take full advantage of recent gains before they dissipate.

Using Your HELOC To Help You Gain More Equity

Simply put, a HELOC is one way to use equity to gain more equity. For more than two years, we have spent considerable time at home. During this period, people became aware of deficiencies and developed increasingly vivid visions of what their dream home might look like. Although normal life is resuming, many of us can’t shake the urge to improve — or even ditch — our current dwellings.

But it remains a seller’s market. With extremely low inventory and mortgage rates trending up, it is an especially challenging time for buyers to find — and afford — that perfect property. Unless they take a different approach.

Many homeowners are using a HELOC to finance home improvement projects that not only make their homes feel like new, but also further increase the value and equity of their most important investment.

Home projects are just one option. With rising credit card interest rates, financial experts are lamenting to pay them off — and pay them off now. A HELOC can be a great tool for consolidating higher-interest debt like credit cards and some student loans, which are also poised for changes.

Other Ways HELOCs Can Be Useful

Analysts say that undergraduate borrowers should expect new student loan interest rates to rise above 5%, while new graduate loan rates may jump as high as 7.66%.2 Although college tuition rates have seen a modest drop as of late, that is unlikely to comfort students experiencing rising expenses most everywhere else. A HELOC can provide vital funds for tuition assistance to ensure long-term plans stay the course. And with a 25-year repayment period, individuals are likely to feel real relief from financial pressure.

Speaking of rising costs, a HELOC can offer peace of mind and a financial stopgap in the unpredictable days ahead. Because you only pay interest on the funds you use, money is available if you need it, but without unnecessary cost.

Of course, those are just a handful of ways homeowners can tap into newfound equity to grow it further, offset expenses or pursue a goal. The possibilities extend beyond what was discussed here. Whatever the need or desire, for many homeowners looking for additional funds, a HELOC may very well be the answer, especially in the current financial climate.

Get Your HELOC* with Academy Bank

Academy Bank is ready to explore your options and help you make the most of your recent home equity gains. With the best rates, lower fees, faster closing processes, and low to no closing costs, our team can ensure you get the funds you need when you need them with little effort now and in the future.

Academy Bank HELOC Customers Enjoy:

- Fixed introductory rate special for the first six months*

- Low monthly minimum payments*

- Waiving of annual fee with auto-draft monthly payments*

- Low or no closing costs

- A lower interest rate than most credit cards

- Easy access to your funds*

- A 25-year line of credit, paying interest only in the first 10 years

Contact us today to learn more about how an Academy Bank HELOC can work for you and to apply.

*Subject to credit approval.

Member FDIC