Contact Us

Bank Routing Number

107001481

Bank by Mail/General Mail

PO Box 26458

Kansas City, MO 64196

Deposit Only Mailbox

PO Box 26744

Kansas City, MO 64196

Phone Number

1-877-712-2265

Download our app

Access your

accounts here.

accounts here.

Grab your phone and scan the code to download!

featured

2024-03-27

Credit

published

Everything You Need to Know About Credit

-

-

Welcome to your complete guide about all things credit! With countless credit terms and concepts out there, it can be difficult to keep everything straight. However, rest assured, we have you covered—from explaining the basics of credit to introducing strategies to build your credit score. It’s time to bring clarity to this often-complex topic and make it more straightforward and understandable for everyone. Let’s get started!

Basics of Credit

Credit is a financial lifeline, allowing you to borrow money with the commitment to pay it back later, often with added interest. It's a convenient way to make purchases and access services if you don’t have cash readily available.

Credit can be obtained directly from sellers or through intermediaries like banks. These parties are known as creditors. In order to access the benefits of credit, you need to submit a request to creditors (just like asking permission to borrow), and your approval depends on your financial history, reflecting your trustworthiness in the financial world.

Lastly, if someone has “good credit,” it means they have a positive track record of responsible financial management.

Credit Limit

A credit limit is the maximum amount a lender allows you to spend using a specific credit card or line of credit. This limit is determined by various factors, including your credit score, personal income, and repayment history.

Lenders often grant higher limits to low-risk borrowers, and they can increase or decrease limits at their discretion. By consistently paying bills on time and avoiding maxing out credit cards or lines of credit, borrowers may see their credit limits raised. A higher credit limit provides more access to credit, which is beneficial for unexpected emergencies, offering financial security, and peace of mind.

Credit Report

A credit report is a detailed record of your credit history, including information about your borrowing and repayment activities. It typically includes details such as your credit accounts (like credit cards and loans), payment history, credit inquiries, and public records like bankruptcies or liens. Credit reports are compiled by credit bureaus based on information provided by creditors and other sources.

Credit Profile

Meanwhile, a credit profile refers to the overall picture of your creditworthiness. It includes not only the information in your credit report but also other factors such as your credit score, income, employment history, and overall financial situation. While a credit report provides the raw data, a credit profile is a broader assessment of your creditworthiness used by lenders and financial institutions to evaluate your credit risk.

Credit Score

Put plainly, a credit score is a numerical representation of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. Credit scores are derived from credit reports, so as your credit report evolves, so does this three-digit number (typically ranging between 300 and 850).

While lenders have their own standards for evaluating credit scores, here is a general yardstick:

- 720 to 850: Excellent Credit

- 690 to 719: Good Credit

- 630 to 689: Fair Credit

- 629 or below: Poor/Bad Credit

A strong credit score comes with several financial benefits. For example, people with higher credit scores will have an easier time accessing loans, credit cards, and mortgages. They will also have lower interest rates and better terms on borrowed money.

Factors that Impact Credit Scores

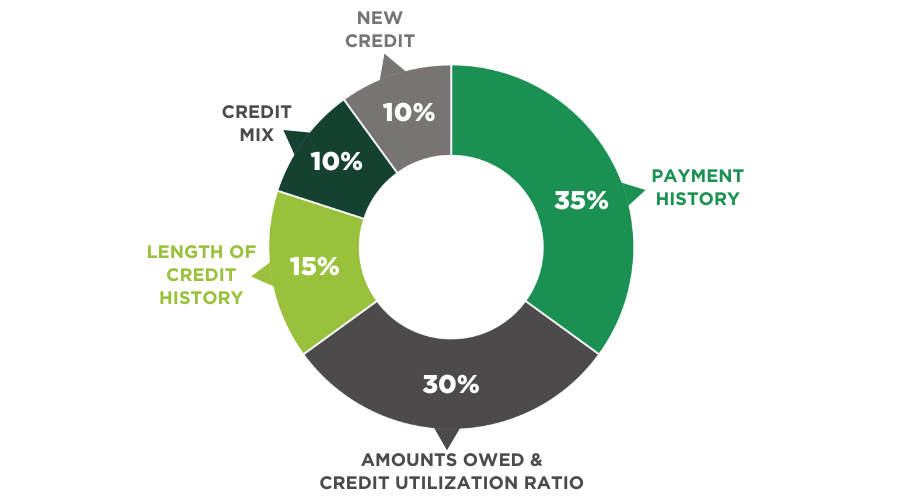

The most common elements considered in determining credit scores typically include:

- Payment History (35%): This is the record of your payments on credit accounts, including whether you have paid on time, missed payments, or defaulted on loans. Payment history is one of the most significant factors in determining your credit score.

- Credit Utilization Ratio (30%): This is the ratio of your credit card balance to your credit limit. Keeping this ratio low, typically below 30%, is generally seen as favorable for credit scores. However, having an even lower ratio (like 10%) is considered even better for maintaining a healthy credit profile.

- Credit History (15%): This factor considers how long you have been using credit. Generally, a longer credit history is viewed more positively because it provides more data for lenders to assess your creditworthiness.

- Credit Mix (10%): Lenders like to see a mix of different types of credit accounts, such as credit cards, retail accounts, and installment loans (like mortgages and auto loans). Having a diverse credit mix can indicate responsible credit management.

- New Credit (10%): Applying for too much credit all at once signals your urgency for cash to lenders, raising red flags. Each credit card application triggers a hard inquiry and temporarily lowering your score. Remember to apply cautiously, space out your applications, and monitor your credit report.

Dive deeper and learn more about credit scoring factors in our previous blog.

Building Credit

Building credit is the process of strengthening your creditworthiness, a key part of your financial well-being. It is an important step towards improving your overall financial standing and gaining access to better credit and loan options. Your credit score serves as the cornerstone of credit building. That’s because when individuals are improving their credit, they typically monitor their credit scores closely to track their progress and identify areas for advancement. For tips and strategies for building credit, read: Your Guide to Building Credit at Academy Bank.

Secured Credit Cards

Secured credit cards operate similarly to traditional ones, but with a twist. You provide a refundable security deposit which becomes your spending limit. This deposit serves as collateral for the card issuer, ensuring protection if payments falter. However, if you responsibly use and pay off the card, you’re not merely spending; you’re building a payment history that can boost your credit score. Secured credit cards are a smart, straightforward, and effective approach to improve your financial standing.

Credit Builder Card from Academy Bank

Now that you know all about the world of credit and secured credit cards, it’s time to take the next step in your credit building journey. Opening a secured credit card like Academy Bank’s Credit Builder Secured Visa® Credit Card is a fitting choice because it is specifically designed to support your credit building process.

Whether you are new to credit or hoping to repair your existing credit score, Credit Builder from Academy Bank gives you the flexibility to customize your credit experience. Set your own credit limit (between $300 to $3,000) and build credit at your own pace. Plus, enjoy peace of mind without any added expenses; there are no application fees, annual fees, or over-limit fees.

By opening a secured card, you get to establish a credit history (how long you’ve been using credit) and build a positive payment history by making consistent, on-time payments. And the best part? Your responsible behavior gets recognized and rewarded through automatic reporting to the three major credit bureaus, meaning your credit score gets a positive boost!

Finally, having an improved credit score can help you to qualify for a standard unsecured card in the future, providing you with more financial flexibility and access to additional benefits and perks.

So what are you waiting for? Your credit building journey awaits.

Helpful Resources: Credit Assessment Calculator and Credit Card Payoff Calculator.

Member FDIC

Subject to credit approval. Transaction and Penalty fees apply. Credit Builder Savings account required. $5.00 quarterly fee charged to the Credit Builder Savings account if not enrolled in eStatements. Improved credit score is not guaranteed. Credit score is determined by credit reporting agencies based on multiple factors, but satisfactory performance on a credit card product can improve your credit score. Default on a credit card, including missed or late payments can damage your credit score. Once added, funds cannot be withdrawn from the Credit Builder Savings account and the Credit Builder credit card without closing the savings account and the credit card.